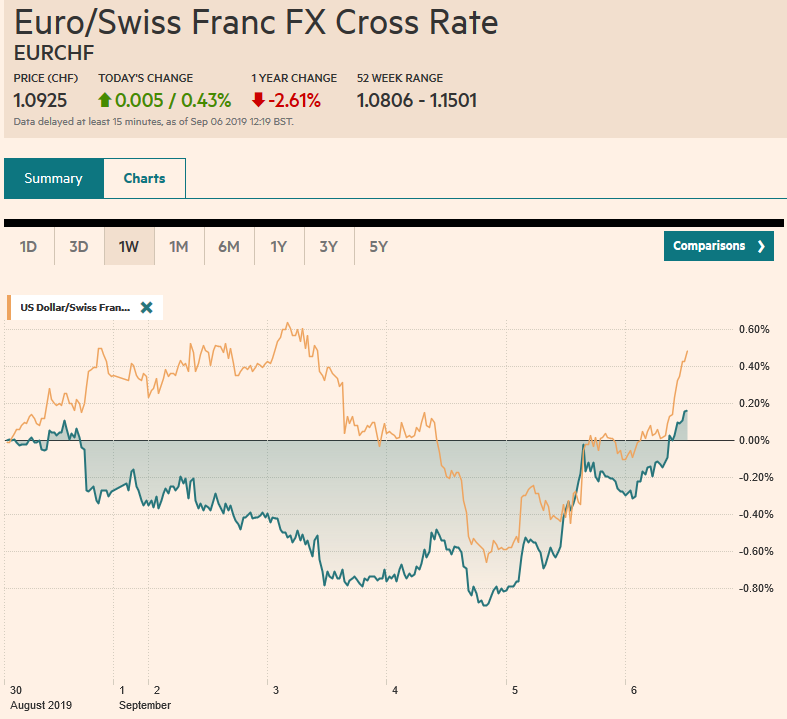

Swiss Franc The Euro has risen by 0.79% to 1.0905 EUR/CHF and USD/CHF, September 06(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Investors hope that the world took a step away from the abyss in recent days. Developments in Hong Kong, US-China talking, a political and economic crisis in Italy appears to have been averted, and a risk of a no-deal Brexit has lessened. Asia Pacific equities closed the week on a firm note and extended the rally the third week. European shares are mixed today, but the Dow Jones Stoxx 600 is also posting its third consecutive weekly gain. Back-to-back gaps higher have seen the S&P 500 explode out of their month-long trading range. It is set to post the second weekly gain in

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Brexit, Canada, China, EUR/CHF and USD/CHF, Featured, Germany, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.79% to 1.0905 |

EUR/CHF and USD/CHF, September 06(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge |

