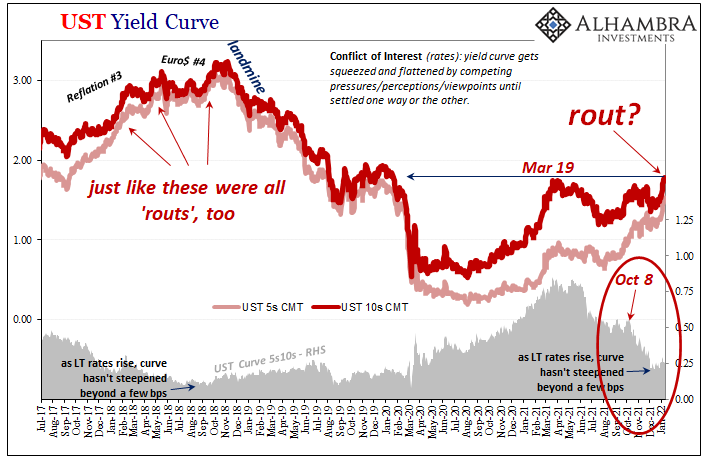

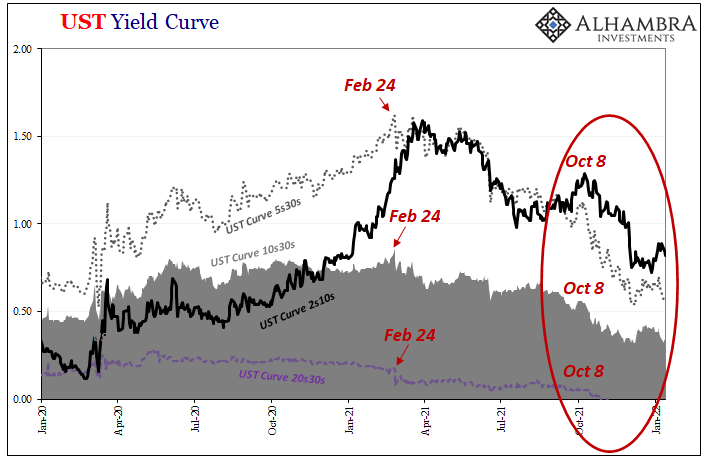

How is that US Treasury rates out in the independent longer end of the yield curve have now “suffered” a seven percent CPI to go along with double taper and triple maybe quadruple (if the whispers are to be believed) rate hikes this year, yet have weathered all of that allegedly bond-busting brutality with barely a market fluctuation? The short end of the curve, as noted here, is being pressured by only the last of those things, rate hikes, and from them creating the malodorous Conundrum No5. Part of the explanation for this can still be found in the word “transitory.” The flattening curve here and elsewhere acknowledges this, how despite the US CPI achieving its lofty status it still is not inflation (OK, Emil, it’s not monetary inflation). . This last point

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bonds, China, Consumer Prices, Core CPI, CPI, currencies, Deflation, disinflation, economy, Featured, Federal Reserve/Monetary Policy, inflation, Markets, newsletter, PPI, producer prices

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| How is that US Treasury rates out in the independent longer end of the yield curve have now “suffered” a seven percent CPI to go along with double taper and triple maybe quadruple (if the whispers are to be believed) rate hikes this year, yet have weathered all of that allegedly bond-busting brutality with barely a market fluctuation? The short end of the curve, as noted here, is being pressured by only the last of those things, rate hikes, and from them creating the malodorous Conundrum No5.

Part of the explanation for this can still be found in the word “transitory.” The flattening curve here and elsewhere acknowledges this, how despite the US CPI achieving its lofty status it still is not inflation (OK, Emil, it’s not monetary inflation). |

