What if Germany’s economy falls into recession? Unlike, say, Argentina, you can’t so easily dismiss German struggles as an exclusive product of German factors. One of the most orderly and efficient systems in Europe and all the world, when Germany begins to struggle it raises immediate questions about everywhere else. This was the scenario increasingly considered over the second half of 2018 and the first few months of 2019; whether or not recession. Over the past few months, however, the question has changed again. Central bankers and Economists were hoping it would all get resolved favorably, and the public would go back to asking about rate hikes and normalization. A growth scare and nothing more, the inflationary boom temporarily delayed. Now, contrary to

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, 5) Global Macro, bond market, bonds, bund market, Bunds, currencies, current situation, economy, Featured, Federal Reserve/Monetary Policy, Germany, industrial production, Interest rates, manufacturing, Markets, newsletter, Recession, schaetzes, sentiment, Yield Curve, ZEW

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| What if Germany’s economy falls into recession? Unlike, say, Argentina, you can’t so easily dismiss German struggles as an exclusive product of German factors. One of the most orderly and efficient systems in Europe and all the world, when Germany begins to struggle it raises immediate questions about everywhere else.

This was the scenario increasingly considered over the second half of 2018 and the first few months of 2019; whether or not recession. Over the past few months, however, the question has changed again. Central bankers and Economists were hoping it would all get resolved favorably, and the public would go back to asking about rate hikes and normalization. A growth scare and nothing more, the inflationary boom temporarily delayed. Now, contrary to official reassurances, it looks like Germany’s economy may already be in recession. So, we begin to wonder what it could mean if it turns out to be a pretty deep and nasty one. |

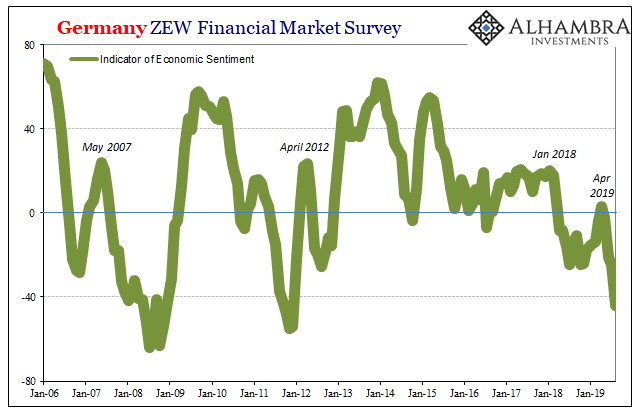

Germany ZEW Financial Market Survey, 2006-2019 |

| Germany’s Zentrum für Europäische Wirtschaftsforschung (ZEW) was among the first to pick up on the global economic inflection. The dollar shifted around December 2017 and January 2018. Immediately afterward, things started to go wrong – markets and economy. The ZEW’s sentiment survey readily captured the change to deflationary impulse (at a time when long before trade wars everyone, and I mean everyone, was absolutely certain of an inflationary breakout).

