Malaysia’s leading gold distributor saves money with a Monetary Metals lease Scottsdale, Ariz, February 8, 2019—Monetary Metals® announces that it has leased gold to Quantum Metal, to support the growth of its business of selling gold through retail banks. Investors earn 4.5% on their gold, which is held as Perth Mint minted gold bars in inventory. Monetary Metals has a disruptive model, leasing gold from investors who own it and subleasing it to businesses who need it, typically for inventory or work-in-progress. Gold owners benefit, because they earn a return rather than pay storage costs. Gold-using businesses benefit, as the lease is the lowest-cost money in their capital structure. And the lease is more

Topics:

Keith Weiner considers the following as important: 6) Gold and Austrian Economics, 6a) Gold & Bitcoin, Featured, gold interest, gold lease, newsletter, Press Releases, yield on gold

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Malaysia’s leading gold distributor saves money with a Monetary Metals lease

Scottsdale, Ariz, February 8, 2019—Monetary Metals® announces that it has leased gold to Quantum Metal, to support the growth of its business of selling gold through retail banks. Investors earn 4.5% on their gold, which is held as Perth Mint minted gold bars in inventory.

Monetary Metals has a disruptive model, leasing gold from investors who own it and subleasing it to businesses who need it, typically for inventory or work-in-progress. Gold owners benefit, because they earn a return rather than pay storage costs. Gold-using businesses benefit, as the lease is the lowest-cost money in their capital structure. And the lease is more user-friendly, being off balance sheet with no need to be hedged.

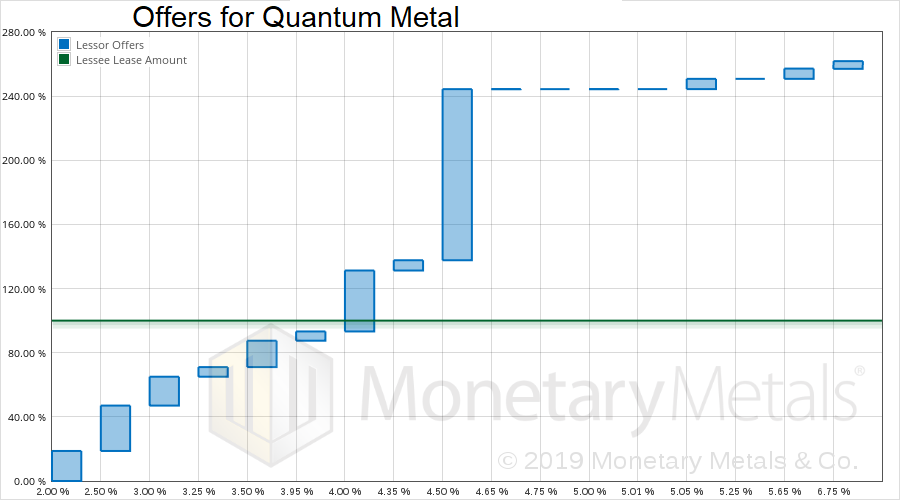

| Monetary Metals provides a fair rate of return to both investors and businesses by conducting a competitive auction. Each investor decides how much gold to offer, and the minimum interest rate. The rate-setting auction phase finds the rate that will raise enough metal for the total business need, 4.5% in this lease. This graph shows the offers, and 250% oversubscription. The second phase, the call for gold, was over 400% oversubscribed.

“Quantum Metal is the biggest gold bullion distributor in Malaysia. It has a need for a considerable amount of gold,” said Keith Weiner, CEO of Monetary Metals. He added, “This deal is the first tranche.” “Pending an imminent listing, we sought the help of Monetary Metals, as finance partners, to procure our gold lease requirements. Monetary Metals were very quick to assist and understood our business,” said De Wet Combrink, CEO of Quantum Metal. |

Offers for Quantum Metal |

Tags: Featured,gold interest,gold lease,newsletter,Press Releases,yield on gold