(I am in Mexico at the World Trade Center General Assembly, participating on a panel about USMCA–NAFTA2.0–for which approval remains elusive. It is possible that the US threatens to pull out of NAFTA 1.0 to force action by the US Congress. Mexico is due to pass legislation this week that may meet demands by the some in the US and Canada for stronger labor protections. However, with the steel and aluminum tariffs still...

Read More »FX Weekly Preview: Important Steps Away from the Abyss

It seems to be well appreciated among by policymakers and investors that the system is ill-prepared to cope with another financial crisis. It is understandable that so many are concerned that the end of the business cycle could trigger a financial crisis. In practice, it seems like it has worked the other way around. The financial crisis triggered the Great Recession. The economy previously contracted when the tech...

Read More »FX Daily, April 05: Trade Talk and German Industrial Output Lifts Sentiment

Swiss Franc The Euro has risen by 0.03% at 1.1219 EUR/CHF and USD/CHF, April 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Comments by Chinese President Xi, recognizing substantial progress in trade, helped boost sentiment after the US-China negotiators failed to set a date for the meeting between the two presidents. Although we have argued that the German...

Read More »FX Daily, April 04: Limited Price Action Does not Do Justice to Macro Developments

Swiss Franc The Euro has fallen by 0.06% at 1.1207 EUR/CHF and USD/CHF, April 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets are subdued despite several macro developments. The US and China may announce as early as today when the two presidents will meet to ostensibly sign a trade deal, while House of Commons effort to block a no-deal...

Read More »FX Daily, April 03: Optimism Sweeps Through the Capital Markets

Swiss Franc The Euro has risen by 0.11% at 1.1188 EUR/CHF and USD/CHF, April 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Japan announced the name of the new era that begins May 1 and a new emperor. The connotation is of beautiful harmony. And investors have taken the bit and run with it. Optimism that the US and China near reaching an agreement on trade....

Read More »Cool Video: Fed’s Independence Challenged and Defended

Marc Chandler talking with Charles Payne and Quincy Krosby about Fed policy - Click to enlarge I was on the set Fox Business set this afternoon talking with Charles Payne and Quincy Krosby about Fed policy. Payne suggested that both the political left and right are trying to politicize the Federal Reserve to print money for their favorite programs. I suggest the Fed’s independence will not so easily be encroached upon....

Read More »FX Daily, April 02: Herding Cats

Swiss Franc The Euro has fallen by 0.07% at 1.1189 EUR/CHF and USD/CHF, April 02(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After surging yesterday, equities are struggling to maintain the momentum that carried that S&P 500 to its best level since last October. Most Asia Pacific equity markets advanced. Japan’s small losses were a notable exception....

Read More »April Monthly Currency Outlook

Poor economic data and soft inflation saw several central banks, including the Federal Reserve and European Central Bank, take a dovish turn in March. Contrary to expectations that interest rates would rise as the G3 central banks were no longer adding to their balance sheets on a combined basis. The sharp drop in interest rates and the flattening of curves in March is one of the key factors shaping the investment...

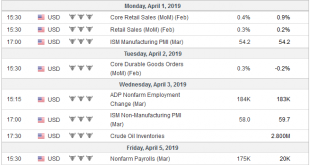

Read More »FX Daily, April 01: China Reanimates the Animal Spirits, While Europe Finds New Ways to Disappoint

Swiss Franc The Euro has risen by 0.20% at 1.1188 EUR/CHF and USD/CHF, April 01(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Better than expected German retail sales ad employments reports at the end of last week has been followed by gains in China’s official PMI and Caixin’s manufacturing reading. However, the spillover from China was limited in Asia....

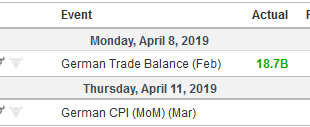

Read More »FX Weekly Preview: The Green Shoots of Spring

Investors have worked themselves into a lather. Equities crashed in Q4 last year amid on corporate earnings and concerns about growth. The Fed’s tightening decision in December was made unanimously. The above-trend growth, the preferred inflation measure was near target, unemployment was the lowest in a generation and real rates were historically low. There are myths in the market, like the Plunge Protection Committee,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org