|

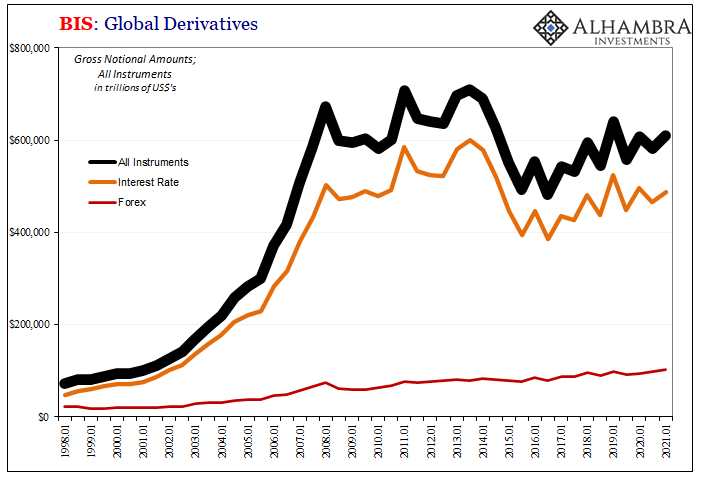

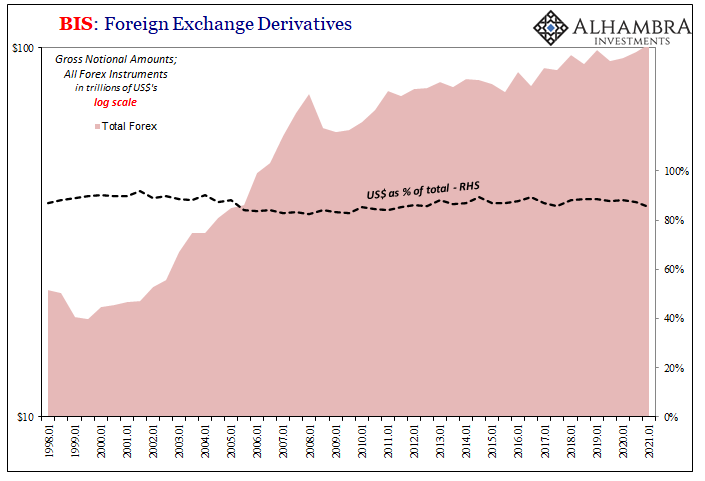

| This last point the purpose behind my recent as well as incoming review of the BIS derivatives data – the real money should there have been any chance.

There wasn’t. |

|

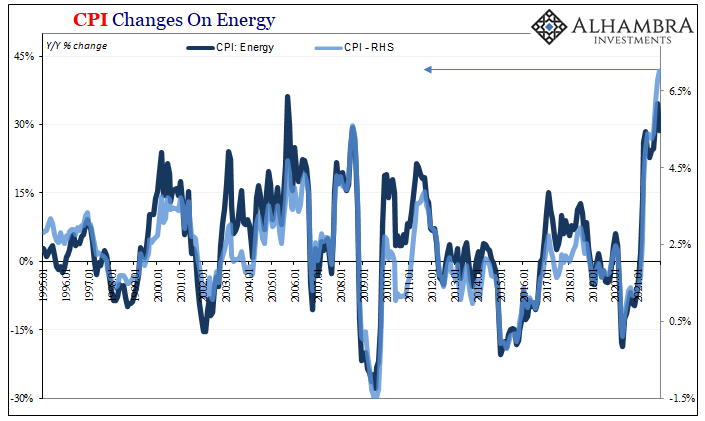

| So, what is going on with prices, and what does “everyone” seem to be missing about them?If your survey doesn’t go past the US headline CPI, then you’re left with a conundrum (especially since Jay Powell’s FOMC isn’t really hawkish about them, either, but rather the prospect Americans will normalize to them along with an historically faulty unemployment rate doing what it has done again). The rate is undoubtedly huge, the highest in forty years.

On top of that, in December while reaching a 7.04% year-over-year rate, it also decoupled from gasoline. |

