The price of silver is going up and down like a yo-yo. On Sunday and into the first part of Monday, the price skyrocketed on news that Reddit was touting the metal. But as the data clearly showed, the price was not driven up by retail buying of physical metal. To be sure, there was retail buying. But even if they depleted the finite inventories of Eagles and Maples, they were not the buyers that pushed the price up to . That would be the futures speculators. Speculators use the futures market because it offers great leverage. But leverage gives them itchy trigger fingers, and they will sell to take profits or stop losses at any time. That time began around 15:00 GMT Monday, and lasted through 6pm Tuesday. On Tuesday alone, the price dropped two bucks. The

Topics:

Keith Weiner considers the following as important: 6a.) Monetary Metals, 6a) Gold & Bitcoin, Basic Reports, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The price of silver is going up and down like a yo-yo. On Sunday and into the first part of Monday, the price skyrocketed on news that Reddit was touting the metal. But as the data clearly showed, the price was not driven up by retail buying of physical metal.

To be sure, there was retail buying. But even if they depleted the finite inventories of Eagles and Maples, they were not the buyers that pushed the price up to $30. That would be the futures speculators.

Speculators use the futures market because it offers great leverage. But leverage gives them itchy trigger fingers, and they will sell to take profits or stop losses at any time.

That time began around 15:00 GMT Monday, and lasted through 6pm Tuesday.

On Tuesday alone, the price dropped two bucks.

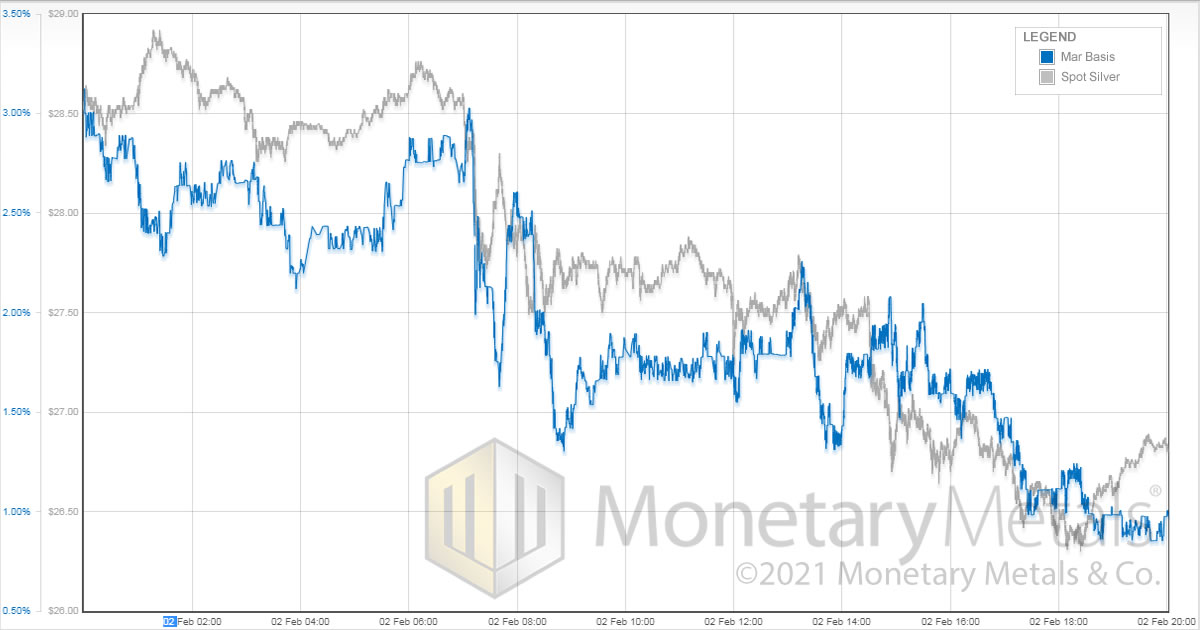

The Retail BuyersThe premia on retail silver products were high on Tuesday, showing that retail buying persisted. Though it must be noted that they dropped later in the day. Retail can buy a lot of silver—eventually—but they are drinking through a fairly narrow straw. We refer to the limited manufacturing capacity of coins and other precision-minted products. If high retail demand persists, then high premiums will sooner or later incentivize mints to buy more equipment. We shall see how long this latest wave of demand endures. Here is a graph of Tuesday’s silver market action. The basis drops from 3% to 1%. This selling, like the buying before it, was predominantly in the futures market. The speculators dove in with both feet, tread water for a brief moment, then leapt out of the pool again. |

Silver Spot vs Mar Basis, February 03 |

What’s Next?

The direction of the next move—and its durability—now depends on retail buyers.

If they keep buying, undeterred or even spurred on by this price drop, then silver metal will become more scarce in the global market. And the price will rise. And the speculators will likely jump in again, but perhaps be less twitchy to get out. Fear of Missing Out can be a powerful motivator. Then we could easily see a move to $40 or more. But if retail buyers have had their fill of volatility, and/or Reddit moves on to the next thing, then we are back to the silver market of mid-January.

Tags: Basic Reports,Featured,newsletter