Swiss Franc The Euro has risen by 0.79% to 1.0905 EUR/CHF and USD/CHF, September 05(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Dollar Index fell the most in three months yesterday and is experiencing mild follow-through selling today. With hopes that Hong Kong has turned a corner, news that in-person US-China talks will resume next month, and a no-deal Brexit is well on the way to being averted,...

Read More »USD/CHF Technical Analysis: The ongoing corrective slide challenges 200-hour SMA support, around mid-0.9800s

Extends overnight retracement slide from an ascending trend-channel resistance. A follow-through selling has the potential to drag the pair towards channel support. The USD/CHF pair remained under some selling pressure for the second consecutive session on Wednesday and retreated farther from over one-month tops set in the previous session. The pair on Tuesday started retreating from a resistance marked by the top end of a short-term ascending trend-channel,...

Read More »FX Daily, September 04: HK Concession and Better EMU PMI Overshadows Self-Inflicted Trade and Brexit Woes

Swiss Franc The Euro has risen by 0.09% to 1.0835 EUR/CHF and USD/CHF, September 04(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Risk appetites have been bolstered by three developments. The UK appears to have taken a tentative step away from leaving the EU without a deal. Hong Kong’s Chief Executive Lam has agreed to formally withdraw the controversial extradition measure that had been suspended. The...

Read More »USD/CHF Technical Analysis: 61.8% Fibo, 0.9822/17 Confluence on Sellers’ Radar

USD/CHF extends declines on the break of one-week-old support-line (now resistance). Sellers look for key technical levels amid bearish signals from MACD. Following its break of immediate support-line, the USD/CHF pair remains on the back foot while taking rounds to 0.9870 amid Wednesday’s Asian session. Sellers now aim for 61.8% Fibonacci retracement level of August month downpour, at 0.9854, as immediate support ahead of targeting 0.9822/17 confluence including...

Read More »FX Daily, September 03: Pound Punished in High Drama

Swiss Franc The Euro has fallen by 0.29% to 1.0831 EUR/CHF and USD/CHF, September 03(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: A showdown between UK Prime Minister Johnson and Parliament over Brexit pushed sterling below $1.20. The euro is extended its losses after finishing last week below $1.10. Growth concerns are seeing equities retreat. Japanese and Chinese shares managed to eke out gains, but...

Read More »What Happened Monday

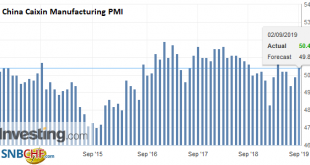

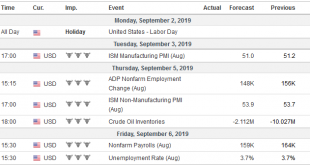

Markets in the US and Canada were closed on Monday for national Labor Day holidays. Here is a succinct summary of key developments that will set the backdrop for Tuesday. 1. On September 1, the new round of tariffs in the US-China fight took effect. The US placed a 15% tariff on around 3000 Chinese goods that thus far had escaped action. China put a 10% level on 1700 US goods. No date has been given for the next round of face-to-face talks that were expected this...

Read More »September Monthly

Three forces are shaping the investment climate. The US-China trade conflict escalates at the start of September as both will raise tariffs on each other’s goods and are threatening another round in mid-December (US 25% tariffs on $250 of Chinese imports will increase to 30% on October 1). Some third parties may benefit from the re-casting of supply chains, but the first impact is understood to weaken growth impulses. That is aggravating the slowdown already evident...

Read More »FX Weekly Preview: Talking and Fighting in the Week Ahead

Equity markets and the US dollar closed last week and August on a firm note. Ahead of the weekend, the dollar rose to new highs for the year against the euro, Swedish krona, Norwegian krone, and the New Zealand dollar. While the next set of US and Chinese tariffs start September 1, the market is making the most of the lull. At the same time, US and Chinese officials probe each other to see if sufficient disruption has been felt to force concessions. Talking and...

Read More »USD/CHF technical analysis: Upside capped by 4-week old resistance-line

USD/CHF remains below near-term resistance-line forming part of immediate rising wedge bearish formation. 200-bar SMA, 50% Fibonacci retracement can question pair’s downside below 0.9857/54 confluence. USD/CHF fails to extend the latest upward trajectory as it trades near 0.9900 during Asian session on Monday. While drawing trend-lines with the help of highs and lows marked since August 23, a short-term rising wedge, bearish formation, appears on the four-hour...

Read More »FX Daily, August 30: US Dollar Finishing August on Firm Note as Euro nears Two-Year Lows

Swiss Franc The Euro has fallen by 0.03% to 1.0903 EUR/CHF and USD/CHF, August 30(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities are advancing at least in part on ideas that trade tensions are easing. China announced it would not take immediate action on the five percentage point increase in levies that the US announced strictly in response to China’s retaliatory tariffs. A lull between...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org

-637031895419073883-310x165.png)