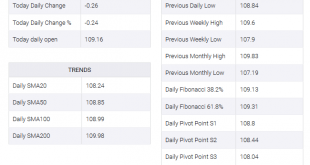

Swiss Franc The Euro has risen by 0.05% to 1.10 EUR/CHF and USD/CHF, September 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: News that Saudi Arabia was able to restore 40%-50% of the oil capacity lost by the weekend strike coupled with the Fed’s efforts to offset the squeeze in the money markets are allowing the global capital markets to trade quietly ahead of the conclusion of the FOMC meeting. Equities...

Read More »USD/CHF technical analysis: 0.9950 to question buyers inside a rising wedge

USD/CHF takes the bids inside a six-week-old rising wedge bearish formation. 200-DMA, 50% Fibonacci retracement could restrict immediate upside. 0.9880 becomes the key support. Despite the recent rise, USD/CHF trades below the confluence of 200-day simple moving average (DMA) and 50% Fibonacci retracement of April-August declines, close to 0.9940, while heading into the European session on Wednesday. Even if the pair manages to overcome 0.9950 immediate resistance...

Read More »FX Daily, September 17: Markets Calm(er)

Swiss Franc The Euro has risen by 0.60% to 1.0984 EUR/CHF and USD/CHF, September 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Oil prices have stabilized after yesterday’s surge. Both Brent and WTI are holding on to around $7-$8 a barrel gain. Equity markets are mixed. Some are attributing the losses in Asia Pacific outside of Japan (Nikkei rose its highest level since late April), Korea and Australia to...

Read More »CHF/JPY: Eyes on central banks and geopolitics

This week the BoJ will hold its regular policy meeting. Global uncertainty, linked to the trade war and Brexit, has strengthened the value of the Swiss franc and Yen. CHF/JPY is struggling to maintain the upside as the Yen picks up a safe haven bid, anchored on geopolitical developments following a textbook risk-off response in global financial markets following the strike on Saudi Arabia’s oil facilities over the weekend. Both the CHF and Yen picked up a bid as...

Read More »FX Daily, September 16: Oil Surge Pared, Markets Remain on Edge

Swiss Franc The Euro has fallen by 0.22% to 1.0942 EUR/CHF and USD/CHF, September 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Oil prices surged in the initial reaction to the unprecedented drone attack on Saudi Arabia facilities. Saudi Arabia may be able to restore around half of the lost production in a few days. Saudi Arabia and other countries, including the US, prepared to tap strategic reserves, oil...

Read More »FX Weekly Preview: Six Things to Watch in the Week Ahead

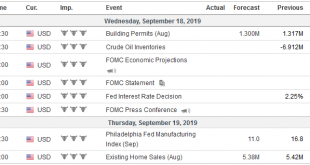

The prospect of a third trade truce between the US and China helped underpin the optimism that extended the rally in equities. Bond yields continued to back-up after dropping precipitously in August, led by a more than 30 bp increase in the US yield benchmark. The Dollar Index fell for the second consecutive week, something it had not done this quarter. United States The Federal Reserve’s meeting on September 18 is the most important calendar event in the week...

Read More »EUR/JPY rallies the hardest vs EUR/CHF as CHF/JPY spikes following ECB

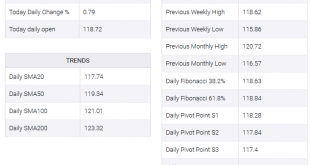

EUR/JPY rallies hard following hawkish ECB cut and trade war optimism. EUR/JPY tracking positive sentiment in financial and commodity markets. While the trade war tensions seem to be easing, with stocks climbing and risk appetite returning in droves to financial and commodity markets, EUR/JPY is up 0.79% on the US session so far following what has been perceived as a hawkish rate cut from the European Central Bank earlier today. EUR/JPY is currently trading at...

Read More »Cool Video: Thoughts on ECB

A few hours after the ECB announced a new package of monetary accommodation, I joined a discussion on CNBC Asia with Nancy Hungerford and Sir Jegarajah. Here is a clip of part of our discussion. I make two points. The first is about the euro’s price action. What impressed me about it was that the euro posted an outside up day, trading on both sides of the previous day’s range and closing above its high. When Sri and I were talking early in the Asian morning, there...

Read More »USD/CHF technical analysis: 0.9890 is the level to beat for sellers

USD/CHF fails to sustain the bounce off key support-confluence including 200-HMA and 38.2% Fibonacci retracement. A downside break highlights the 61.8% Fibonacci retracement level while 200-DMA caps the upside. Failures to sustain the bounce off 200-hour moving average (HMA) and 38.2% Fibonacci retracement of latest run-up drag the USD/CHF back to the key support-confluence while taking rounds to 0.9900 ahead of Friday’s European open. Should prices slip below 0.9890...

Read More »FX Daily, September 13: Bonds and the Dollar Remain Heavy Ahead of the Weekend

Swiss Franc The Euro has fallen by 0.19% to 1.0932 EUR/CHF and USD/CHF, September 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The markets are digesting ECB’s actions and an easing in US-Chinese rhetoric. Next week features the FOMC meeting and three other major central banks (Japan, Switzerland, and Norway). The US equity rally that saw the S&P 500 edge closer to the record high set in late July...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org