|

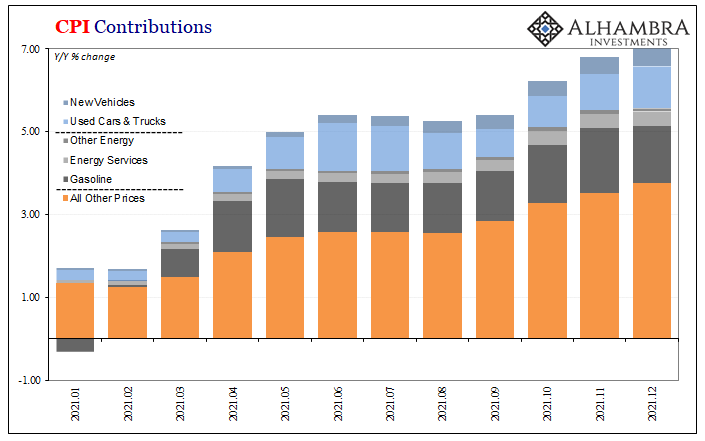

| Though, as noted previously, the CPI has been boosted and amplified by used car prices along with those for gasoline, that wasn’t as much the case in December. For the first time in a very, very long time, too, the headline CPI (y/y) accelerated during the same month when the index for energy prices decelerated (month-over-month they were down).

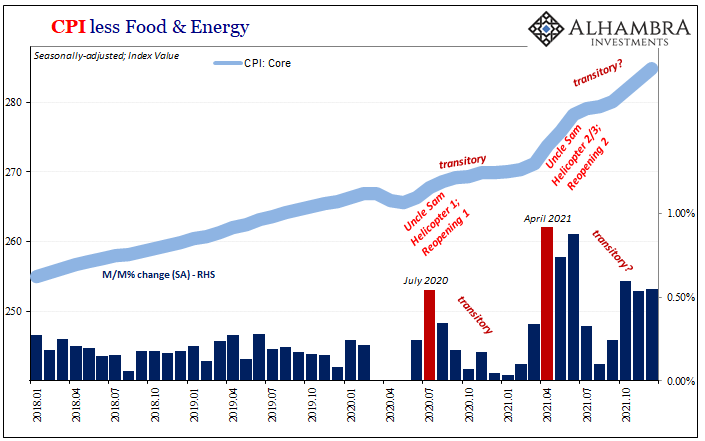

Even though car prices made up much of the difference in the index, as you can see above the prices of other things beside gasoline and vehicles have gone up, too. The core CPI rate – which removes energy and food, though not automobiles – registered an enormous (and painful) 5.45% year-over-year gain for December 2021. |

|

| Clearly, it’s not just the energy sector (nor Big Food gouging consumers on beef and vegetable prices, as some politicians have recently alleged).

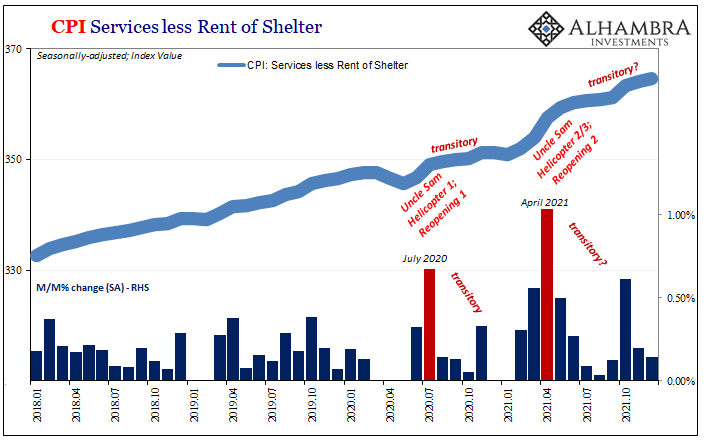

Even so, already in the core CPI you can see how it has changed speed. It had first slowed way down around July before reaccelerating in October if at a lesser rate than the earlier bulge – or Emil’s camel hump – around Uncle Sam’s Helicopter #3. Thus, a smaller yet still noticeable third hump to round out Q4 2021. But when we move away from prices of goods and into services, Hump #3 (since I’m numbering pretty much everything these days, why not?) appears entirely a one-off itself. The CPI data for services less rent depicts a very different end of year result. In fact, outside of October, consumer prices that aren’t for goods have slowed way down again to among the lower rates of increase. |

|

| The third hump here is smaller, more importantly much skinnier.

