The price of silver is going up and down like a yo-yo. On Sunday and into the first part of Monday, the price skyrocketed on news that Reddit was touting the metal. But as the data clearly showed, the price was not driven up by retail buying of physical metal. To be sure, there was retail buying. But even if they depleted the finite inventories of Eagles and Maples, they were not the buyers that pushed the price up to $30. That would be the futures speculators....

Read More »Ruh Roh Silver

Sometimes you can count on the manipulation conspiracy theorists to get it exactly wrong. Not just a little bit wrong, nor halfway wrong. Not even mostly wrong. Totally wrong, backwards. Michael Crichton, in talking about the Gell-Mann Amnesia Effect said this: “You open the newspaper to an article on some subject you know well. In Murray’s [Gell-Mann] case, physics. In mine, show business. You read the article and see the journalist has absolutely no understanding...

Read More »Gold, the Tried-and-True Inflation Hedge for What’s Coming!

Global confirmed coronavirus cases surpassed 100 million this week. There is no denying that the coronavirus pandemic has caused tremendous hardship and loss. To mitigate new cases climbing further, stricter lockdown and travel restrictions are being announced and implemented, with the curfew in the Netherlands as an example. Lock-down fatigue, as evidenced by the riots against this implemented curfew, is growing. Through it all, hope is on the horizon as vaccine...

Read More »$1.9 Trillion American Rescue Plan Positive for Gold

The Massive $1.9 Trillion American Rescue Plan is Just the Start Massive $1.9 Tr. American rescue plan to affect markets Yellen takes over at US Treasury, what to expect More spending initiatives to come How all this is positive for gold and silver prices The Biden Administration’s policies are positive for gold and silver prices. The $1.9 trillion – American Rescue Plan released on January 14 is just the beginning of spending initiatives. The plan is chocked full...

Read More »The Problem with Record-Low Interest Rates

Are you familiar with the GoldNewsletter podcast? They boast over 200 episodes on the topics of investment, economics, and geopolitics. This week, hosts Fergus Hodgson & Brien Lundin interviewed Monetary Metals’ CEO Keith Weiner on the topic of falling interest rates and how cheap borrowing comes at the expense of capital productivity. [embedded content] Did you enjoy this episode? Subscribe to the GoldNewsletter podcast via...

Read More »A Georgia Gold Rush Story: The Rise and Fall of America’s First Private Gold-Coin Mint

(Note: This article is dedicated to the memory of Carl Watner, who died on December 8, 2020 at the age of 72. A long-time defender of individual liberty and free markets, his 1976 article in Reason magazine, “California Gold, 1849-65,” helped renew awareness and appreciation for private money in American history). Put the federal government in charge of the supply of money, let it outlaw private competition and bestow a “legal tender” privilege on its own paper and...

Read More »Episode 8: Why The Dollar Isn’t Money – PART 2

In a prior episode, we introduced the distinction between money and fiat currency, discussing what gives the dollar – or any fiat currency – its value. Now, we continue that conversation discussing additional characteristics of money, and illustrate how a false definition of money can lead to a corrupt state that wields blank checks. In this episode: Essential characteristics of money Thinking like a monetary scientist Friction in money & credit Why marginal...

Read More »Gold & Silver Charts Point to Higher Prices & Chris Vermeulen

Chris Vermeulen of TheTechnicalTraders.com joins Dave Russell of GoldCore TV. Chris discusses the chart patterns that the long term gold and silver charts are presenting and what he believe that this means for gold, silver and platinum for 2021. Chris is an expert technical analyst and also understands the fundamentals of the precious metals markets and how it acts as financial insurance for your portfolio. Click the video below to watch. [embedded content] You can...

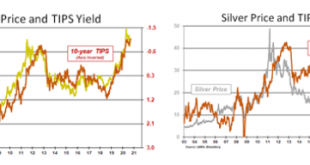

Read More »Gold to $2,300 and Silver to $35 by Year End – 2021, the Year the Barometer Explodes?

The US dollar set for further dramatic declines? Negative interest rate policy spreading Increased global liquidity in attempt to ignite a recovery Democrats’ win paves way for massive stimulus packages Gold and silver set to rally strongly in a perfect storm As the current wave of Covid19 strongly takes hold, it has devastated the lives of individuals and families and created an uneasy anxiousness not just in individuals but also in financial markets. It has turned...

Read More »Reflections Over 2020

Wow, it has been a heckuva year! One thought leads to another on this sunny-but-cool January 1. Having watched a few seasons of Forged in Fire, I’ve gained an appreciation of how difficult it is to pound and grind a lump of steel into a blade, even with power tools. There are many ways for it to go wrong. And “wrong” generally means catastrophic failure—a crack in the metal that will cause it to break into pieces when hit. That led to thoughts regarding an...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org