Swiss Franc The Euro has risen by 0.10% to 1.1786 CHF. EUR/CHF and USD/CHF, April 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates US shares slumped before the weekend amid concern that Trump Administration was prepared to escalate the trade tensions with China. However, cooler heads are prevailing, and there is a recognition that the conflict is still in the posturing...

Read More »Great Graphic: Has the Dollar Bottomed Against the Yen?

The US dollar appears to be carving a low against the yen. After a significant fall, investor ought to be sensitive to bottoming patterns. The first tell was the key reversal on March 26. In this case, the key reversal was when the dollar made a new low for the move (~JPY104.55) and then rallied to close above the previous session high. The second tell was the divergence with the technical indicators. The divergence is...

Read More »FX Daily, April 06: Trade Trumps Jobs

Swiss Franc The Euro has fallen by 0.08% to 1.1779 CHF. EUR/CHF and USD/CHF, April 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Trade and equity market volatility, which are not completely separate, continue to dominate investors’ interest. Many had come around to accept that while trade tensions were running high, it was likely to be mostly posturing. This...

Read More »FX Daily, April 05: Investors Find Comfort in Brinkmanship Blinks

Swiss Franc The Euro has fallen by 0.07% to 1.1787 CHF. EUR/CHF and USD/CHF, April 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Global equity markets are higher, following the stunning recovery in the US yesterday, where the S&P 500 rallied 76 points or 3% from its lows to it highs, near where it finished. The outside up day is seeing following through today....

Read More »FX Daily, April 04: Trade Specificities Rattle Markets

Swiss Franc The Euro has risen by 0.31% to 1.1799 CHF. EUR/CHF and USD/CHF, April 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Late yesterday, the US announced that specific tariffs and goods that would be targeted for intellectual property violations. China had warned of a commensurate response and earlier today made its announcement. This sent reverberations...

Read More »Weekly Technical Analysis: 02/04/2018 – Gold, WTI Oil Futures, GER30 Index, USD/JPY

USD/CHF The USDCHF pair attempted to breach 0.9581 level yesterday but it returns to move below it now, which keeps the bearish trend scenario valid until now, supported by stochastic move within the overbought areas, waiting to head towards 0.9488 as a first target. We reminding you that confirming breaching 0.9581 will push the price to visit 61.8% Fibonacci correction level at 0.9675 before any new attempt to...

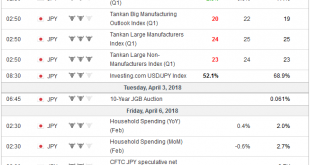

Read More »FX Daily, April 03: Markets in Search of Footing

Swiss Franc The Euro has risen by 0.04% to 1.1754 CHF. EUR/CHF and USD/CHF, April 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The sell-off in US tech shares dragged the market lower. The S&P 500 fell for the sixth session of the past eight and closed below the 200-day moving average for the first time in a couple of years. The sell-off in Asia and Europe is...

Read More »Cool Video: Bloomberg Double Feature

Many are still celebrating the Easter holiday today, but not Tom Keene and Lisa Abramowicz and the Bloomberg team. They hosted me on Bloomberg TV today. As is often the case, the discussion was broad, covering the pressing economic and financial issues. In the first clip, which runs about 2.5 minutes, I sketch out the argument for the US economy being in a late-stage expansion. I cite the 12-month moving average of...

Read More »FX Daily, April 02: Monday Blues

Swiss Franc The Euro has fallen by 0.03% to 1.1746 CHF. EUR/CHF and USD/CHF, April 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar drifted a little lower in Asia to start the week while equities had a slightly heavier bias. The MSCI Asia Pacific Index slipped 0.1%. European bourses are mostly closed for the extended Easter holiday, while the S&P is...

Read More »FX Weekly Preview: The Start of Q2

The chief uncertainty has shifted from monetary policy and macroeconomics to the increase of volatility in the stock markets and the prospects of a trade war. Some of the major benchmarks, including the S&P 500, the MSCI Asia Pacific Index, the MSCI Emerging Markets Index, and Shanghai Composite held above the February lows in the retreat during the second half of March. Other bourses did not. These include the DAX,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org