In a prior episode, we introduced the distinction between money and fiat currency, discussing what gives the dollar – or any fiat currency – its value. Now, we continue that conversation discussing additional characteristics of money, and illustrate how a false definition of money can lead to a corrupt state that wields blank checks. In this episode: Essential characteristics of money Thinking like a monetary scientist Friction in money & credit Why marginal utility matters so much Insights from the habits of humans – and gold – over 5000 years [embedded content] Episode Transcript John Flaherty: Hello, everyone, and welcome again to the Gold Exchange podcast. I’m John Flaherty and I’m here with Keith Wiener, founder and CEO of Monetary Metals. In the last

Topics:

Michelle Agner considers the following as important: 6a) Gold & Bitcoin, Featured, newsletter, The Gold Exchange Podcast

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

In a prior episode, we introduced the distinction between money and fiat currency, discussing what gives the dollar – or any fiat currency – its value. Now, we continue that conversation discussing additional characteristics of money, and illustrate how a false definition of money can lead to a corrupt state that wields blank checks.

In this episode:

-

- Essential characteristics of money

- Thinking like a monetary scientist

- Friction in money & credit

- Why marginal utility matters so much

- Insights from the habits of humans – and gold – over 5000 years

Episode Transcript

John Flaherty: Hello, everyone, and welcome again to the Gold Exchange podcast. I’m John Flaherty and I’m here with Keith Wiener, founder and CEO of Monetary Metals. In the last episode, we defined money and drew some distinctions with its evil twin, fiat currency. On this episode, we’d like to go a little deeper into some of the important characteristics of gold as money.

So, Keith, last episode we talked about a few of the essential characteristics of money and why gold has emerged as money over time. We have these basic characteristics of portable, durable, divisible, fungible, meaning interchangeable.

We also talked about it as a medium of exchange. Last episode we said that you can go into a grocery store and exchange this fiat currency for goods and things. Why in the world would that not be considered money?

Keith Weiner: I’d like to make an analogy to before Galileo, the medievals defined speed as the degree of motion. Now, in a certain sense, and for a layman, or let’s say a child who doesn’t really have that much understanding of the world, it isn’t wrong. I mean, yes, you can trade your dollars for groceries. As I said, I hate that glib expression “worthless fiat dollars” because it wasn’t worthless. It definitely trades with groceries and gasoline and even gold.

But if you want to do science, then degree of motion is not only inadequate, but actually it’s kind of in a way, begging the question. And begging the question as a fallacy when you presume what you should be asking. So degree of motion, OK, so something that’s in motion has a degree of motion-ness. OK, great. But now it’s circular. A degree of what? Motion, well speed, but what is it that it has a degree of?

And the medievals weren’t able to define that. It’s a Galileo, you know, sort of seminal genius of science who enabled the fields of physics by saying, no, no, no, no, it’s not degree of motion. It’s a change in distance that you can measure per unit of time. So, feet per second, or meters per second, that’s what speed is. All of a sudden things come into sharper focus. The mind comes to clarity.

And now you understand when you have something of five miles per hour and something of ten miles per hour. Yes, you can say the latter has a greater degree, but now you can measure degree of what? Change in distance for the same amount of time. And so to define money as medium of exchange, you suffer from the same low resolution, low clarity confusions. So is the Bolivar money inside the borders of Venezuela? And then as soon as you cross the border, what had been money ceases to be money?

Is money-ness something that comes and goes by the decrees or edicts of governments? What was the lesson of King Canute, in the old fable where he has his men set his throne down on the beach and orders the tide back. And of course, the tide doesn’t obey him and he gets wet. Can man command, or government command, something such as money? Or is there some economic law that is independent of legislative law?

And so by defining it simply as a medium of exchange, not only are we making confusion about that, but as with defining speed as degree of motion, there’s also a degree of begging the question…OK, the dollar is a medium of exchange. Why is it the medium? Why does it work as a medium? Yes, OK, legislative fiat, that’s part of it. But the dollar is actually pretty good at something. But one has to look at spread.

One has to look at bid and offer prices on the dollar and realize that certainly in America, but in many places around the world, that spread is effectively zero. The dollar has no friction. So now we’re getting into the concept of friction, which is how much loss of energy is there to move from point A to point B, and that the medium of exchange has low friction. Is there a non-credit that has low friction? And that’s that’s what money is.

So gold being the commodity with the lowest friction, as distinguished from the dollar, which is the credit of low friction. And now we’re making a distinction between a commodity versus credit, which is a promise to pay a commodity, and therefore the field of monetary science becomes possible when one sharpens the definition.

John: So why has gold emerged as the preeminent means to do this over time?

Keith: So you mentioned a couple of characteristics. Let’s take portability for a minute. And portability implies obviously a certain value density. That is, I can easily carry in my pocket a year’s wages, both in terms of the weight and bulk of one year’s wages for the average person. It would easily fit in your pocket without pulling your pants down, let alone breaking your back.