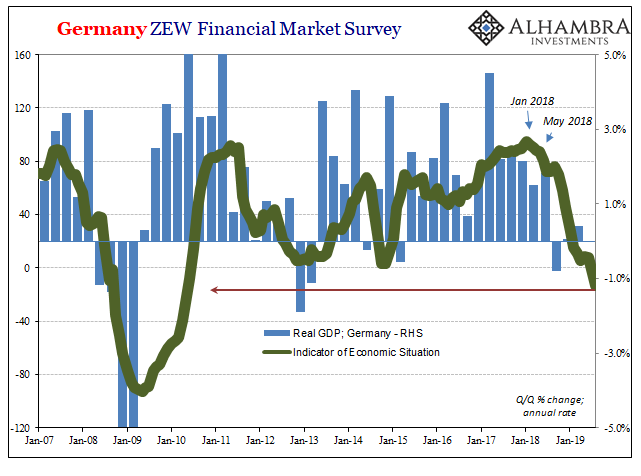

Having tumbled and turned negative through the middle of 2018, sentiment improved in the spring of 2019 – if only briefly. Following April, and following a rash of negative changes across the eurodollar landscape, ZEW-measured sentiment has dropped again. The latest reading for August is a sharp -44.1. That’s the lowest since December 2011 and the second worst monthly number since the Global Financial Crisis. It’s a compelling and alarming indication that as bad as things may be right now, they aren’t going to turn around soon. When the ZEW sentiment bottomed out at the end of 2011 there was another year maybe year and a half to go before the eventual recession would finish and reflation (not recovery) would resume. In 2008, sentiment had hit its trough in October 2008 and over the following six months it was the worst economic conditions since the thirties. If that’s the outlook, then put together with the ZEW’s take on the current condition we are forced into considering beyond simple recession scenarios. The group’s Economic Situation index dropped to -13.5 also for August. That’s already lower than at any point during the 2012 recession. Worse already than the last recession with sentiment reaching lows like the one before it. |

Germany ZEW Financial Market Survey, 2007-2019 |

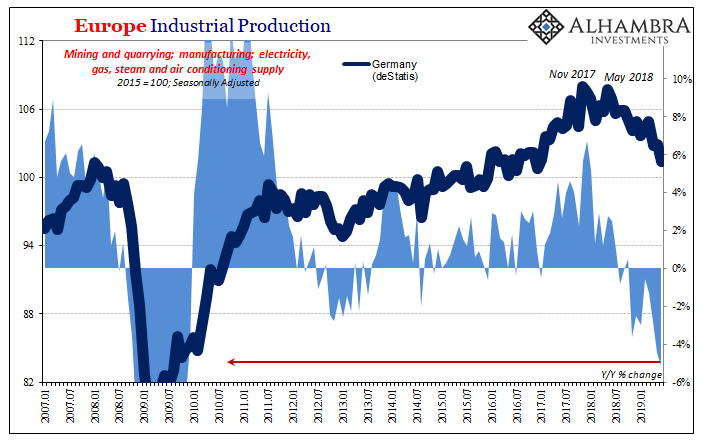

| More and more the German data compares only to 2008-09. According to Germany’s deStatis, Industrial Production fell by more than 5% year-over-year in June 2019. As you can see above, that’s by far the worst figure since the Great “Recession.” Industry is down almost 6% from May 2018 (May 29) and more than 6% from the peak in November 2017. |

Europe Industrial Production, 2007-2019(see more posts on Eurozone Industrial Production, ) |

| It would be an impressive feat for a few billion in US tariffs on Chinese goods – that weren’t even being discussed as far back as November 2017 – if trade wars were realistically to blame for any of this.

The overriding problem isn’t geopolitics it is the global dollar shortage – another one. |

