Overview: The modest economic goals announced as China's National People's Congress starts was seen as a cautionary sign after growth disappointed last year. It seemed to weigh on Chinese stocks, though others large bourses in the region advanced, led by Japan's Nikkei and South Korea with gains of more than 1%. Europe's Stoxx 600 is little changed after rising for the past two sessions. US index futures are slightly softer. Strong gains were seen before the weekend. Benchmark 10-year yields are softer across the board. European yields are off mostly 6-8 bp with the peripheral premiums narrowing a little. The 10-year US Treasury yield that had punched through 4% last week is near 3.92% today. The US dollar is mostly firmer, but against several pairs, remains

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Bank of Canada, China, Currency Movement, Featured, Federal Reserve, Japan, newsletter, RBA, Russia, Switzerland, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

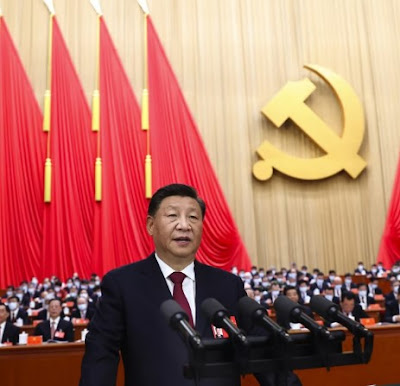

Overview: The modest economic goals announced as China's National People's Congress starts was seen as a cautionary sign after growth disappointed last year. It seemed to weigh on Chinese stocks, though others large bourses in the region advanced, led by Japan's Nikkei and South Korea with gains of more than 1%. Europe's Stoxx 600 is little changed after rising for the past two sessions. US index futures are slightly softer. Strong gains were seen before the weekend. Benchmark 10-year yields are softer across the board. European yields are off mostly 6-8 bp with the peripheral premiums narrowing a little. The 10-year US Treasury yield that had punched through 4% last week is near 3.92% today.

The US dollar is mostly firmer, but against several pairs, remains within recent ranges. After a firmer than expected CPI report, and speculation of as much as a 75 bp hike on March 23, is helping the Swiss franc resist the dollar's tug. It is the only G10 currency gaining on the greenback today. Emerging market currencies are more mixed, but the free-floating accessible currencies, including the South African rand, Turkish lira, and Mexican peso are heavier. Outside of the rouble, the South Korea won, and Taiwanese dollar are the strongest in among the emerging market currencies. Gold reached its best level in nearly three weeks ahead of the weekend (almost $1857) but is testing the $1850 area in the European morning. A break could see $1845 but the intraday momentum indicator suggests buying will likely appear ahead of support. April WTI approached $80 a barrel, its best level since mid-February, but is set to snap a four-day advance, despite the Saudi announcement it was lifting prices for next month's shipment to Asia. Look for initial support around $77.60.

Asia Pacific

On the eve of the National People's Congress, this year's economic targets were announced, and they seem modest. The economy is to grow by around 5%. The median projection in Bloomberg's survey was 5.3%, and the IMF's latest forecast was 5.2%. It targets creating 12 mln urban jobs, up from 11 mln previously. The official forecast for CPI at 3% was higher than the private economists (2.4% median in Bloomberg's survey) and the IMF (2.2%). China aims for a budget deficit of 3% of GDP, smaller than the 5% projected by economists in Bloomberg's survey after a 4.7% deficit last year. At the same time, it plans to reduce the quota for local bonds sales. The projected 7.2% increase in defense spending (to ~CNY1.55 trillion or $225 bln), the most in four years, will also capture attention. Still, the US defense spending is more than three times larger (~$800 bln in the fiscal year ending September 30).

Japan reports labor earnings tomorrow. January's year-over-year gain in nominal cash earnings is expected to have slowed slightly less than 2% from 4.1% in December. This returns the pace back to where it was before the December bonuses (+6.5% year-over-year) and reimbursement of commuting costs. Hours worked fell slightly throughout Q4 22. Real earnings continue to fall on a year-over-year basis and the last time they grew was in March 2022 (0.6%). Still, the 3.2% decline seen (median of Bloomberg's survey) would be the largest drop since October 2014.

The Reserve Bank of Australia meets the first thing tomorrow. While the housing market is suffering and the labor market has begun softening, price pressures are still too high and most expected a 25 bp rate hike. That would bring the cash target rate to 3.60%. RBA Governor Lowe speaks Wednesday morning in Sydney and will provide some color. With January inflation at 7.4%, the swaps market has roughly another 100 bp of tightening discounted.

The dollar eased to a three-day low near JPY135.35 in late Asia Pacific turnover before rebounding in early European activity to poke above JPY136.00. The pre-weekend high was closer to JPY136.80, which seems too far today. That said, JPY137 is an important area later this week as there are large option expirations there on Wednesday and Thursday. The Australian dollar is softer but well within the range seen last week. In fact, the Aussie remains within last Wednesday's range (~$0.6695-$0.6785). Initial support in the $0.6730 area is holding, setting up a test on nearby resistance around $0.6750. There are A$1 bln in options that expire today at $0.6775. Today's high is $0.6770. The greenback moved lower in four of last week's five sessions but has begun the new week with a firmer tone. Still, like the Australian dollar, the US dollar remains within the range set in the middle of last week (~CNY6.8625-CNY6.9350). It reached CNY6.9315 today. The reference rate was set today at CNY6.8951 compared with the median in Bloomberg's survey of CNY6.8959.

