Swiss Franc The Euro has risen by 0.15% at 1.1447 EUR/CHF and USD/CHF, April 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Financial centers that have been closed for the extended holiday have re-opened, but the news stream is light and market participants are digesting developments and positioning for this week’s central bank meetings and the first look at Q1...

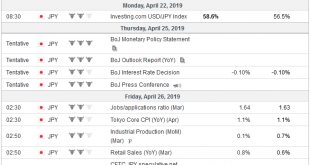

Read More »Cool Video: Discussion of the Deflationary Risks in Japan and Brexit

[embedded content] I joined CNBC Asia’s Amanda Drury and Sri Jegarajah via Skype earlier today as the new week was beginning in Asia. In this three minute clip, we discuss the outlook for the BOJ and sterling. Most of the rise in Japan’s inflation is due to food and energy prices. Despite an aggressive balance-sheet expansion effort, the BOJ has missed its target by a long shot. It appears to have all but given up on...

Read More »FX Daily, April 22: Surge in Oil Punctures Holiday Markets

Swiss Franc The Euro has risen by 0.16% at 1.1424 EUR/CHF and USD/CHF, April 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: With many centers closed for the extended holiday, the calm in the global capital markets has been punctuated by reports that the US is considering ending its exemption for eight countries to have bought Iranian oil over the past six...

Read More »FX Weekly Preview: Six Events to Watch

The divergence thesis that drives our constructive outlook for the dollar received more support last week than we expected. A few hours after investors learned that Japan’s flash PMI remained below the 50 boom/bust level, Europe reported disappointing PMI data as well. And a few hours after that the US reported that retail sales surged in March by the most in a year and a half (1.6%). This coupled with the new cyclical...

Read More »FX Daily, April 19: Holiday Note

Swiss Franc The Euro has fallen by 0.03% at 1.1399 EUR/CHF and USD/CHF, April 19(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Many financial centers are closed today. These include Australia, India, most European markets, and the US. In Asia, equity markets that were open moved higher. The Nikkei, which gapped higher on Monday, rose 0.5% today for a 1.5%...

Read More »FX Daily, April 18: EMU Disappointment Lifts the Dollar

Swiss Franc The Euro has fallen by 0.15% at 1.1393 EUR/CHF and USD/CHF, April 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: A bout of profit-taking in equities began in the US yesterday and has carried through Asia and Europe today. The MSCI Asia Pacific Index fell for the first time in five days, while the Dow Jones Stoxx 600 is snapping a six-day advance....

Read More »Pound to Swiss Franc rates: UK housing price growth hits 6 year low

Pound to Swiss Franc rates We have seen a fairly stagnant market following the Brexit extension until 31st October. Although a key factor on GBP/CHF economic date releases will now gain back some of their impact. Yesterday saw the ease of House Price Growth data and figures dropped to a six year low. The average house price of across the UK grew by 0.6%, but property prices in the...

Read More »FX Daily, April 17: Veracity of Chinese Data Questioned, but Lifts Sentiment Nevertheless

Swiss Franc The Euro has risen by 0.24% at 1.1395 EUR/CHF and USD/CHF, April 17(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The veracity of Chinese data will be questioned by economists, but today’s upbeat reports round out a picture that began with stronger exports and a surge in lending. Chinese officials, we argue, had a “Draghi moment” and decided to...

Read More »Cool Video: Trump Ahead in 2020?

Marc Chandler - Goldman Predicts Trump Win - Click to enlarge Goldman Sachs opined that President Trump had an edge to win the 2020 presidential election and Fox Business thought it was newsworthy and invited to me join the discussion. First, I tried playing down the significance of Goldman’s call. The markets have anticipated this. redictIt.Org has shown the President to be an easy favorite since the start of the...

Read More »FX Daily, April 16: The Dollar and Stocks Catch a Bid

Swiss Franc The Euro has risen by 0.14% at 1.1366 EUR/CHF and USD/CHF, April 16(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Amid light news, global equities are moving higher In Asia, the Nikkei rose to a new high since early December, while the Shanghai Composite rose 2.3% and posted its highest close since March 2018. European equities are solid, with...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org