Despite the CNY’s recent fall, we believe the People’s Bank of China will refrain from competitive devaluation Following US President Donald Trump’s announcement of a new 10% tariff on USD300 billion of Chinese goods, the Chinese renminbi (rmb) weakened sharply and breached CNY7.00 per USD. The recent rmb move, in our view, represents a major shift in the People’s Bank of China’s (PBoC) currency policy, reflecting the...

Read More »The Gulag of the Mind

Befuddled and blind, we wander toward the cliff without even seeing it, focusing on our little screens of entertainment and self-absorption. There are no physical barriers in the Gulag of the Mind–we imprison ourselves, and love our servitude. Indeed, we fear the world outside our internalized gulag, because we’ve absorbed the narrative that the gulag is secure and permanent. We’ve also absorbed the understanding that...

Read More »BoJ stays put amid economic headwinds

Japan’s central bank has little room for further easing despite a downbeat outlook. At its monetary policy meeting on 30 July, the Bank of Japan (BoJ) decided to keep its monetary policy unchanged, as expected. The decision came as the Japanese economy faces strong external headwinds and a downbeat outlook for domestic demand. However, we do not expect the BoJ to make any changes to its current monetary easing...

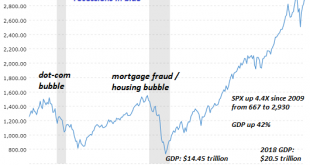

Read More »Nothing Is Guaranteed

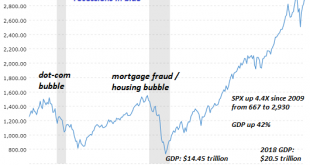

There are no guarantees, no matter how monumental the hubris and confidence. The American lifestyle and economy depend on a vast number of implicit guarantees— systemic forms of entitlement that we implicitly feel are our birthright. Chief among these implicit entitlements is the Federal Reserve can always “save the day”: the Fed has the tools to escape either an inflationary spiral or a deflationary collapse. But there...

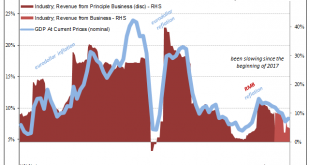

Read More »Main Street Small Business on the Precipice

Small businesses on the precipice need only one small shove to go over the edge, and there won’t be replacements filling the fast-multiplying empty storefronts. As a generality, the average employee (including financial pundits) has no real experience or understanding of what it takes to start and operate a small business in the U.S. Government employees in the agencies that oversee and enforce regulations on small...

Read More »China’s Big Gamble(s): Betting on QE Again?

As an economic system, even the most committed socialists had come to realize it was a failure. What ultimately brought down the Soviet Union wasn’t missiles, tanks, and advanced air craft, it was a simple thing like bread. You can argue that Western military spending forced the Communist East to keep up, and therefore to expend way too much on guns at the expense of butter. Even if that was the case, the Soviet system...

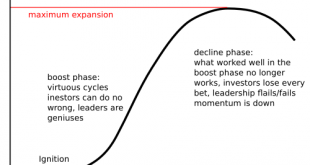

Read More »Why Is What Was Once Affordable to Many Now Only Affordable to the Wealthy?

With these speculative and risk management skills accessible only to the wealthy, no wonder only the wealthy have gained purchasing power in the 21st century. Let’s start with an excerpt from a recent personal account by the insightful energy/systems analyst Ugo Bardi, who is Italian but writes his blog Cassandra’s Legacy in English: Becoming Poor in Italy. The Effects of the Twilight of the Age of Oil. “I am not poor....

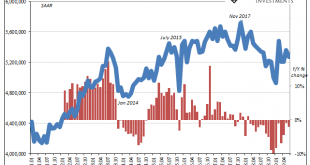

Read More »Real Estate Perfectly Sums Up The Rate Cuts

It’s only a confusing when you just accept the booming economy of the unemployment rate. From this perspective, 2018 was, and more so 2019 is, a downright conundrum. By all mainstream accounts, this just shouldn’t be happening. Home sales are running at a pace similar to 2015 levels – even with exceptionally low mortgage rates, a record number of jobs and a record high net worth in the country. Not only that, 2015...

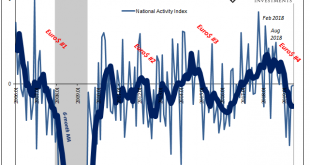

Read More »US Economic Crosscurrents Reach the 50 Mark

In the official narrative, the economy is robust and resilient. The fundamentals, particularly the labor market, are solid. It’s just that there has arisen an undercurrent or crosscurrent of some other stuff. Central bankers initially pointed the finger at trade wars and the negative “sentiment” it creates across the world but they’ve changed their view somewhat. A few billion in tariffs, even if we include what is to...

Read More »It’s Not Just the News That’s Fake–Everything’s Fake

That we fall for the fakes and cons is understandable, given that’s all we have left in the public sphere. What do we mean when we say corporate media is fake? We mean it’s a carefully crafted con, a set of narratives, cherry-picked data and heavily massaged statistics (the unemployment rate, etc.) designed to instill the reader’s confidence in a narrative that serves the interests not of the citizenry but of a select...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org