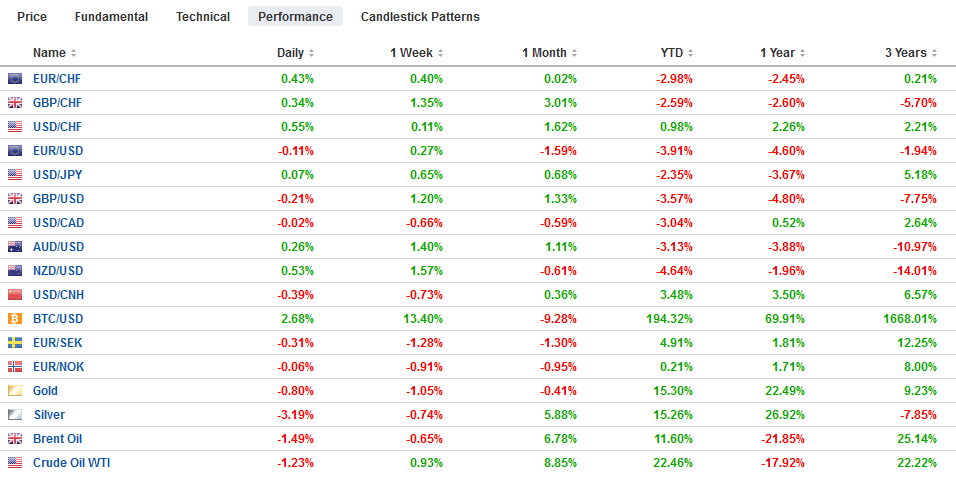

FX RatesOverview: Investors hope that the world took a step away from the abyss in recent days. Developments in Hong Kong, US-China talking, a political and economic crisis in Italy appears to have been averted, and a risk of a no-deal Brexit has lessened. Asia Pacific equities closed the week on a firm note and extended the rally the third week. European shares are mixed today, but the Dow Jones Stoxx 600 is also posting its third consecutive weekly gain. Back-to-back gaps higher have seen the S&P 500 explode out of their month-long trading range. It is set to post the second weekly gain in a row, something not seen for nearly two months. Interest rates are backing up, with the US 10-year yield poised to snap a five-week decline. Global benchmarks are higher today following the sharp rise in US rates yesterday. Bonds in the periphery in Europe are bucking the pressure and yields have slipped. The foreign exchange market reflects the improved investor sentiment with the yen and Swiss franc trading heavily and the growth-sensitive dollar-bloc currencies and Scandis leading the way higher. Emerging market currencies are recouping some recent losses against the dollar, but the Turkish lira is an exception. Like yesterday, it is seeing the gains scored earlier in the week pared. |

FX Performance, September 06 |

Asia Pacific

Hong Kong Chief Executive Lam may have waited too long to formally withdraw the controversial extradition bill and the protest demand extended beyond it. Although China is clearly not above intimidation, it continues to rely on Hong Kong to address the violent protests. Some, albeit belated, concessions by Lam may be designed to split the business community away from the movement. The economic fallout is growing. For the first time since 1995, Fitch cut Hong Kong’s long-term foreign currency borrowing credit rating to AA with a negative outlook from AA+.

The Chinese yuan has stabilized. The PBOC continued to set the dollar’s reference rate in the mid-CNY7.08 area, below where bank models suggest and below where spot trades. Gradually, in recent days, the market came closer to the PBOC rather than the other way around. Moreover, for the second consecutive session, the dollar is trading weaker against the offshore yuan than the onshore yuan. After the mainland markets closed for the week, the PBOC announced a 0.5% cut in reserve requirements. Separately, note that ZTE rallied 9% in Shenzhen trading amid reports that Spain will use the company for part of its 5G rollout.

Household spending rose 0.8% from a year ago in July after a 2.7% increase in June. The year-over-year pace peaked in May at 4.0%, the strongest in four years. Some observers see this as evidence Japanese households are trying to beat the hike in the sales tax starting next month (to 10% from 8%). At the same time, the weak cash earnings report also suggest limited fuel for consumption going forward. Cash earnings have fallen every month so far this year, but June. Today’s report showed a 0.3% decline in July year-over-year. The median forecast in the Bloomberg survey was for a small gain. Lastly, we note that US and Japanese negotiators have a tight timeframe to finalize a trade agreement. The objective was having Trump and Abe a formal agreement around the UN meetings later this month.

The dollar rose above JPY107 for the first time in a month yesterday and is straddling that area today. It has yet to close above it, for a convincing break. There are around $1.9 bln in options in the JPY107.00-JPY107.05 area that expire today. The US jobs data is the wild card. There is also a $300 mln option at JPY107.25 that also expires today. The next chart hurdle is seen near JPY107.50-JPY107.60. The Australian dollar is rising for the fourth consecutive session and is pushing above a retracement level at $0.6830. The next target is near $0.6880. A move back below $0.6800 would be disappointing.