That’s important because in order for something to have a consistent value, you can’t have a situation where in one town there is a relative surplus and then two towns away, there’s a relative scarcity. So essentially the value between those two towns would be different, significantly different. That would be another kind of spread. That would be a distance based-spread. That is, money is worth more here and less there. So by being portable, if there ever was to be any kind of spread between two different locations, gold would be the simplest and easiest thing to bring from one place to another.

So wherever gold is essentially offered cheaper, one would acquire it there and then bring it to wherever gold is bid higher until that spread compressed to nearly zero. And so today, of course, with airplanes, there’s no place on the planet that’s more than essentially 24 hours from any other place, certainly in terms of where gold is traded. Not necessarily the backwater villages of Third World countries, but Zurich, London, New York, Singapore, any of the major places, gold can be on an airplane to or from those places and be there in less than 24 hours. And so that can allow traders to compress any geographic base spread to essentially zero. And that’s obviously a key characteristic of it.

John: Let’s get into gold as a store of value. Another essential characteristic. Right. We’ve all seen the charts of the fiat currencies going back 100 years and how their value gets slowly eroded. Can you comment on gold as a store of value and the other characteristics that that lead to that?

Keith: This is one of those ones that there’s actually a lot more ‘there’ there than most people would think. And the first thing I’m going to do, again, in keeping with the idea of science is words are important and definitions are important. Gold is not a store in the sense of, if I had a bottle that’s a store of liquid and you pour the liquid in and you put the cap on and then you can hold that bottle for a day or a year or century, and when you come back, assuming the lid doesn’t leak the same stuff that you put in there, it comes back out. There’s nothing like that in economics.

So it isn’t literally a store in that sense. What we mean is that when we essentially purchase the gold today, either trading fiat currency for it, or trading hours of labor, or trading goods that we produce and trade that for gold, that we’re essentially paying a certain price for that gold. And then we’re relying on that, if we want to hold that gold for, let’s say, a decade, someone else is going to bid on that gold 10 years from now. And we can be reasonably confident that the bid on the gold is consistent with the bid that we made today.

And so there’s something about it that says the next person is going to pay the same as with the previous person paid, which is the previous the previous previous all the way back to us, which is a very different thing, because now it’s making an assumption about the behaviors of very large numbers of people.

How can we be so sure the very large numbers of people will behave that way? Other than now there’s a glib response that says they behaved that way for 5000 years. But that in itself is really not satisfactory, as the proof. Just because people for 5000 years believe something doesn’t necessarily mean that they’re going to continue to believe it next year. So if you drill down into gold a bit deeper and I’ve talked a lot about the spread marketability, that is if you buy gold and immediately sell it, you take the least loss of any commodity.

There are two related phenomenon that are almost part of, I call it a triumvirate. They’re all part of the same, or different aspects of different angles on the same phenomenon. And there’s something else – you can observe marketability. You can actually measure that as a spread. Go look at the buy and sell price on a commercial contracts for gold, not not one gold coin in a retail store. And you can see that. The next thing you can see is the ratio of how much gold is produced in a year, relative to how much gold is in human hands, is in total inventory. In any normal good, whether it’s crude oil or whether it’s lumber, copper or anything else and any normal good, there’s only a few months worth of inventory accumulated.

And if production sort of exceeds a certain rate and now you start to accumulate inventory, it’s called a glut. And the moment a glut happens, the price collapses, which obviously discourages production and encourages consumption. And eventually the glut is worked off. But with gold, what you can see is that for 5000 years at least, we’ve been producing gold and accumulating it. Gold isn’t really consumed. I mean, even if you manufacture something out of it, that can be melted down and returned to raw gold form. And frequently is. Gold is recycled, even in electronics and other applications, it’s not really consumed.

And so we accumulate gold without any particular limit, and that’s suggestive of what I just said a moment ago. How do you know the next person is going to buy that ounce of gold? Well, if you look at this 5000 years of accumulation, there’s no such thing as a glut in gold. And so the third characteristic of our triumvirate is that all goods have a concept called marginal utility, which is basically looking at what’s the value of the next unit, the Nth plus one unit of the good, in relation to the previous, the Nth unit.

Suppose you’re walking through the desert in Arizona in the summer at 120 degrees Fahrenheit, you’re dying of thirst and you come across some guy selling gallons of water jugs out of the back of his truck. What is the amount that you’re willing to pay? What is your bid price on a gallon of water? Well, anything you have, it’s your life. What is your bid price on the second gallon of water? Well, that’s how you’re going to get back to civilization. So, a pretty high price.

What is your bid on the third and the fourth? Somewhere between the fourth and maybe the fifth, it’s zero. You don’t want any more water. And in fact, carrying it becomes a burden. So you can see that even though we’re talking about 120 degrees Fahrenheit and a bone dry desert, that’s literally killing you until you got lucky and found the guy selling the water….four or five gallons…by that point, the Nth plus one unit is worth zero.