What this suggests is exactly that; transitory outside of some goods. But what about outside of the US? Remember, too, how inflation is both a monetary phenomenon as well as a global one united by a global monetary system. Again, this the purpose of reviewing all manner of global money proxies like TIC, Z1, and the BIS collection of global derivatives. The yield curve even for US Treasuries is a sorting mechanism that takes account of so many other factors beyond domestic goods prices. Since the Chinese also released their consumer price data today, along with their producer price estimates, those figures are both handy and topical. |

|

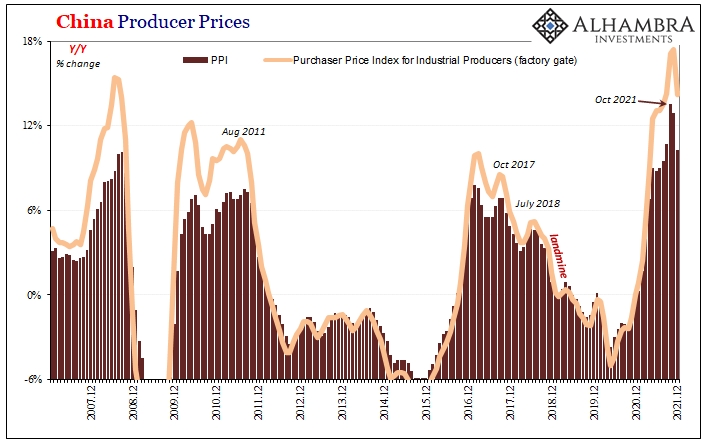

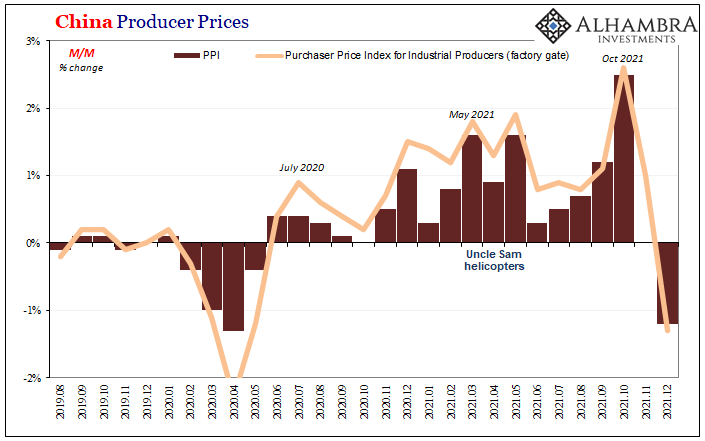

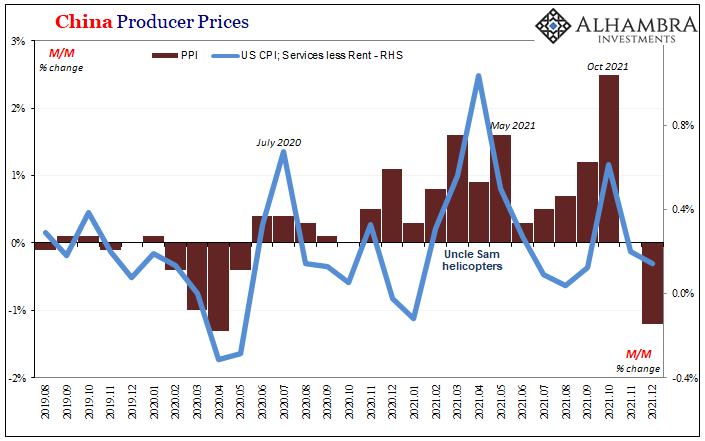

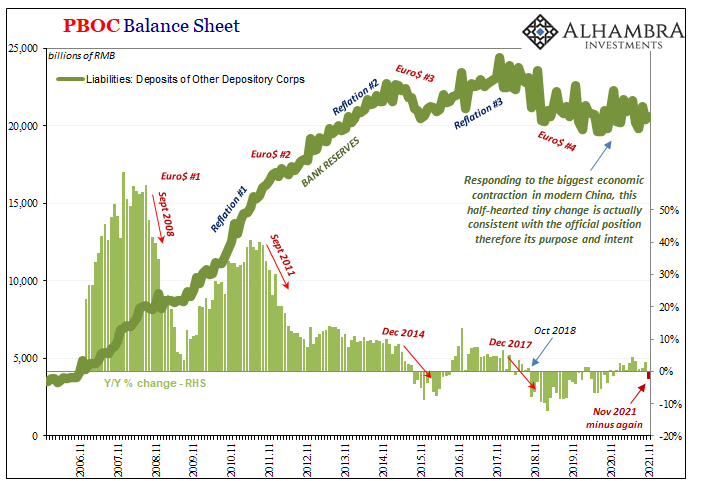

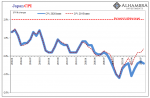

| Like other producer prices from around the world, China’s had surged but only up to October – yes, there’s that month again. And while factory gate prices held up in November, neither would in December.

