Swiss Franc The Euro has risen by 0.03% at 1.1219 EUR/CHF and USD/CHF, April 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Comments by Chinese President Xi, recognizing substantial progress in trade, helped boost sentiment after the US-China negotiators failed to set a date for the meeting between the two presidents. Although we have argued that the German economy may be past the worst, the sharp drop in factory orders spooked investors. However, today’s stronger than expected industrial output data, lifted by construction, lends credence to ideas that the external sector is the chief weight as the auto industry continues to work through its

Topics:

Marc Chandler considers the following as important: 4) FX Trends, Brexit, EUR/CHF, Featured, FX Daily, jobs, newsletter, trade, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

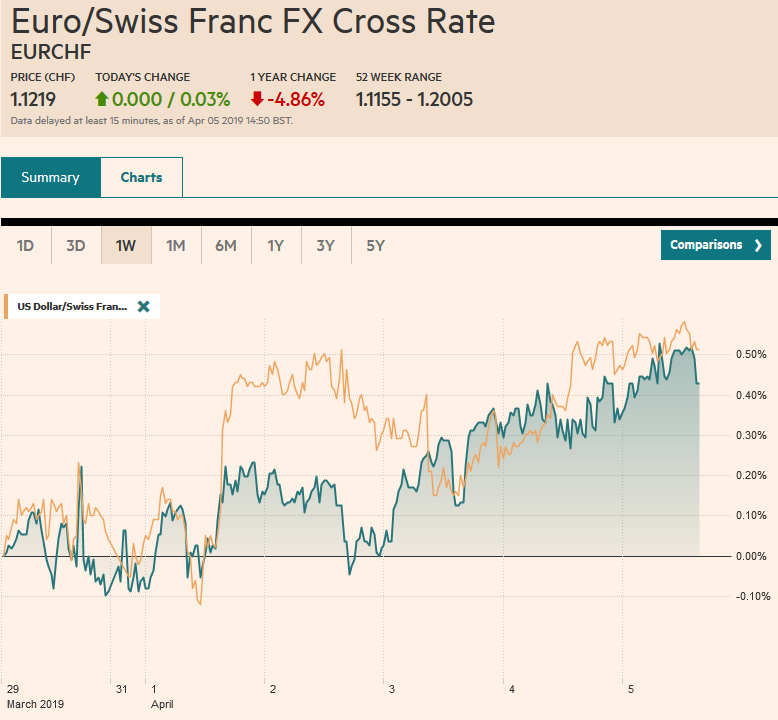

Swiss FrancThe Euro has risen by 0.03% at 1.1219 |

EUR/CHF and USD/CHF, April 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Comments by Chinese President Xi, recognizing substantial progress in trade, helped boost sentiment after the US-China negotiators failed to set a date for the meeting between the two presidents. Although we have argued that the German economy may be past the worst, the sharp drop in factory orders spooked investors. However, today’s stronger than expected industrial output data, lifted by construction, lends credence to ideas that the external sector is the chief weight as the auto industry continues to work through its idiosyncratic challenges. US (and Canada’s) job reports area the highlight ahead of the weekend. China, Taiwan, and Hong Kong markets are closed today, but most Asia-Pacific markets edged higher, though Australian stocks continued to underperform and today’s 0.8% loss leaves it flat for the week. European shares are a little higher to close in on a 2.4% gain for the week. Core bond yields are one to two basis points higher, which is enough to put the benchmark German bund back (slightly) above zero. |

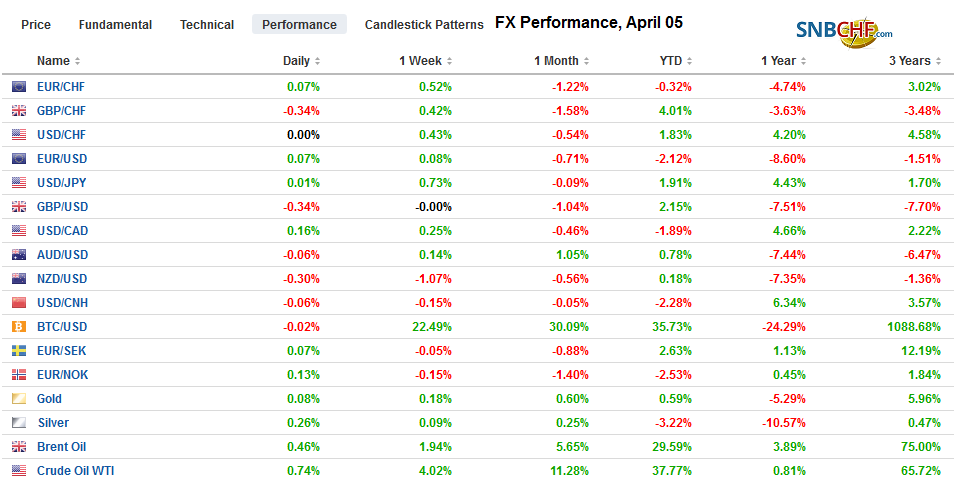

FX Performance, April 05 |

Asia Pacific

Reports had played up the likelihood that a date for the meeting between Xi and Trump would be announced as early as yesterday. A meeting date is only seen possible if an agreement has been struck and the two presidents need to sign-off. This may seem unremarkable, but it is a concession to China, which wants to avoid the risk that Trump walks out as he did in North Korea. Trump has seemed to want to leave some things open for Xi and him to resolve. Xi’s comments came after Trump said the deal (which had not been agreed to) would be “very monumental.” No date has been set, and now reports suggest it may still take several weeks “to get it down on paper.”

