After a dismal end of 2018, investors are faring better through the first two- thirds of the Q1 19. Equity markets have recouped a good part of the late-2018 decline. Bond yields, however, have not returned to where they previously were. The tightening of financial conditions, which was both cause and effect of heightened anxiety among investors, and spooked some central bank have eased considerably. The volatility of...

Read More »FX Daily, February 22: Markets Ending Week with A Whimper

Swiss Franc The Euro has fallen by 0.09% at 1.1333 EUR/CHF and USD/CHF, February 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets are winding down what appears to be an inconclusive week quietly and on a mixed note. The MSCI Asia Pacific Index is poised to snap a four-day advance but held on to a nearly 2% gain for the week. European...

Read More »FX Daily, February 21: Aussie Slammed by Dalian Coal Embargo, While Firmer Flash PMI does Euro Little Good

Swiss Franc The Euro has risen by 0.04% at 1.1347 EUR/CHF and USD/CHF, February 21(see more posts on EUR/CHF, USD/CHF, ) Source: merkets.ft.com - Click to enlarge FX Rates Overview: The US dollar is firm against most major and emerging market currencies. There is more optimism on US-Chinese trade as a series of understandings are drafted, and an extension past March 1 of the tariff freeze is reportedly in the...

Read More »Cool Video: Fox Business–Stocks and the US Consumer

Varney and Company on Fox Business TV - Click to enlarge I joined Varney and Company on Fox Business TV earlier today. Varney had liked by bullish call on stocks from the end of last year, but seemed dismayed that I have turned cautious. I suggested that the S&P are approaching a key area a little above 2800 that has capped in Q4 18. In addition to these chart points, I am concerned that the S&P 500 has rallied...

Read More »FX Daily, February 20: US-China Trade and Brexit Dominate Ahead of FOMC Minutes

Swiss Franc The Euro has fallen by 0.12% at 1.1337 EUR/CHF and USD/CHF, February 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US dollar is narrowly mixed against the major currencies, but the strongest currency today is the Chinese yuan, following reports that US wants China to keep the yuan stable and not offset US tariffs with currency depreciation. The...

Read More »FX Daily, February 19: Investors Need Fresh Incentives

Swiss Franc The Euro has fallen by 0.08% at 1.1345 EUR/CHF and USD/CHF, February 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Activity in the global capital markets is subdued as investors await fresh developments. New wording for the Irish backstop apparently is being drafted. US-China trade talks resume. No decision has been made on US auto tariffs, but...

Read More »FX Daily, February 18: Dollar Drifts Lower

Swiss Franc The Euro has risen by 0.06% at 1.1349 EUR/CHF and USD/CHF, February 18(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: In quiet turnover, the US dollar slipped lower against most of the major currencies to start the new week. The news stream is light and the US markets are closed today. The MSCI Asia Pacific Index was up five of the past six...

Read More »FX Weekly Preview: Drivers, While Marking Time

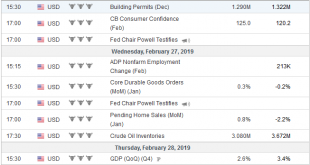

The main issues for investors have not changed. There are three dominant ones: Trade, growth, and Brexit. Unfortunately, there won’t be any closure in the week ahead, and that may make short-term participants reluctant to turn more aggressive. United States The US reported exceptionally poor December retail sales and January industrial output figures. Growth forecasts were adjusted. The St. Louis Fed’s GDP Now tracker,...

Read More »FX Daily, February 15: Equities Stall While Greenback Remains Firm

Swiss Franc The Euro has fallen by 0.10% at 1.1336 EUR/CHF and USD/CHF, February 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 snapped a four-day advance yesterday, and equities in the Asia Pacific followed suit. All the markets in the region were lower but in Australia. MSCI’s regional benchmark stalled after reached a four-month high in the...

Read More »Socialism, Keynesianism, and Fascism

The American political discourse has changed since the 2018 midterm election. Enthusiasm and passion were to be found on the left-wing of the Democratic Party. A new sense of hope and mission replaced the defeatism and cynicism seen in 2016. Some identified with democratic socialism, but in the political rhetoric the broad brush of “socialism” has been used to paint the entire party. The 2020 contest is already being...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org