Europe

The US has increased its efforts to deny China more advanced chip fabrication ability than it currently has and access to such chips. And President Biden's FY24 budget request (March 9) will likely seek more funds to manage a new round of sanctions, which may include sectoral limits on investment by US companies in China. Yet, the ability of Russia to continue to secure chips casts doubt about the efficacy of such efforts. Reports suggest that chips via Turkey, UAE, and Kazakhstan are still going to Russia. Last year, companies from the EU, UK, US, and Japan sold Russia an estimated $60 mln of advanced chips and circuits, according to press reports, a little more than a third of pre-war sales. Separately, a metric of the impact of the sanctions on Russia is that it has been selling its foreign currencies to cover its domestic funding gap. Russia announced it was almost halving (45% less) its foreign exchange sales in the March 7-April 6 period from the current month. Indeed, it is possible that Russia is a net buyer of foreign exchange in H2. Given the current sanctions, the Chinese yuan is the most likely candidate.

Switzerland's CPI edged up to 3.4% last month from 3.3% in January. Economists in Bloomberg's survey anticipated a slowing to 3.1%. The Swiss National Bank had anticipated a 3.0% rate in Q1 23. It will not find much comfort in the EU-harmonized measure that that was unchanged at 3.2%, especially with the core rate rise to 2.4% from 2.2%. The SNB meets on March 23. While most look for a 50 bp hike, a larger move cannot be ruled out. Its key deposit rate stands at 1.0%. The euro rose against the Swiss franc last week, the third consecutive weekly advance, but it was turned back after approaching CHF1.0050. The year's high was set in mid-January near CHF1.01. Initial support now is seen nearCHF0.9900.

The euro is trading in about a quarter-cent range on either side of $1.0635 today in quiet turnover. It too remains within the range set in the middle of last week (~$1.0565-$1.0690). The 20-day moving average (~$1.0660) continues to frustrate attempts to push the single currency higher. It has not closed above moving average since February 2. The intraday momentum indicators suggest an upside bias in the early North American activity today. Sterling is holding above $1.20 today but it appears to be stymied by the large GBP1.5 bln option at $1.2050 that expires today and another GBP1 bln at $1.2060. The path of least resistance may be on the downside. Support below $1.20 is seen in the $1.1960-80 area.

America

Federal Reserve Chair Powell begins his semi-annual testimony tomorrow. His message is clear: the economy continues to grow above its long-term sustainable, non-inflationary pace. While inflation has slowed, officials have yet to be sure that it is on a durable path to the target. Therefore, more interest rate hikes are needed. He will likely be asked whether a 50 bp hike is under consideration after the Fed slowed to a quarter-point move last month. The answer seems obvious: As the minutes from the last Fed meeting noted, a few members considered a 50 bp move last month. The economic data since then has generally been stronger than market expectations.

Since their introduction in 2012, the Summary of Economic Projections (dot plot) has often been played down by the Fed chair. However, more recently, Powell and others have been putting greater weight on them as a signaling device. The median projection in December was for a terminal rate to be 5.1%. The strength of recent data and guidance by officials encouraged help spur market expectations from a little below 5% at the end of last year to nearly 5.50% now. We suggest that the Fed will not want to be seen as less hawkish than the market, so the question is whether the Fed signals a terminal rate above the market or validate the market's expectation. Given that we expected the February data to slow, from this week's jobs report and next week's retail sales and manufacturing output, and for CPI to continue to gradually fall, it seems most likely that the median Fed dot rises to 5.50%.

The US reports January factory goods orders. On the back of a 4.5% decline in durable goods orders, economists expected a 1.8% decline, which would offset December's gain. Canada sees the IVEY Purchasing Managers Index, which jumped from 49.3 in December to 60.1 in January. That was the highest since last May. The Bank of Canada meets Wednesday and announced a "conditional pause" at its last meeting in late January. Barring a surprise, the employment data on Friday is the key data this week. Note that in the past three months, it has average 94k full-time jobs compared with a 12-month average of 49k. The three-month average has not been this high since November 2021.

We have noted that a few currency pairs remain within the ranges seen last Wednesday to illustrate the broad sideways movement. The greenback remains within the range seen on February 24 (~CAD1.3530-CAD1.3665). We assume that the options for almost $565 bln that expire today at CAD1.36 and the roughly $950 mln of options that expire there tomorrow have been neutralized. Note too that the exchange rate seems more sensitive to the two-year rate differentials than the S&P 500. The greenback has been trending lower against the Mexican peso and settled below MXN18.00 before the weekend, a new five-year low. It is consolidating today at the lower end of its pre-weekend range that extended slightly through MXN17.95. The daily momentum indicators are over-extended but have note turned up. The intraday momentum indicators warn that previous support at MXN18.00 is now resistance.

Tags: #USD,Bank of Canada,China,Currency Movement,Featured,federal-reserve,Japan,newsletter,RBA,Russia,Switzerland