If you like rate cuts and think they are powerful tools to help manage a soft patch, then there was good news in two international oil reports over the last week. The US Energy Information Administration (EIA) cut its forecast for global demand growth for the seventh straight month. On Friday, the International Energy Agency (IEA) downgraded its estimates for the third time in four months. That wasn’t all, as the EIA’s report focused in on some more sobering aspects of the US economy. Furthermore, weekly data on gasoline demand in the U.S.—the largest gasoline consumer in the world—have disappointed market expectations. Shaky fuel demand, during the summer months when driving generally picks up, is particularly worrying to energy investors. As we noted a little

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, 5) Global Macro, bonds, Consumer Prices, CPI, currencies, economy, Featured, Federal Reserve/Monetary Policy, FOMC, inflation, jay powell, Markets, newsletter, oil prices, rate cuts

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| If you like rate cuts and think they are powerful tools to help manage a soft patch, then there was good news in two international oil reports over the last week. The US Energy Information Administration (EIA) cut its forecast for global demand growth for the seventh straight month. On Friday, the International Energy Agency (IEA) downgraded its estimates for the third time in four months.

That wasn’t all, as the EIA’s report focused in on some more sobering aspects of the US economy.

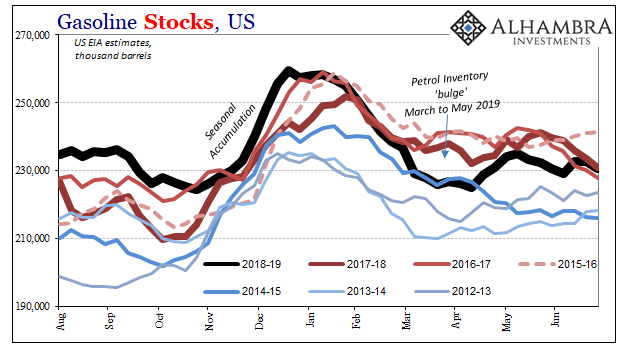

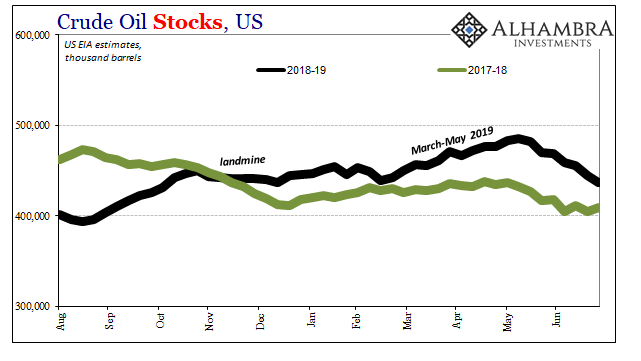

As we noted a little while back, domestic crude and distillate inventory figures have been signaling a slowdown for quite some time – back to last year’s landmine, as a matter of fact. Gasoline stocks, in particular, have been up when they should be heading down. That’s leaving a lot of crude oil to pile up, as well. |

U.S. Gasoline Stocks, 2012-2019 |

Even the media is being pushed off its “supply glut” excuse for lower oil prices, if only by the chance to blame a few billion in tariffs.

Translating all this into reality: lower demand is now such that even the optimists have to admit that something is going wrong, something substantial. Absent any other explanation apart from “trade wars”, geopolitics by default. Where this matters for Jay Powell and his crew is in two related pieces. The first, obviously, lower demand (growth) for oil is inconsistent with an overheated economy otherwise taking a temporary nap from its boom. |

U.S. Crude Oil Stocks, 2017-2019(see more posts on Crude Oil, ) |

| As we’ve seen with transportation services and manufacturing sentiment, it’s hard data backing up the growing industrial slump which all traces back to weak consumer and business activity: less demand for energy because of less demand to move goods due to fewer goods being produced as more pile up in unwanted inventory all because consumers just aren’t spending like everyone was told they would with a 50-year low unemployment rate.

