The US dollar set for further dramatic declines? Negative interest rate policy spreading Increased global liquidity in attempt to ignite a recovery Democrats’ win paves way for massive stimulus packages Gold and silver set to rally strongly in a perfect storm As the current wave of Covid19 strongly takes hold, it has devastated the lives of individuals and families and created an uneasy anxiousness not just in individuals but also in financial markets. It has turned a public health crisis in to an economic, financial and in some cases a political crisis too. We have watched as some of the most powerful democracies in the world struggle to maintain the very thing that defines them. All the while gold sits and watches and acts as a barometer for the perceived risk

Topics:

Stephen Flood considers the following as important: 6a.) GoldCore, 6a) Gold & Bitcoin, Daily Market Update, Featured, gold and inflation, gold forecast, gold price, negative interest rates, newsletter, US Dollar weakness

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- The US dollar set for further dramatic declines?

- Negative interest rate policy spreading

- Increased global liquidity in attempt to ignite a recovery

- Democrats’ win paves way for massive stimulus packages

- Gold and silver set to rally strongly in a perfect storm

As the current wave of Covid19 strongly takes hold, it has devastated the lives of individuals and families and created an uneasy anxiousness not just in individuals but also in financial markets. It has turned a public health crisis in to an economic, financial and in some cases a political crisis too. We have watched as some of the most powerful democracies in the world struggle to maintain the very thing that defines them. All the while gold sits and watches and acts as a barometer for the perceived risk in the world.

As it sat with a wise head throughout 2020 signaling that all was not well, is 2021 the year that the barometer is set to explode?

Gold and Silver prices closed December on a positive note, gold gained 6.8% and silver 16.6% for the month. For all of 2020 gold gained 25.1% and silver 47.9%. The main rally for the year was from mid-March to mid-August when both metals set the high for the year; gold’s year high was also a new all-time high of $2,063.54 on August 6 and silver’s year high was $29.13 on August 10. Silver’s all-time high was $48.49 on April 28, 2011. The March to August rally was driven by massive amounts of fiscal and monetary stimulus to offset the economic impact of the coronavirus-induced lockdowns.

The IMF estimates that governments have added more than $12 trillion in fiscal support. In addition to cutting interest rates, the five major central banks (the Fed, ECB, BoC, BoJ, and BoE) have added more than $8 trillion in assets to their balance sheets since March 2020 in order to support their respective economies during the Covid-19 pandemic. This compares to about $2.5 trillion in initial response from the central banks to the Great Financial Crisis in 2008-09.

After an initial decline from the highs for the year in August both gold and silver traded somewhat sideways as markets balanced recession fears with reflation expectations through the end of November. Central banks slowed their quantitative easing programs and governments pulled back on fresh stimulus spending. Then both metals began to rally again in December on hopes, then passage of new stimulus spending in the US and lower real interest rates. This rally has continued into the first trading week of 2021, which brings us to what we can expect in 2021.

Watch the latest episode of GoldCore TVStarting 2021 on a positive note will be accentuated by entering a seasonally strong period over the next several months – our outlook for the gold price is to average $2,000 in the first quarter, an average of $2,100 for all of 2021 (the average for 2020 was $1,770.19) with a year-end price of around $2,300. For silver, an average of $28 for first quarter; an average of $32 for the year (the average for 2020 was $20.53) with a year-end price of around $35.

|

|

|

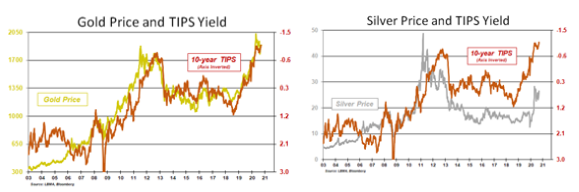

Real Interest Rates Central bank forward guidance in recent weeks calls for policy rates to stay low for the foreseeable future. The Bank of England is looking into negative rates, and the Federal Reserve recently adopted average inflation targeting of 2%, which the ECB is now considering following. The Federal Reserve’s summary of economic projections released with its September statement showed real-interest rates reaching negative 1.62% by 2023 year-end. Interest rates are likely to stay low for many years to come due to the increased government deficits this year and continuing rising government debt levels. With policy rates remaining low, if the yield curve steepens as longer-term interest rates rise with renewed inflation expectations central banks are likely to implement some form of yield curve control by purchasing increased amounts of longer-maturing debt. Included in this factor of low real interest rates is negative yielding debt, which globally grew to a record high of over $18 trillion. Gold and silver prices are negatively correlated to real-interest rates (TIPS: Treasury Inflation Protected Securities). |

|

|

Global Liquidity Central banks responded swiftly this year adding unprecedented amounts of assets to their balance sheets. Although the rate of increase of asset purchases has slowed in recent months, we expect central banks to continue to increase their balance sheets for at least the next two years. Their work is not done yet. The economic recovery needs time to gather steam and governments are continuing to run huge deficits that central banks will need to soak up.

|

Economic and financial events to watch this week

The main economic releases for the week are the Fed minutes and ADP Employment report on Wednesday. If the Fed meeting minutes show a consensus in the discussions at the last meeting of a dovish leaning Fed, then gold and silver prices should move higher on the release.

ADP employment report is expected to show an increase of 50k jobs in December (down from an increase of 307k in November). And the US employment report is scheduled to be released on Friday. The employment report is expected to show an increase of 62k jobs in December (down from an increase of 344k in November). If the employment report does indeed show that 62k jobs were created in December, then the US economy is still 9.7 million jobs below the February 2020 peak (another reason the Fed will maintain a very accommodative monetary policy stance). In the current environment, the gold and silver markets are less reactive to economic data and more reactive to monetary and fiscal stimulus news.

The last note we leave readers with is the final 15 days of Trump’s presidency could create some geopolitical upticks in gold and silver prices. And as both seats in Georgia have gone to the Democrats the Senate is tied 50-50 (Vice President-elect Harris will now act as the tie-breaking vote), we can expect larger fiscal stimulus packages to pass Congress than if Republicans had maintained control of the Senate. This should also be good for gold and silver prices.

Tags: Daily Market Update,Featured,gold and inflation,gold forecast,gold price,negative interest rates,newsletter,US Dollar weakness