Swiss Franc The Euro has fallen by 0.13% to 1.0914 EUR/CHF and USD/CHF, September 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Some gestures in the US-China trade spat have given the market the reason to do what it had been doing, and that is taking on more risk. Equities are higher in Asia Pacific and opened in Europe higher before slipping. The MSCI Asia Pacific and the Dow Jones Stoxx 600 are advancing...

Read More »CHF is ‘not strong in real terms’ – no need for SNB intervention

A note from Standard Chartered on the Swiss National Bank and the Swiss franc. The SNB monetary policy meeting is next week, September 19. In brief, Stan Chart argue the franc is not strong in real terms adjusting EUR/CHF for inflation leaves CHF around 10% weaker than (non-adjusted) current spot no need for SNB to intervene to try to weaken it therefore the SNB is not likely to cut rates at their meeting, nor intervene in forex markets in the near term EUR/CHF...

Read More »FX Daily, September 11: Dollar is Firm as ECB is Awaited

Swiss Franc The Euro has fallen by 0.31% to 1.092 EUR/CHF and USD/CHF, September 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities are extending their recent gains while bonds remain on the defensive. The dollar is firm. There is a degree of optimism that is prevailing. There are some more overtures in terms of US-Chinese trade. In Hong Kong, developers and banks led an equity rally on ideas...

Read More »EUR/CHF technical analysis: Break out or fake out?

The cross needs to hold above the 1.0970s and beyond the 25th July swing lows. To the downside, a break back below the prior descending resistance will spell bad news for the bulls. EUR/CHF has been running higher of late, despite the onset of the European Central Bank – a possible buy the rumour sell the fact scenario as the less committed euro shorts are squeezed. Nevertheless, the price action is all the counts from a technical analysis perspective. EUR/CHF has...

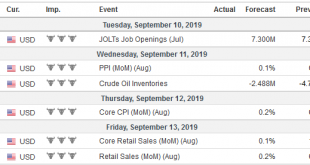

Read More »FX Daily, September 10: Turn Around Tuesday

Swiss Franc The Euro has fallen by 0.22% to 1.0933 EUR/CHF and USD/CHF, September 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The momentum from the end of last week carried into yesterday’s activity, but the momentum began fading. Today, equities were mixed in Asia Pacific and weaker in Europe. The Dow Jones Stoxx 600 reversed lower yesterday and is slipped further today. The S&P 500 may gap lower at...

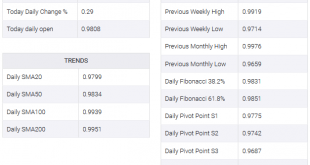

Read More »USD/CHF technical analysis: Remains inside 4-day old triangle after Swiss unemployment rate

USD/CHF clings to 0.9890 after unemployment data. A four-day-old symmetrical triangle limits the pair’s near-term moves. 200-HMA adds to the support while 0.9920 limits the upside. USD/CHF remains largely unchanged after the headline job data as it trades near 0.9890 ahead of Monday’s European session open. August month seasonally adjusted Unemployment Rate for Switzerland matches 2.3% forecast and prior. Hence, the pair is more likely to continue within immediate...

Read More »FX Daily, September 9: Market Sentiment Still Constructive

Swiss Franc The Euro has risen by 0.52% to 1.0944 EUR/CHF and USD/CHF, September 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The improvement of investor sentiment seen last week is carrying over into the start of the new weeks. Global equities are firm as are benchmark yields. Asia Pacific equities advanced, except in Hong Kong, where Chief Executive Lam’s promise to formally withdraw the controversial...

Read More »FX Weekly Preview: Gaming the ECB and Putting the Cart Before Horse in the Brexit Drama

The step away from the edge of the abyss may have stirred the animal spirits, but it remains precarious at best. The formal withdrawal of the extradition bill in Hong Kong is too late and too little at this juncture. The ambitions of the protests have evolved well beyond that. Italy has a new government, but a prolonged honeymoon is unlikely for this unlikely union. Face-to-face talks between the US and China are better than no talks but hardly indicates an end to...

Read More »FX Daily, September 06: Focus Shifts to North American Jobs Before Turning Back to Europe next Week

Swiss Franc The Euro has risen by 0.79% to 1.0905 EUR/CHF and USD/CHF, September 06(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Investors hope that the world took a step away from the abyss in recent days. Developments in Hong Kong, US-China talking, a political and economic crisis in Italy appears to have been averted, and a risk of a no-deal Brexit has lessened. Asia Pacific equities closed the week...

Read More »USD/CHF bounces from trend-line support on trade news

US/Sino trade teams will consult in mid-September with a view for a meeting in Washington in early October. USD/CHF is currently trading 0.26% higher and bouning of trend-line support. The announcement that trade talks are back on track as given the markets the extra fuel needed to recover with respect to risk appetite. Currencies, such as the Yn and CHF, would otherwise benefit from investment, but in such a case that a trade deal could eventually emerge from the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org