So the value of all goods at the margin is always falling and eventually gets to zero. You don’t want any more of it. Storage becomes a burden. Carrying it becomes a burden. But not for gold. For gold, the Nth plus one unit is worth the same as the Nth. And that’s what we’ve seen for 5000 years of accumulation. And so that doesn’t necessarily mean that if you hold gold for 10 years, the price of gold as measured in dollars, or the price of gold, if one were to measure that as the inverse of all the goods, the average price of all the goods in the market, the general price level.

It doesn’t mean that gold’s price as measured by those metrics will be the same. But what we what we now can say is for 5000 years, the value of the Nth plus one unit of gold is the same as the Nth, is the same as the Nth minus one, as the same as the Nth minus two. All the way back to the first. There’s something constant about gold that is not true for any other commodity or for that matter, for the dollar.

John: Why then would Silver be considered a monetary metal? Can you comment on silver’s characteristics as you just defined them for gold?

Keith: It’s a very interesting question and actually a non-trivial question. The world is full of dynamics, that is, moving situations that lead to one winner take all. When computer networking started to become a thing, there were multiple different computing network standards. You had token ring and you had Novell, NetWare and BanaianVine’s and TCPIP, and eventually TCPIP won. That’s the only networking that anybody I’m aware of is using today. Why, after thousands of years, are there still two monetary metals? And the fact that they’re both heavy and shiny, and, gold does not tarnish, silver is pretty hard to tarnish, but it does tarnish.

They’re both good conductors and good reflectors and and all those things. They both are actually similar. Why the two of them both survive? Why isn’t one winner take all? And it turns out that if you drill down into marketability, what you find is a distinction between marketability in the small and general marketability in the large. In other words, if you’re a wage earner and you want to set aside 10 percent of your wage, whether you’re talking ancient Roman times, whether you’re talking Renaissance, whether you’re talking today, what is the median wage earner in this country making per hour? Something like 25 dollars?

So if he wants to set aside an hour’s worth of wages and put it aside as savings, that’s about an ounce of silver. That ounce of silver turns out to have less frictional loss, less spread than 25 dollars worth of gold, which would be something like half a gram. It’d be a tiny little flake, hard to even hold. You couldn’t put it in your pocket. It would be lost in the lint in your pocket.

And so for really small amounts of value, such as the amount that a worker would set aside of his weekly wages, silver is the most marketable, and therefore involves the least losses. And gold is less efficient for that purpose, whereas obviously for larger transactions, gold is the more efficient.

John: So, Keith, any other thoughts on how we have defined money and how we would like to see it defined more in the mainstream?

Keith: You know, one last thought, which is if you define money as the government’s debt obligation, I mean, think about not only the corruption of the thought process, but the corruption of money and the corruption of the government. Think about how terribly, terribly convenient that is for the government who just simply wants to borrow more so they can spend more and buy more votes and give more graft to their favorite cronies and special interests and voting blocs and all that.

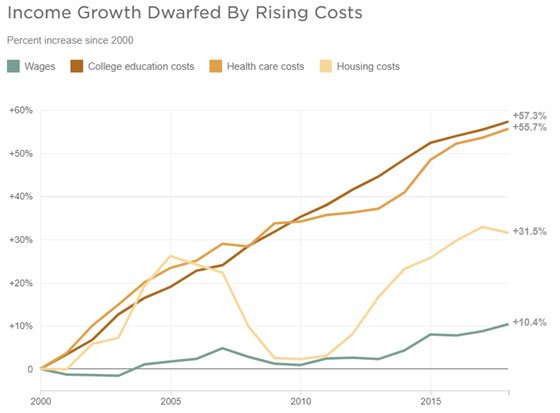

But now there is a natural and nearly limitless demand for their debt paper, and they always want to borrow more because they always want to be paying off somebody, presumably including themselves. And so by defining money that way, it’s essentially giving the government a blank check. And then we wonder, why is the government approaching 30 trillion dollars in debt? It’s because of that blank check. In addition to that, of course, because what people call money today and what statute calls money today is the government debt, then the interest rate can can collapse to zero and there’s no bond vigilante.

There’s no such thing as people saying, “Enough is enough. We’re not going to accept that. Inflation is going to be greater than what you’re paying us in interest. And therefore, we’re going to sell the bond.” There is no way to sell the bond. To hold that money balance is to hold a slice of that debt and to finance a slice of that debt. Whether you hold that as Federal Reserve notes, whether you hold it as banking system credit, whether you hold it as obviously Treasury bonds or Treasury bills….you are financing a piece of that debt. And willingly so because people consider it to be money.

So it’s it’s not only a false definition, but it’s a definition that serves the interest of the of a corrupt state that just wants to borrow more, to spend more. And so if we want to understand the root of the problem, we need to understand that very definition gives them the blank check that I think most people would object to them having in the first place.

John: Well, Keith, this has been a great discussion. As usual, we appreciate your insights today on this very important topic. I’d like to thank you and our audience for joining us today on the Gold Exchange podcast.

Tags: Featured,newsletter,The Gold Exchange Podcast