Europe

The UK has been thrown into disarray by this week’s Parliament actions that are forcing a reluctant Prime Minister to seek an extension to Brexit again if no agreement has been struck with the EU in about five weeks. Almost two dozen Tory MPs have lost the whip, leaving Johnson a minority government. The Prime Minister’s own brother resigned from the cabinet in dispute over Brexit. Reports suggest that the opposition may seek an election on October 29, while next week Johnson may try again to have a snap election (before the EU summit on October 17). Johnson could put the opposition in an uncomfortable position by engineering a vote of confidence. Labour would have to vote in favor of the government or give Johnson the initiative again. Without putting a fine point on it, Corbyn has shown not to be restricted by political consistency. Our concern remains that many are thinking that all the UK has to do is ask for another extension and Europe will rubber-stamp it. Better, it seems, to request a delay because of an election in November.

Following a poor factory orders report yesterday, Germany reported yet another contraction in industrial output today. It fell by 0.6% in July. The median forecast in the Bloomberg survey called for a 0.4% increase. Construction and the production of consumer goods rose, but intermediate goods and energy output fell. It is the fifth decline in the seven months. Industrial production has fallen by an average of 0.5% a month this year. In the first seven months of 2018, industrial output fell by an average of 0.2% a month. It has declined by 4.2% year-over-year, which is the least since April. Nevertheless, it reinforces the Bundesbank’s warning that Europe’s biggest economy likely contracted for the second consecutive quarter in Q3.

The euro is consolidating around where it has closed for the past two sessions (~$1.1035). Recall that it fell to a new 2.5 year-low on Tuesday near $1.0925 before rebounding to $1.1085 yesterday, stalling at the 20-day moving average. It is difficult to envision strong gains for the euro ahead of next week’s ECB meeting. Although there has been some official push against resuming asset purchases, surveys suggest most participants expect the hawks to lose the debate. There are 1.5 bln euro options struck at $1.1045-$1.1050 that expire today. Sterling rallied to almost $1.2355 yesterday, its best level since late July and is consolidating a little lower today. Support is seen near $1.2450. This week’s three-day advance that is under threat today was the longest rally in nearly two months.

America

Yesterday’s data sent conflicting signals about today’s US employment report. On the one hand, the ADP estimate for private-sector hiring was 195k, well above expectations and its biggest increase in four months. On the other hand, the employment component of the non-manufacturing ISM fell to 53.1 from 56.2, its lowest level in nearly 2 1/2 years. The weekly jobs claims were little changed during the week in which the non-farm payroll survey was conducted. We suspect the calendar effect and the census workers may produce a stronger than expected increase. Average hourly earnings are expected to rise by 0.3%, but the base effect means that it will not be sufficient to avoid moderation in the year-over-year pace to 3.0% from 3.2%. An increase in the average workweek to 34.4 hours (yes, no typo: It has not been above 34 1/2 hours a week for three years) would also help make for a constructive read.

Canada has lost jobs for in June and July but is expected to have grown 20k jobs last month. The average monthly job growth this year is just below 32k. In the first seven months of 2018, the average gain was a little more than 18k. Canada lost 11.6k full-time position in July and is expected to have grown 17.5k in August. The average increase of full-time jobs this year has been 29.3k, vs. 10.5k in Jan-July 2018. Watch the average hourly wage of permanent workers. It soared to 4.5% in July after finishing last year a little below 1.5%.

Around midday in NY, Fed chief Powell will address investors in Zurich about the global economy. Nearly regardless of what he says, or today’s jobs data, that will deter the market from thinking that a rate cut on September 18 is as done of a deal as these things get. The mid-course correction that Powell announced at the end of July is not complete.

The US dollar was approached CAD1.34 in earlier in the week, but the less dovish Bank of Canada stopped it in its tracks. It dipped below CAD1.32 yesterday and is straddling it today. Resistance is pegged in the CAD1.3250-CAD1.3265 area. The next target on the downside is around CAD1.3150. The Mexican peso, like the Canadian dollar, is poised to snap a seven-week slide (The Australian and New Zealand dollar’s are breaking their six-week losing streaks.). The dollar peaked against the Mexican peso in late August near MXN20.26. It tested MXN19.60 yesterday. It is consolidating mostly in yesterday’s range ahead of the North American session. The next target is near MXN19.45.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Brexit,Canada,China,EUR/CHF and USD/CHF,Featured,Germany,newsletter