The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015...

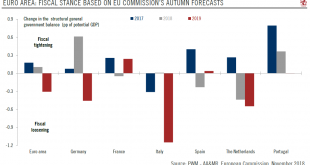

Read More »Euro area’s fiscal policy to turn supportive of growth next year

SUMMARY The Euro area’s fiscal stance will turn expansionary in 2019. Among the five biggest economies, this shift mainly reflects significant fiscal loosening in Germany, Italy and the Netherlands. France and Spain plan modest fiscal tightening, but less that what the European Commission (EC) demanded. In Italy, the government budget plan represents a significant deviation from the EU’s fiscal rules. The outcome of arm...

Read More »Harmful Modern Myths And Legends

Loreley Rock near Sankt Goarshausen sits at a narrow curve on the Rhine River in Germany. The shape of the bluff produces a faint echo in the wind, supposedly the last whispers of a beautiful maiden who threw herself from it in despair once spurned by her paramour. She was transformed into a siren, legend says, a tantalizing wail which cries out and lures fishermen and tradesmen on the great river to their death. While...

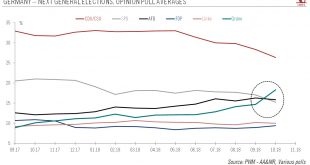

Read More »The Beginning of the End for Angela Merkel

The transition to new leadership in Germany could have implications for Europe as a whole. As a consequence of the heavy drop of support in recent regional elections, Chancellor Merkel has declared she would not run again for leadership of the CDU at the 6-8 December party convention. Merkel also said she would retire from politics at the end of the current parliament in 2021. It is questionable whether she will get...

Read More »Crypto bond catapults Swiss franc onto blockchain

Stable coins are proliferating as a means to counter the effects of huge price swings of cryptocurrencies. A new bond has been launched in Switzerland to help investors and blockchain start-ups escape the volatility of cryptocurrencies. Issued by Swiss Crypto Tokens, the bond is a representation of the safe haven currency on the blockchain. The first 10 million units of the bond, each worth a franc and pegged to the...

Read More »Swiss Retail Sales, September 2018: -2.3 percent Nominal and -2.7 percent Real

02.11.2018 – Turnover in the retail sector fell by 2.3% in nominal terms in September 2018 compared with the previous year. This is the sharpest decline since December 2016. Seasonally adjusted, nominal turnover fell by 1.6% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real turnover in the retail sector also adjusted for sales days and holidays fell by 2.7%...

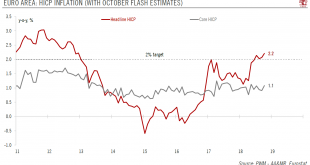

Read More »Rebound in inflation data brings some relief to the ECB

Strong wage growth should support the recovery of euro area inflation in the coming months. Euro area flash HICP rose from 2.1% year on year (y-o-y) in September to 2.2% in October, in line with expectations and the highest level since December 2012. Crucially, core inflation (HICP excluding energy, food, alcohol and tobacco) rebounded from 0.9% to 1.1% in October. Energy inflation rose to 10.6% y-o-y from 9.5% y-o-y in...

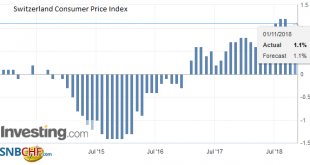

Read More »Swiss Consumer Price Index in October2018: +1.1 percent YoY, +0.2 percent MoM

1 November 2018 – The consumer price index (CPI) increased by 0.2% in October 2018 compared with the previous month, reaching 102.1 points (December 2015 = 100). Inflation was 1.1% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO). The 0.2% increase compared with the previous month can be explained by several factors including rising prices for heating oil...

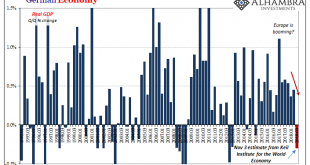

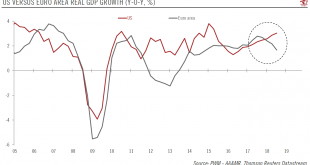

Read More »Euro area’s initial growth figures for Q3 prove disappointing

While growth in France rebounded, Italy stalled in Q3. Our full-year forecast for the euro area remains unchanged but is clearly at risk. According to initial estimates, growth in the euro area slowed in Q3 to 0.2% q-o-q (quarter on quarter) from 0.4% in Q2. These latest GDP results were below consensus expectations and our own forecast. This was the weakest quarterly growth figure for the euro area since Q2 2014 and...

Read More »KOF Economic Barometer: Upswing Sets a More Leisurely Pace

The KOF Economic Barometer fell in October after having risen in the previous month. At 100.1 points, the barometer is now as good as on its long-term average of 100.0. Since May of this year, the KOF Economic Barometer has thus been fluctuating around its long-term average. The Swiss economy is therefore in the coming months likely to grow with average rates. In October, the KOF Economic Barometer fell...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org