Though the year-over-year rates remain unusually high, they’ve dropped considerably from their top in a very short time; which, as you can see above, typically has meant a “cycle” peak. Not only that, if you compare China’s producer prices to the US services (less rent) CPI, what emerges is a common outline; all three camel humps. |

|

| Like US services, Chinese producer and factory prices came down dramatically first in November and then even more during December; here the third hump was higher in China but equally skinny. The outlier is US goods.

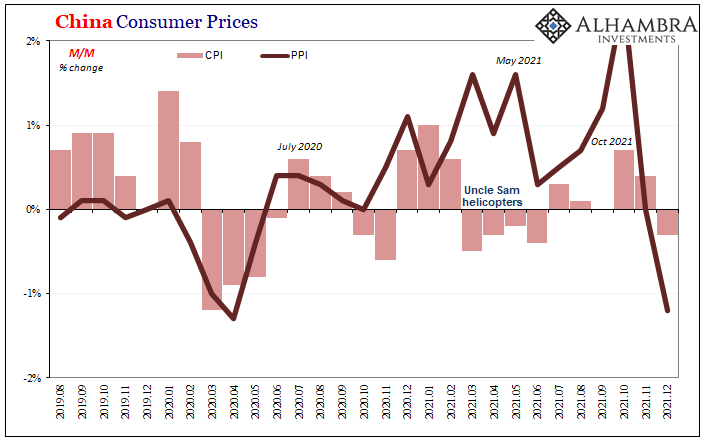

Moving over to China’s consumer prices, what’s missing – or mistimed – is that second hump which otherwise had matched up nicely with US Helicopter #2 in other subsets. In China, there was no impact from it because, why would there be? Since it did have at least a solid correlation with China’s producer prices, we’re really beginning to zero in on what this likely means insofar as “transitory” might be concerned. |

|

| In other words, the earlier frenzy of American consumer buying unleashed by Helicopter #2 had pushed up producer prices globally to go along with consumer prices domestically, goods as well as services, but those effects really do seem to be waning the further away you go in time, in geography, and travel beyond US consumer goods prices.

Waning but not yet extinguished: there was a temporary restart around October perhaps related to the pre-Christmas rush for goods, the panic over better-order-early-or-Christmas-is-canceled when spooked shoppers further confounded the still-tangle of supply issues. After that early holiday spending, however, prices around the world apart from US goods have decelerated and in China they’ve outright declined. |

|

| As I began, if your view of “inflation” is only US goods focused exclusively on the multi-decade high seven, Taper Rejection’s growing Conundrum No5 just might seem irrational. Looking beyond US goods to the entire vast majority of what’s left of global “inflation”, believing specifically US goods prices are representative of inflation or even “inflation”, that is what’s irrational. |

There’s quite a lot of disinflation indicated in these other parts already, with November and then December quieting way down across a the global economy.

Furthermore, this downshift predates omicron by at least a month. In fact, remember how yield curves had shifted to even flatter during October almost certainly anticipating these global outcomes – prices along with what they might signal for economic activity.

Transitory isn’t just some buzzword Jay Powell will maybe soon regret abandoning, it is becoming more and more evident in the data even if that data doesn’t yet include prices for US goods. It’s already in services, however, and then corroborated by quite a lot more evidence globally.

And since there was never any indication of money for it to have been inflation, how else could it really have turned out? Uncle Sam tried his best, but atop the monetary throne still sits the eurodollar.

Tags: Bonds,China,Consumer Prices,Core CPI,CPI,currencies,Deflation,disinflation,economy,Featured,Federal Reserve/Monetary Policy,inflation,Markets,newsletter,PPI,producer prices