Sales of gold products by the Perth Mint surged in September to their highest since January 2017, while silver sales more than doubled from August to mark an over two-year peak, boosted by lower bullion prices, the mint said on Wednesday. Sales of gold coins and minted bars surged 61 percent from August to 62,552 ounces last month, the mint said in a blog post. Gold sales in September rose about 35 percent from a...

Read More »Textbook Falling Interest Behavior

Costco This is a textbook case. Well, it would be if there was a textbook that presented the dynamics of the rising and falling interest rate cycles. Costco is spending over a quarter billion dollars, to make a capital investment in chicken processing. This is not the typical entrepreneurial investment, which seeks to increase margins by serving an unserved or underserved demand. This is an investment made with...

Read More »LBMA Clearing and Vaulting data reveal the absurdity of the London ‘Gold’ Market

The first day of each month sees the reporting of a number of statistics about the London Gold Market by the bullion bank led London Bullion Market Association (LBMA). These statistics focus on clearing data and vault holdings data and are reported in a 1 month lag basis for clearing activity and a 3 month lag basis for vault holdings data. Therefore the latest clearing data just published is for the month of August,...

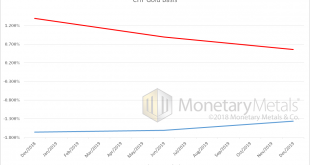

Read More »Permanent Gold Backwardation, Report 30 Sep 2018

Sometimes, one just needs to look in the right place. And often in those cases, it just takes a conversation to alert one where to look. We had a call with a Swiss company this week, to discuss gold financing for their business. They reminded us that there is a negative interest rate on Swiss francs. And then they said that a swap of francs for gold has a cost. That is, the CHF GOFO rate is negative (the dollar based...

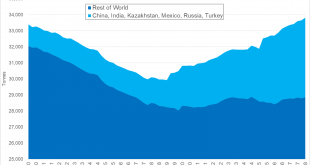

Read More »Central Banks Positivity Towards Gold Will Provide Long Term “Support To Gold Prices”

– There has been a recent change for the better in central bank attitudes to gold – There has been “net gold demand by central banks – approx. 500 tonnes per year – as a source of return, liquidity and diversification” – Policy shift to maintaining stable gold holdings reflects central bank concerns about financial markets and geopolitics – Little in the current global economic and political environment to support any...

Read More »Seasonality in Cryptocurrencies – An Interesting Pattern in Bitcoin

Looking for Opportunities The last time we discussed Bitcoin was in May 2017 when we pointed out that Bitcoin too suffers from seasonal weakness in the summer. We have shown that a seasonal pattern in Bitcoin can be easily identified. More than a year has passed since then and readers may wonder why we have not addressed the topic again. There is a simple reason for this: the lack of extensive historical data for...

Read More »We Need a Free Market in Interest Rates

We do not have a free market in interest rates today. We have not had one since the creation of the Fed in 1913. The Fed began buying bonds almost immediately, which pushes up the price and hence pushes down the interest rate. However, as I discuss in my theory of interest and prices, the Fed creates a resonant system with positive feedback loops. It wants lower rates (so the government can borrow more, more cheaply)...

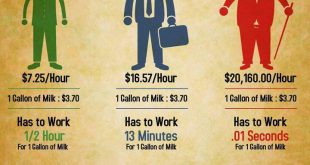

Read More »Why Are Wages So Low, Report 23 Sep 2018

Last week, we talked about the capital consumed by Netflix—$8 billion to produce 700 shows. They’re spending more than two thirds of their gross revenue generating content. And this content has so little value, that a quarter of their audience would stop watching if Netflix adds ads (sorry, we couldn’t resist a little fun with the English language). So it is with wry amusement that, this week, Keith heard an ad for an...

Read More »Trump’s Backdoor Power Play to Rein In the Fed

“Just run the presses – print money.” That’s what President Donald Trump supposedly instructed his former chief economic adviser Gary Cohn to do in response to the budget deficit. The quote appears in Bob Woodward’s controversial book Fear: Trump in the White House. Trump disputes many of the anecdotes Woodward assembled. But regardless of whether the President used those exact words, they do reflect an “easy money”...

Read More »Silver Is ‘Undervalued’ Relative to Stocks, Bonds, Gold – GoldCore

Silver is ‘undervalued’ relative to stocks, bonds and gold: GoldCore Silver at $14/oz is cheap relative to gold with gold-silver ratio over 85 Silver drops to 32-month lows prompting sellout of Silver Eagle coins at U.S. Mint U.S. Mint said “recent increased demand” prompted a “temporary sell out” of its American Silver Eagle bullion coins as investors see silver coins as a bargain “We believe that we are on the verge...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org