US/Sino trade teams will consult in mid-September with a view for a meeting in Washington in early October. USD/CHF is currently trading 0.26% higher and bouning of trend-line support. The announcement that trade talks are back on track as given the markets the extra fuel needed to recover with respect to risk appetite. Currencies, such as the Yn and CHF, would otherwise benefit from investment, but in such a case that a trade deal could eventually emerge from the protracted negotiations is pressuring them in Asia today. USD/CHF is currently trading 0.26% higher and bouning of trend-line support. Vice Premier Liu He who is the head Chinese trade negotiator has been reported to have spoken with Mnuchin and Lighthizer on Wednesday on a phone call and trade teams

Topics:

Ross J Burland considers the following as important: 4.) FXStreet, 4) FX Trends, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The announcement that trade talks are back on track as given the markets the extra fuel needed to recover with respect to risk appetite. Currencies, such as the Yn and CHF, would otherwise benefit from investment, but in such a case that a trade deal could eventually emerge from the protracted negotiations is pressuring them in Asia today. USD/CHF is currently trading 0.26% higher and bouning of trend-line support. Vice Premier Liu He who is the head Chinese trade negotiator has been reported to have spoken with Mnuchin and Lighthizer on Wednesday on a phone call and trade teams will consult in mid-September with a view for a meeting in Washington in early October. |

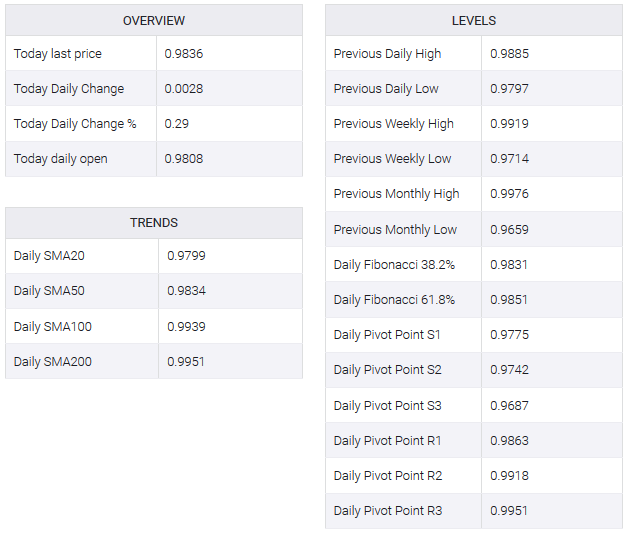

USD/CHF levels(see more posts on USD/CHF, ) |

Can the US/China finally make something happen?

However, it’s hard to see a quick resolution considering the determination of Washington to stand firm on China when issues such as the violation of intellectual property rights, forced technology transfer and Chinese subsidies to state-owned enterprises have not been bridged – that is the sticking point and both nations are as stubborn as the other.

Many observers expect China to wait it out to see if Trump loses the 2020 elections.

“In our view the escalation in trade tensions between the US and China is likely to cut around 0.6ppts from world growth through until 2021. This will have ramifications for risk appetite, risky assets and safe-haven demand,”

analysts at Rabobank argued.

Tags: Featured,newsletter