(Combining the weekend macro commentary and price action review in one note. Check out the July monthly.) Three economic reports highlight the week ahead: Japan's labor cash earnings at the start of the week and the US employment report and China's CPI at the end of the week. In addition, the Reserve Bank of Australia meets early on July 5. The Bank of Japan's insistence that inflation, which is running slightly above target is not sustainable is that it is a...

Read More »Equities Jump, Dollar Slips, and European Yields Drop

Overview: Stocks are rallying. Nearly all the large bourses in the Asia Pacific region rose with China being the noted exception. In Europe, the Stoxx 600 is up over 1% to post gains for the third consecutive session, the longest advance this month. US futures are up around 2% as they return from yesterday’s holiday. While the US 10-year yield has edged up 3.26%, European yields are mostly softer, with the peripheral premiums falling more than core rates. The US...

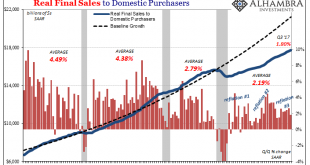

Read More »Neither Confusing Nor Surprising: Q1’s Worst Productivity Ever, April Decline In Employed

Maybe last Friday’s pretty awful payroll report shouldn’t have been surprising; though, to be fair, just calling it awful will be surprising to most people. Confusion surrounds the figures for good reason, though there truly is no reason for the misunderstanding itself. Apart from Economists and “central bankers” who’d rather everyone look elsewhere for the real problem. The Establishment Survey was right in the (statistical) zone, so for most of the public the...

Read More »Less Retail Jobs, More Amazon Robots: Get Used To It

When it comes to job creation in the United States, President Trump will be displeased to hear the latest findings from Quartz: 170,000 fewer retail jobs in 2017 – and 75,000 more Amazon robots. In November, we explained that while everyone likes to point the finger at Amazon, America’s retail apocalypse can’t be tied to just one catalyst (see: A Look At America’s Retail Apocalypse In Charts), however, fierce...

Read More »Aligning Politics To economics

There is no argument that the New Deal of the 1930’s completely changed the political situation in America, including the fundamental relationship of the government to its people. The way it came about was entirely familiar, a sense from among a large (enough) portion of the general population that the paradigm of the time no longer worked. It was only for whichever political party that spoke honestly to that...

Read More »When Health Insurance Works: A Look Inside Switzerland’s Healthcare System

[Part of a series on the Swiss economy and society.] The enigmatic independence of Switzerland is perhaps best demonstrated in the fact that its healthcare system manages to satisfy both free marketers and the statist-socialists in the country. It is a giant social safety net woven by individual responsibility and self-made wealth. Health insurance is almost entirely consumer-based, though there are strict cantonal...

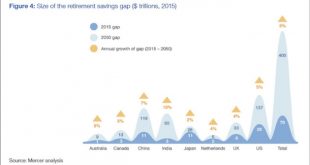

Read More »“This Is A Crisis Greater Than Any Government Can Handle”: The $400 Trillion Global Retirement Gap

Today we’ll continue to size up the bull market in governmental promises. As we do so, keep an old trader’s slogan in mind: “That which cannot go on forever, won’t.” Or we could say it differently: An unsustainable trend must eventually stop. Lately I have focused on the trend in US public pension funds, many of which are woefully underfunded and will never be able to pay workers the promised benefits, at least without...

Read More »Key Events In The Coming Week: All Eyes On Fed Balance Sheet Announcement

This week attention will fall on US FOMC rate decision, BoJ policy rate announcement, German and NZ elections. Economic data releases include PMI in the Euro area, retail sales in the UK and existing home sales in US. In Emerging Markets, there are monetary policy meetings in South Africa, Indonesia, Hungary, Taiwan and Philippines. BofA highlights the week's key global events: Central bank meetings: US FOMC and BoJ The Fed will make policy announcement on Wednesday. Balance sheet...

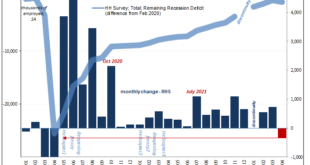

Read More »2017 Is Two-Thirds Done And Still No Payroll Pickup

The payroll report for August 2017 thoroughly disappointed. The monthly change for the headline Establishment Survey was just +156k. The BLS also revised lower the headline estimate in each of the previous two months, estimating for July a gain of only +189k. The 6-month average, which matters more given the noisiness of the statistic, is just +160k or about the same as when the Federal Reserve contemplated starting a...

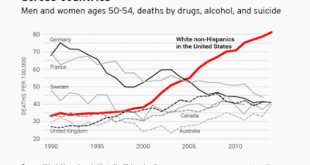

Read More »How will Yellen Address Fostering a Dynamic Global Economy?

Summary Yellen has identified two challenges regarding the US labor market, the opioid epidemic and women participation in the labor force. The topic of the Jackson Hole gathering lends itself more to a discussion of these issues than the nuances of monetary policy. Dynamic world growth needs a dynamic US economy, and that requires more serious thinking about these socio-economic and political issues. The topic at...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org