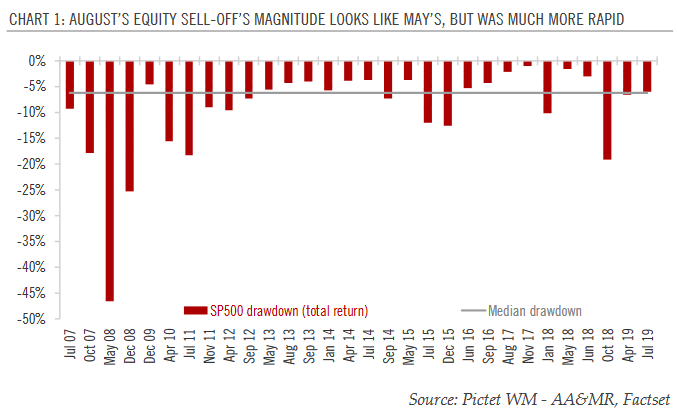

There is an ongoing tug-of-war between trade tensions and fundamentals Due to renewed trade tensions, the S&P 500 corrected by 6.0% and the Stoxx Europe 600 by 5.8% from the late July peak to the 5 August low. Because the pullback was clustered around just a few days, its intensity was reminiscent of the worst market days of past major crises. Safe haven assets benefitted significantly, with gold gaining 7.4% from the late July equity market peak to the 5 August low and 10-year US Treasuries returning 2.3% over the same period. Meanwhile, the US reporting season provided some reassurance, with better corporate results than generally feared. Current preannouncements remain in line with average Q3 2019 earnings growth expectations. Developed market earnings growth

Topics:

Jacques Henry considers the following as important: 5) Global Macro, Developed market equities, earnings equities, Featured, Macroview, newsletter, Uncategorized

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

|

There is an ongoing tug-of-war between trade tensions and fundamentals Due to renewed trade tensions, the S&P 500 corrected by 6.0% and the Stoxx Europe 600 by 5.8% from the late July peak to the 5 August low. Because the pullback was clustered around just a few days, its intensity was reminiscent of the worst market days of past major crises. Safe haven assets benefitted significantly, with gold gaining 7.4% from the late July equity market peak to the 5 August low and 10-year US Treasuries returning 2.3% over the same period. Meanwhile, the US reporting season provided some reassurance, with better corporate results than generally feared. Current preannouncements remain in line with average Q3 2019 earnings growth expectations. Developed market earnings growth expectations for the full year 2019 have continued to trend downwards and are now in the low single digits, i.e. close to 2% in the US and 5% in Europe and Japan. Nevertheless, rich equity valuations remain supported by lower sovereign yields and systematic strategies’ positioning remain supportive of equities. Finally, provided the US-China trade tensions remain frozen and the Hong Kong protests contained, the worst of the sell-off is most likely behind us. |

August’s Equity Sell-off’s Magnitude Looks Like May’s, but was Much More Rapid |

Tags: Developed market equities,earnings equities,Featured,Macroview,newsletter,Uncategorized