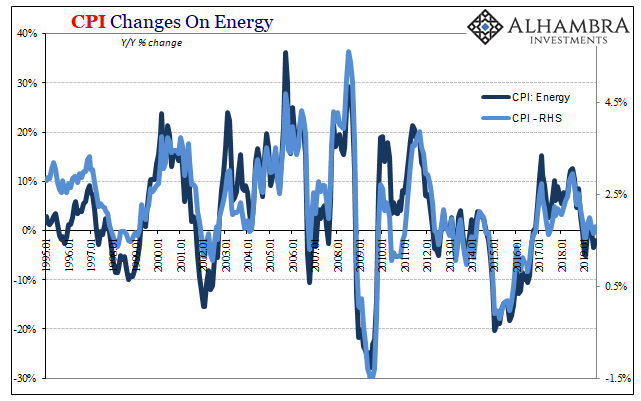

That’s the argument behind a single rate cut or a series of them if it should continue to develop this way (as the bond market sees it). There’s only one remaining impediment: inflation. Always the dual-mandate, Chairman Powell can’t cut rates if the PCE Deflator or the CPI is accelerating like he has been predicting. And if he’s right about transitory, then he really would have to be one and done. If consumer prices were to accelerate, it would confirm the unemployment rate and therefore “prove” the Federal Reserve had done its job on both counts. Right back to rate hikes after some lengthy grace period. |

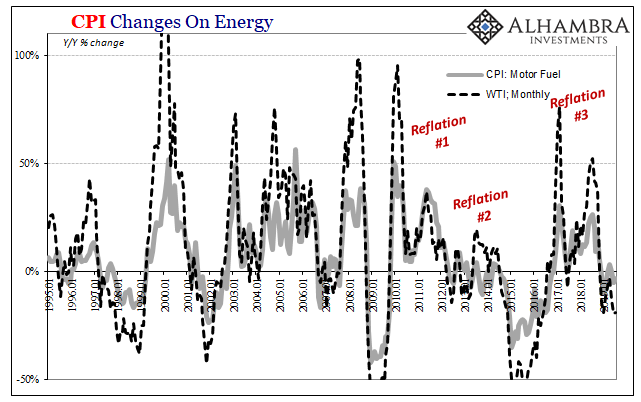

CPI Changes on Energy, 1995-2019 |

| But with questions about a broad range of demand factors alongside tame inflation reports, the Fed is able to use them both to justify what to many seems to be a shocking reverse. Without oil prices, there just isn’t any inflation suggested by any of the indices or their parts. Without oil demand, there won’t be a pickup in oil prices and therefore headline inflation to hinder the Fed’s growing unease about the situation. |

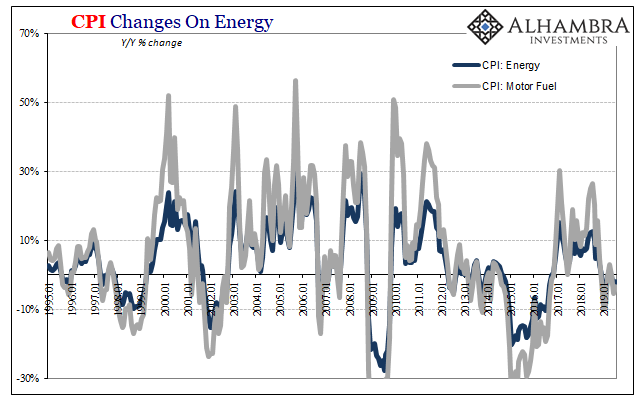

CPI Changes on Energy, 1995-2019 |

| The CPI like the PCE Deflator continues to be set by the movement of oil prices alone. According to the latest figures for the former, broad consumer price inflation was +1.81% last month, up slightly from the +1.65% rate posted in June. Though WTI on average was down more than 19% year-over-year in July for the second straight month, motor fuel prices were just 3.3% lower (compared to -5.4% in June) and general energy prices fell by just 2% (compared to -3.4%). |

