We have written much about the notion of inflation. We don’t want to rehash our many previous points, but to look at the idea of purchasing power from a new angle. Purchasing power is assumed to be intrinsic to the currency. We have said that the problem with the word inflation is that it treats two different phenomena as if they are the same. One is the presumed effect of rising quantity of dollars. The other is the...

Read More »Will Basel III Send Gold to the Moon, Report 2 Apr

A number of commentators have predicted that the rules of the Basel III bank regulations will cause gold to skyrocket (no, this article is not about our view that gold does not go up, that it’s the dollar going down, that the lighthouse does not go up, it’s the sinking ship going down in the storm). Will it? It would be easy to say—as with all of their other predictions of gold to infinity and beyond—“wait and see.” But...

Read More »Brexit and Learning To “Live With Boom and Bust Economic Cycles”

Generations of people have learned to live with boom and bust economic cycles. Years of relative plenty were followed, as night follows day, by grief including high unemployment and forced emigration on a large scale. In fact, if you go back much beyond the late 1960s, it would not be too cynical to say the cycles were often more about going from bust to really busted, as for decades the country was hit by crippling...

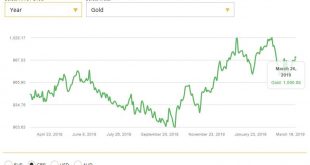

Read More »Gold Gains On Recession Concerns and ‘No Deal’ Brexit Risks

– Gold gains due to concerns about slowing growth, monetary and geopolitical risks – Increasing possibility of ‘No Deal’ Brexit heightens recession risks in UK, Ireland – Brexit uncertainty is impacting UK & Irish economies; Likely do long term damage – UK sees sharp slowdown in mortgage approvals in February as housing market slows – Gold surges to near all time record highs in Australian dollars at $1,860/oz –...

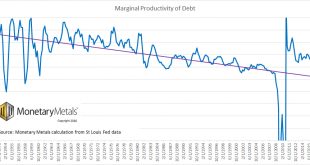

Read More »On Board Keynes Express to Ruin, Report 24 Mar

Last week, I ranted about the problem with our monetary system and trajectory: falling interest rates is Keynes’ evil genius plan to destroy civilization. This week, I continue the theme—if in a more measured tone—addressing the ideas predominant among the groups who are most likely to fight against Keynes’ destructionism. They are: the capitalists, the gold bugs, and the otherwise-free-marketers. I do not write this to...

Read More »Cryptocurrencies accepted by Switzerland’s biggest online retailer

An assortment of 2.7 million products, from computers to beer, can now by bought online with cryptocurrencies. (© Keystone / Gaetan Bally) Switzerland’s largest online shop, Digitec Galaxus, has announced it will start accepting payments in bitcoin and other cryptocurrencies. The company, which saw turnover of close to a billion francs last year, is by far the largest Swiss retailer to date to take this step. The move...

Read More »Keynes Was a Vicious Bastard, Report 17 Mar

My goal is to make you mad. Not at me (though I expect to ruffle a few feathers with this one). At the evil being wrought in the name of fighting inflation and maximizing employment. And at the aggressive indifference to this evil, exhibited by the capitalists, the gold bugs, and the otherwise-free-marketers. So, today I am going to do something I have never done. I am going to rant! I am even going to use vulgar...

Read More »The Duality of Money, Report 10 Mar

This is a pair of photographs taken by Keith Weiner, for a high school project. It seemed a fitting picture for the dual nature of money, the dual nature of wood both as logs to be consumed and dimensional lumber to be used to construct buildings. Last week, in Is Capital Creation Beating Capital Consumption, we asked an important question which is not asked nearly often enough. Perhaps that’s because few even...

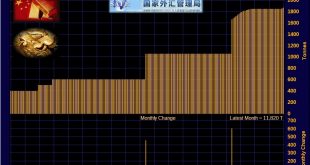

Read More »China Gold Reserves Rise To 60.26 Million Ounces Worth Just $79.5 Billion

China increased its gold reserves for a third straight month in February, data from the People’s Bank of China (PBOC) showed this morning. The value of China’s gold reserves rose slightly to $79.498 billion in February from $79.319 billion at the end of January, as the central bank increased the total amount of gold reserves to 60.260 million fine troy ounces from 59.940 million troy ounces. The People’s Bank of China...

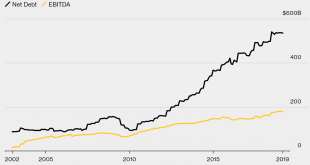

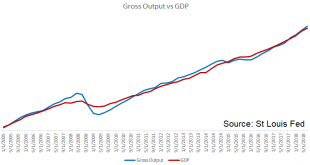

Read More »Is Capital Creation Beating Capital Consumption? Report 3 Mar

We have written numerous articles about capital consumption. Our monetary system has a falling interest rate, which causes both capital churn and conversion of one party’s wealth into another’s income. It also has too-low interest, which encourages borrowing to consume (which, as everyone knows, adds to Gross Domestic Product—GDP). What Is Capital At the same time, of course entrepreneurs are creating new capital. Keith...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org