The Chinese have been reforming their monetary and credit system for decades. Liberalization has been an overriding goal, seen as necessary to accompany the processes which would keep the country’s economic “miracle” on track. Or get it back on track, as the case may be. Authorities had traditionally controlled interest rates through various limits and levers. It wasn’t until October 2004, for example, that the upper limit on lending rates was rescinded. In August...

Read More »Some Brief European Leftovers

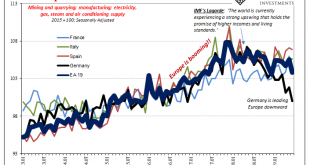

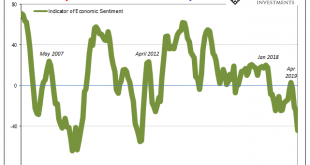

Some further odds and ends of European data. Beginning with Continent-wide Industrial Production. Germany is leading the system lower, but it’s not all just Germany. And though manufacturing and trade are thought of as secondary issues in today’s services economies, the GDP estimates appear to confirm trade in goods as still an important condition and setting for all the rest. The weakness is persisting and intensifying – particularly after May 2019. Europe...

Read More »Retail Sales’ Amazon Pick Up

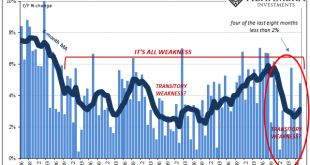

The rules of interpretation that apply to the payroll reports also apply to other data series like retail sales. The monthly changes tend to be noisy. Even during the best of times there might be a month way off trend. On the other end, during the worst of times there will be the stray good month. What matters is the balance continuing in each direction – more of the good vs. more of the bad. Or when what seems to be a good month is less good than it used to be....

Read More »US Industrial Downturn: What If Oil and Inventory Join It?

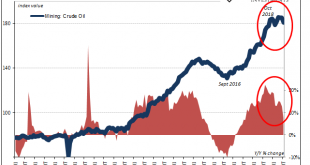

Revised estimates from the Federal Reserve are beginning to suggest another area for concern in the US economy. There hadn’t really been all that much supply side capex activity taking place to begin with. Despite the idea of an economic boom in 2017, businesses across the whole economy just hadn’t been building like there was one nor in anticipation of one. The only place where there was a truly robust trend was the oil patch. Since the last crash a few years ago,...

Read More »The Path Clear For More Rate Cuts, If You Like That Sort of Thing

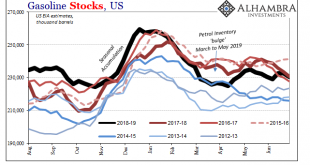

If you like rate cuts and think they are powerful tools to help manage a soft patch, then there was good news in two international oil reports over the last week. The US Energy Information Administration (EIA) cut its forecast for global demand growth for the seventh straight month. On Friday, the International Energy Agency (IEA) downgraded its estimates for the third time in four months. That wasn’t all, as the EIA’s report focused in on some more sobering aspects...

Read More »Why You Should Care Germany More and More Looks Like 2009

What if Germany’s economy falls into recession? Unlike, say, Argentina, you can’t so easily dismiss German struggles as an exclusive product of German factors. One of the most orderly and efficient systems in Europe and all the world, when Germany begins to struggle it raises immediate questions about everywhere else. This was the scenario increasingly considered over the second half of 2018 and the first few months of 2019; whether or not recession. Over the past...

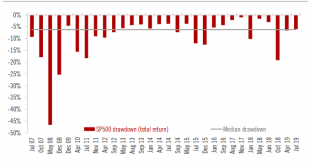

Read More »Developed market equities update: a fairly reassuring reporting season

There is an ongoing tug-of-war between trade tensions and fundamentals Due to renewed trade tensions, the S&P 500 corrected by 6.0% and the Stoxx Europe 600 by 5.8% from the late July peak to the 5 August low. Because the pullback was clustered around just a few days, its intensity was reminiscent of the worst market days of past major crises. Safe haven assets benefitted significantly, with gold gaining 7.4% from the late July equity market peak to the 5 August...

Read More »The Internal War in the Deep State Claims Its High Profile Casualty: Jeffrey Epstein

The “traditionalist” Neocons are going to have to decide to fish or cut bait. I’ve been writing about the fracturing Deep State for the past five years: The conflict has now reached the hot-war stage where bodies are turning up, explained away by the usual laughable covers: “suicide,” “accident” and “heart attack.” That Jeffrey Epstein’s death in a secure cell is being labeled “suicide” tells us quite a lot about the...

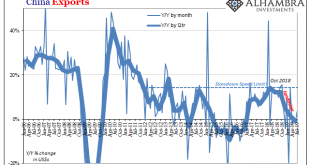

Read More »The Myth of CNY DOWN = STIMULUS Won’t Die

On the one hand, it’s a small silver lining in how many even in the mainstream are beginning to realize that there really is something wrong. Then again, they are using “trade wars” to make sense of how that could be. For the one, at least they’ve stopped saying China’s economy is strong and always looks resilient no matter what data comes out. Even after all that supposed “stimulus” starting in the middle of last year...

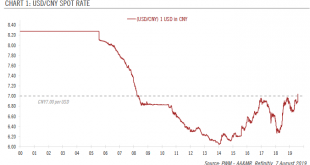

Read More »The US labels China a currency manipulator

The near-term impact will likely be limited but this is a clear negative for trade negotiations. Shortly after the renminbi’s sharp depreciation on Monday, the US Treasury Department labelled China a currency manipulator. This is the first time in 25 years that the US government has designated a country as a currency manipulator. According to the US Treasury Department, the decision was triggered by the perceived lack...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org