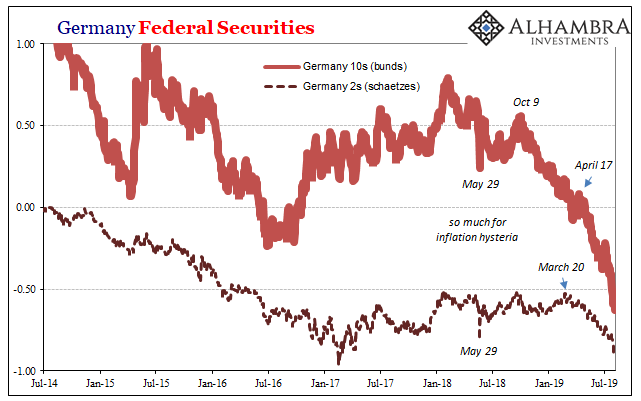

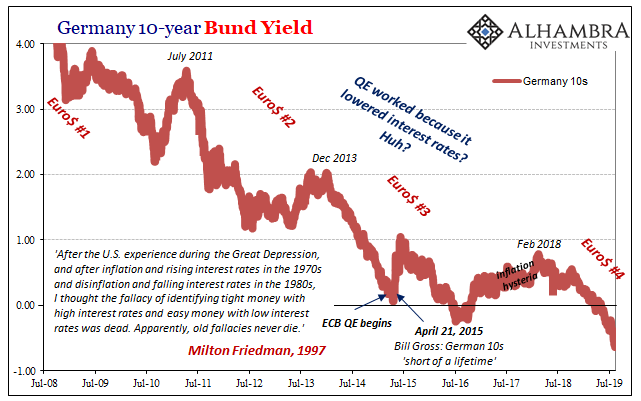

Germany 10-year Bund Yield, 2017-2019 |

| Germany’s bond market has been pointing in this direction the entire time, not that the public would know. Having ceded economic forecasts and thought to each central bank, staffed with people whose job it is to misunderstand and misrepresent bonds (term premiums), there’s been very little appreciation for what’s behind interest rates and what they really mean.

Bund yields (10s) peaked all the way back in February 2018 – just as the ZEW was picking up the first signs of a reverse. The 10-year rate is an indication of potential, or market perceptions about the probabilities for a range of factors including growth and inflation. Not only does the German bond market register the earthquake from May 29, it also has consistently pointed to the October – December landmine as a very real event which should have been seriously considered in real-time. Instead, as it unfolded central bankers in Europe as everywhere else were still “hawkish.” Mario Draghi ended the ECB’s QE two months into the yield plunge thinking (hoping?) the plunge was an error. |

Germany Federal Securities, 2014-2019 |

| In March 2019, schaetze yields would join bund yields on the escalator down – very plainly showing how something had changed to becoming somehow worse than it already was. As before, the ZEW estimates caught on very quickly this time, too.

That’s why it’s no longer about whether Germany can escape, we now have to consider just how bad it might get. Apart from empathy, why does anyone outside of Germany care? Simple. The landmine wasn’t Germany’s alone. German bonds have already been proven right about what was coming for Germany’s economy, especially what it has looked like on the other side of that October-December divide. As German 10s reach new and even more absurd record lows, Japan’s 10-year is a few bps above its record, and even US Treasury 10s are in sight of theirs. The entire global system was disrupted. Germany is unfortunately for Germans first in the order, and that’s why it’s being pummeled the hardest so far. The global market’s message is incredibly simple – that’s only the beginning. |

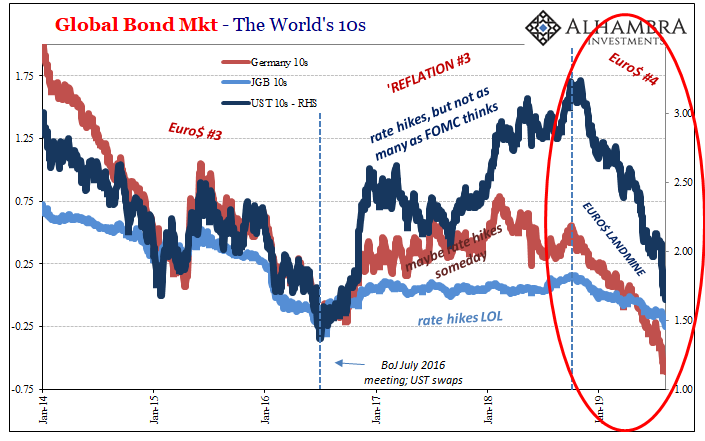

Global Bond Mkt - The World's 10s |

| It is somewhat understandable why the idea that a few billion in US tariffs on Chinese goods are the cause of all this. To start with, partisan politics (especially in the US). More than that, though, there’s just no other explanation in the mainstream conversation.

A global dollar shortage? Can’t happen. Every central banker past and present has assured the world to that effect. So many QE’s and trillions of bank reserves in all sorts of denominations including dollars. The bond market, however, says that’s just what is happening and it’s getting worse – all over the world. German bonds have had Germany’s economy right this entire time. Is there really any chance it’s just Germany? |

Germany 10-year Bund Yield, 2008-2019 |

Tags: bond market,Bonds,bund market,Bunds,currencies,current situation,economy,Featured,Federal Reserve/Monetary Policy,Germany,industrial production,Interest rates,manufacturing,Markets,newsletter,recession,schaetzes,sentiment,Yield Curve,ZEW