We have recently written several essays about the fallacious concept of Gross Domestic Product. Among GDP’s several fatal flaws, it goes up when capital is converted to consumer goods, when seed corn is served at the feast. So we proposed—and originally dismissed—the idea of a national balance sheet. It’s easy (conceptually) to add up all the assets and the liabilities. But the problem is that the falling interest rate...

Read More »Update on gold – bad news is good news

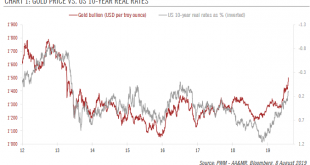

Increased trade tensions have boosted the gold price to above USD 1,500. The increased trade tensions following Trump’s 1 August tweet threatening additional tariffs on Chinese goods has boosted the gold price above USD 1,500 per troy ounce. The recent developments are supportive of gold investment demand because of a lower opportunity cost associated with holding gold and greater demand for safe haven assets. Coupled...

Read More »The Sound Money Showdown in U.S. States

Policies relating to sound money have been the subject of substantial debate at the state level this year, with bills, hearings, and/or votes taking place in nearly a dozen legislatures. As most state legislatures have now wrapped up their work for the year, let’s review the victories (both offensive and defensive)—and lone defeat—for sound money during the 2019 session. The Sound Money Defense League’s primary goal is...

Read More »I Know Usury When I See It, Report 4 Aug

“I know it, when I see it.” This phrase was first used by U.S. Supreme Court Justice Potter Stewart, in a case of obscenity. Instead of defining it—we would think that this would be a requirement for a law, which is of course backed by threat of imprisonment—he resorted to what might be called Begging Common Sense. It’s just common sense, it’s easy-peasy, there’s no need to define the term… This is not a satisfactory...

Read More »After Fed Disappoints, Will Trump Initiate Currency Intervention?

Following months of cajoling by the White House, the Federal Reserve finally cut its benchmark interest rate. However, the reaction in equity and currency markets was not the one President Donald Trump wanted – or many traders anticipated. The Trump administration wants the Fed to help drive the fiat U.S. dollar lower versus foreign currencies, especially those of major exporting countries. Instead, the U.S. Dollar...

Read More »Obvious Capital Consumption, Report 28 Jul

We have spilled many electrons on the topic of capital consumption. Still, this is a very abstract topic and we think many people still struggle to picture what it means. Thus, the inspiration for this week’s essay. Enterprise Car Service Suppose a young man, Early Enterprise, inherits a car from his grandfather. Early decides to drive for Uber to earn a living. Being enterprising, he is up at dawn and drives all day....

Read More »Gold Consolidates Near All Time High In British Pounds

Sterling is under pressure today and gold near all time record highs in sterling (see chart) due to the likelihood that Britain’s ruling Conservative party will elect Boris Johnson (aka ‘BoJo’) as its new leader and Prime Minister today. The result of the weeks-long internal party election will be announced today and there are increasing concerns about the outlook for the UK economy and sterling due to the poor...

Read More »Financial Media Elite Defensively Bash “Useless” Gold

Actually, Keynes’ “barbarous relic” remark was made not about gold itself but about the gold standard for currencies. Keynes wasn’t denying gold’s use as money. But that is the least of the problems with Wolf’s reply. Who cares about the prices of useless metals? “No significance in the modern world”? For starters, governments themselves care. That’s why central banks, against Wolf’s advice, continue to hold huge...

Read More »The Fake Economy, Report 21 Jul

Folks in the liberty movement often say that the economy is fake. But this does not persuade anyone. It’s just preaching to the choir! We hope that this series on GDP provides more effective ammunition to argue with the Left-Right-Wall-Street-Main-Street-Capitalists-Socialists. We frame it that way, because nearly everyone loves to tout GDP (though some do so only when it suits their political agenda). It is fashionable...

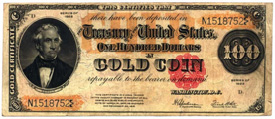

Read More »Monetary Metals Don’t Need a “Gold Standard” Proxy System

President Trump moved recently to nominate an avowed sound money advocate, Judy Shelton, to the Federal Reserve Board. That triggered a flurry of superficial and derisive references in the controlled media to Shelton’s past support of a gold standard. For example, CBS News described her as “a believer in the return to the gold standard, a money policy abandoned by the U.S. in 1971.” According to the story, “mainstream...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org