CPI Changes on Energy, 1995-2019 |

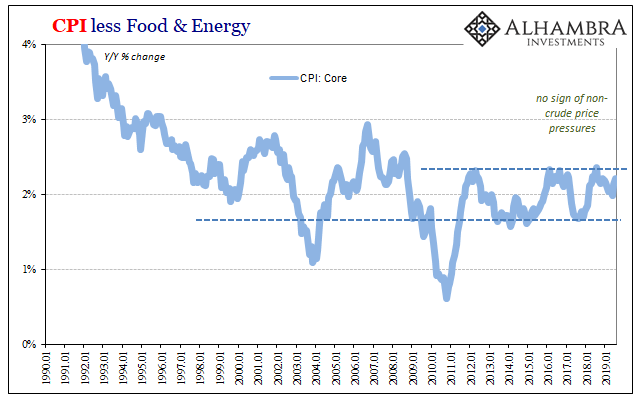

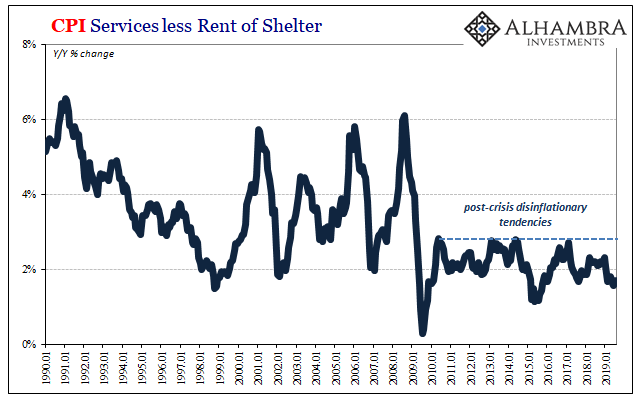

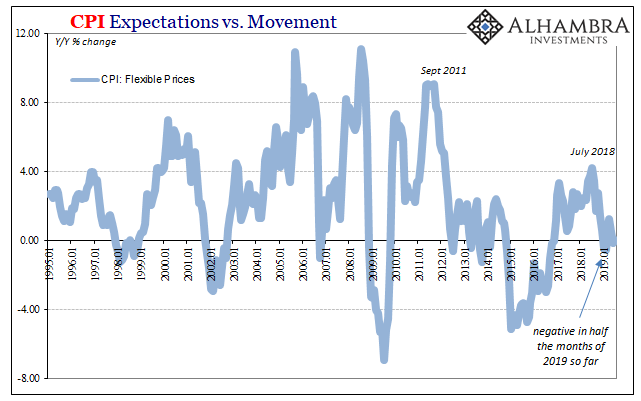

| Outside of energy, the same disinflationary tendencies are maintained in the estimates. The core CPI rate was 2.21% in July. Prices for services excluding shelter rebounded (+1.69%) only a little from the prior month and one of the lowest rates since 2009 (+1.58%). Even prices which tend to be changed most often are not being changed by much at all; the “flexible” CPI has been either near zero or slightly negative all year. |

CPI less Food & Energy, 1990-2019 |

CPI Services less Rent of Shelter, 1990-2019 |

|

| Therefore, the FOMC in all likelihood has all the justification it requires for more than just the one-and-done performed so far. There’s also the political pressure from the White House which isn’t supposed to matter, independence and all, but government officials are fallible humans, too. |

CPI Expectations vs. Movement, 1995-2019 |

| If you like rate cuts and think of them positively, all this bad news should be very encouraging indeed. However, if you don’t care much for rate cuts and think of them as more show than substance… |

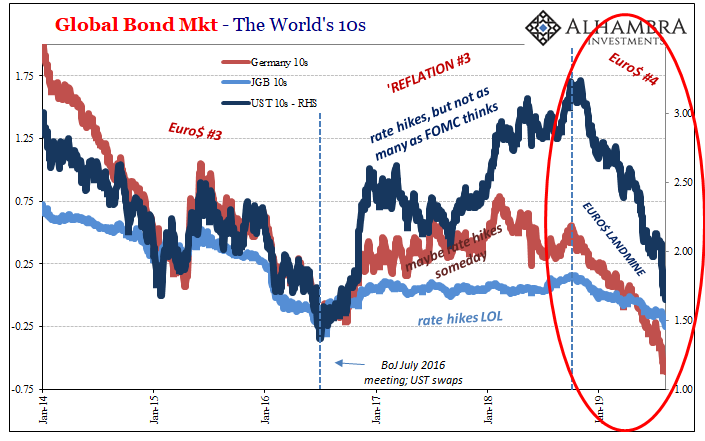

Global Bond Mkt - The World's 10s, 2014-2019 |

Tags: Bonds,Consumer Prices,CPI,currencies,economy,Featured,Federal Reserve/Monetary Policy,FOMC,inflation,jay powell,Markets,newsletter,oil prices,rate cuts