While we have been on the leading edge of the “green shoots camp”, we see Japan as an exception. Japan justified our concern earlier today with weak income and spending data. Household spending slowed in February to 1.7% from 2.0% in January. It was softer than economists expected. The fuel for consumption is wealth and income. Income figures were poor. Labor cash income shocked with a 0.8% loss. Economists had expected a 0.9% gain after a 1.2% increase year-over-year in January. In real terms, it fell 1.1% after having risen by 1.1% in January.

The Australian dollar is firm trading near the highs it has been bumping against this week near $0.7130, putting it up about 0.4% for the week. There is a large option for A$1.7 bln struck at $0.7100 that expires today. That makes the Aussie the strongest of the majors this week, volatility often injected by the US jobs report. The yen, on the other hand, is among the weakest of the majors, losing about 0.7%. The dollar has set a higher high against the yen every day this week. After finishing last week near JPY110.85, it is in a ten-tick range on either side of JPY111.70 today. The relevant expiring options are struck at JPY111.50 (~$520 mln) and JPY112.00 (~$885 mln).

Europe

Germany industrial output did not just rise 0.7% in February, exceeding market expectations for a 0.5% increase prior to yesterday’s surprisingly weak factory orders, but the 0.8% decline in January was revised away. A hint may have been provided yesterday with German construction PMI. The construction sector is including in industrial output in Germany. The PMI rose to 55.6 in March, from 54.7 in February and 50.7 in January. Industrial production was lifted by a 6.8% rise in construction. Manufacturing is still weak and eased 0.2%, which is the fifth decline in the past six months. Judging from the retail sales and recent IFO survey, and today’s report, it appears that the German domestic economy is doing better, but the external sector remains an important headwind. Spain was not as fortunate. Industrial output slid 1.1% in February after a 3.6% gain in January.

Prime Minister May has formally requested a delay in Brexit to the end of June. This may prove to be a bit difficult. The UK idea seems to be that as long as it leaves before the selection of the next European Commission, it ought not to be required to participate in the EU Parliament elections at the end of next month. However, the EC’s instructions were to accept the Withdrawal Agreement and get a short extension to pass the necessary legislation, leave without an agreement at the end of next week, or seek a longer delay.

There seemed to be two important developments this week. The House of Commons instructed May to seek a delay to block a no-deal exit. May, arguably belatedly, has begun talks with Labour, the main opposition party. However, it is still not clear how May is going to play her hand. She could seek to work with the two dozen or so Labour MPs who mostly come from “Leave” districts, or she could try to cut a deal with Corbyn.

The euro has been confined to yesterday’s ranges, which were inside Wednesday’s range or roughly $1.1200-$1.1250. Maturing options are struck at that range today (~870 mln euros at $1.12 and ~2.2 bln euros at $1.1250. It closed last week a little below $1.1220. The intraday technicals seem to allow for another attempt on the upper end of the range, but it may prove to be a better sale on a bounce. Sterling is slightly firmer on the week. It finished last week near $1.3035 and is now closer to $1.3075. There is an option for almost GBP220 mln struck at $1.31 that will be cut today. It reached a high near $1.33 this week. It had tested and held $1.30.

America

The US jobs data is front and center. There are not many inputs economists can draw on for their forecasts. The ADP is off-step with a strong February estimate (that was revised up) and the softer March report. The ISM manufacturing employment rose. The weekly jobless claims eased during the survey period, and last week fell to 50-year lows, suggesting momentum. There are practically no other indicators suggesting that the February jow growth a miserly 20k was an accurate reflection of the economy. We note the stability of the US jobs growth: averaging 186k over 3 mo, 190k over 6, 209k over 12, and 199k over 24 months. Other elements of the report are also important for market participants. Due to the base effect, hourly earnings need to rise by about 0.3% to maintain the year-over-year pace of 3.4%. It is also possible that the workweek increased from 34.4 hours to 34.5 hours). The unemployment rate is expected to be steady at 3.8%. A second poor report would likely weigh on the dollar, with the yen a major beneficiary, as risk would have to come off (stocks down bonds up).

President Trump confirmed reports that he will nominate Cain to the Federal Reserve Board of Governors. This nomination, like Moore’s, is being bet with derision may many economists. Both are in favor of easier money, thought Cain has been a fan of a return to the gold standard. It is recognized that governments often want to influence monetary policy. As practices have evolved, the power to do so has become more constrained as the independence of the central bank became more necessary to investors. The power of appointment is the preferred way. While the economic profession wants monetary policy to be handled by its guild, a monopoly is not necessary. More importantly, if an executive power of appointment is curbed, won’t they be likely to return to more direct ways of influencing monetary policy?

Canada reports its March employment data as well. The recent string of economic data has been better than expected. The February jobs gains were strong. January GDP rose 0.3% instead of 0.1%, and yesterday’s IVEY survey jumped to 54.3 from 50.6 in February to return near January’s 54.7 reading. Over the past three months, Canada has averaged job growth of 43.5k (full-time 26.3k) and a 48.3k average for the past six months (full-time 29.2k). Economists anticipate a payback for the heady 55.9k increase in February (67.4k full-time) in March. The median forecast in the Bloomberg survey is for a 10k increase in headline job growth (with a little more than half coming from full-time positions). Ahead of the job reports, the US dollar is trading firm against the Canadian dollar near the week’s highs (~CAD1.3375). Support has been established near CAD1.3300, and a close above CAD1.34 would lift the tone.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Brexit,EUR/CHF,Featured,FX Daily,jobs,newsletter,Trade,USD/CHF