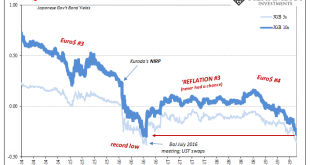

After trading overnight in Asia, Japan’s government bond market is within a hair’s breadth of setting new record lows. The 10-year JGB is within a basis point and a fraction of one while the 5-year JGB has only 2 bps to reach. It otherwise seems at odds with the mainstream narrative at least where Japan’s economy is concerned. Japan JGB, Jan 2014 - Jul 2019 - Click to enlarge Record lows in Germany, those seem to make sense. By every account, the German...

Read More »Emerging Markets: FX Model for Q3 2019

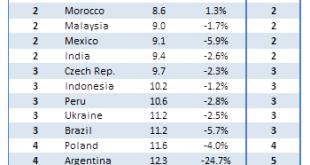

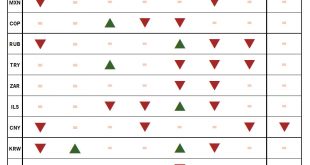

The broad-based dollar rally remains intact despite the market’s overly dovish take on the Fed We still believe markets are vastly overestimating the Fed’s capacity to ease in 2019 and 2020 What’s clear is that the liquidity story is not enough to sustain EM MSCI EM FX is on track to test the September 2018 low near 1575 and then the April 2017 low near 1568 Our 1-rated (strongest fundamentals) grouping for Q3 2019 consists of TWD, PHP, CNY, THB, and KRW Our...

Read More »Definitely A Downturn, But What’s Its Rate of Change?

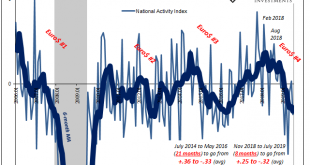

The Chicago Fed’s National Activity Index (NAI) fell to -0.36 in July. That’s down from a +0.10 in June. By itself, the change from positive to negative tells us very little, as does the absolute level below zero. What’s interesting to note about this one measure is the average but more so its rate of change. The index itself is a product of econometric research. Economists had been searching for an alternative to the unemployment rate in order to increase the...

Read More »Dollar Firm as Markets Calm

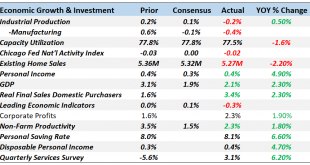

- Click to enlarge Market sentiment has improved after President Trump said China has asked to restart trade talks PBOC fixed the yuan basically flat and firmer than what models suggested The G-7 summit wraps up today with little to show for it We believe the Chicago Fed National Activity Index remains the best indicator to gauge US recession risks Germany July IFO business climate came in weaker than expected The lira experienced a flash crash against the yen...

Read More »Monthly Macro Monitor: Does Anyone Not Know About The Yield Curve?

The yield curve’s inverted! The yield curve’s inverted! That was the news I awoke to last Wednesday on CNBC as the 10 year Treasury note yield dipped below the 2 year yield for the first time since 2007. That’s the sign everyone has been waiting for, the definitive recession signal that says get out while the getting is good. And that’s exactly what investors did all day long, the Dow ultimately surrendering 800 points on the day. I don’t remember anyone on CNBC...

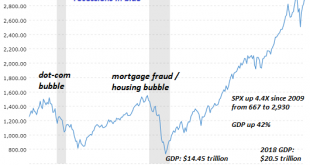

Read More »The Benefits of a Profoundly Shattering Recession

Does anyone really think The Everything Bubble can just keep inflating forever? What do I mean by a profoundly shattering recession? I mean, a systemic, crushing recession that can’t be reversed with central bank magic, a recession that only deepens with time. The last real recession was roughly two generations ago in 1981; younger generations have no experience of a profound recession, and perhaps older folks have forgotten the shock, angst and bitterness. A...

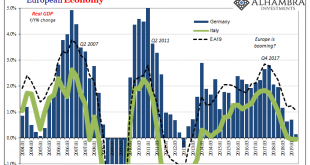

Read More »Germany’s Superstimulus; Or, The Familiar (Dollar) Disorder of Bumbling Failure

The Economics textbook says that when faced with a downturn, the central bank turns to easing and the central government starts borrowing and spending. This combined “stimulus” approach will fill in the troughs without shaving off the peaks; at least according to neo-Keynesian doctrine. The point is to raise what these Economists call aggregate demand. If everyday folks don’t want to spend – because a lot of them can’t – then the government will spend on their...

Read More »Our Wile E. Coyote Federal Reserve

Whatever the Fed chooses to do, it’s already failed.. Wile E. Coyote has gotten a bad rap: in all fairness, his schemes are ingenious, if overly complicated, and it’s not his fault that the Acme detonator misfires or the Road Runner doesn’t respond as predicted. Every set-up to nail the Road Runner should work. That it fails and leaves him suspended over the cliff for a woefully brief second to intuit his impending doom really isn’t his fault. Wile E. Coyote and the...

Read More »Dollar Firm Ahead of Jackson Hole

FOMC minutes were not as dovish as many had hoped; bond and equity markets are set up for a big reset Today sees the start of the annual Fed symposium in Jackson Hole; the US reports a slew of data Markit flash eurozone August PMI readings were reported; ECB publishes the account of its July 25 meeting Japan-Korea relations continue to deteriorate Indonesia delivered a dovish surprise; Mexico and Brazil report mid-August inflation data The dollar is broadly firmer...

Read More »Brazilian real stands out in EM currency scorecard

Prospects for emerging-market currencies look cloudy. The currencies of countries with sound external buffers and limited exposure to global trade should fare relatively better than others. In recent months, the global environment has become more challenging for EM currencies. Trade tensions have increased and are weighing on economic activity. Commodity prices have also fallen. Such developments tend to weigh on global appetite for relatively risky EM assets. More...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org