Overview: We came into this week expecting the dollar to rise on the back of a recovery in rates. The two-year note has risen from 4.40% after the jobs report to 4.60%. The dollar's rise has been less impressive. The Dollar Index had begun with week with a six-day fall in tow. Today is it is rising for the third session. However, the gains have been a modest 0.80% off the pre-weekend lows. The dollar broadly is consolidating in narrow ranges thus far today in quiet...

Read More »China’s CSI 300 Rises for Seventh Consecutive Session and Offshore Yuan Strengthens for the Sixth Session

Overview: The dollar is trading quietly after being sold yesterday. It is still soft against the dollar bloc and the Swiss franc but is firmer against the other G10 currencies. Narrow ranges have dominated. Emerging market currencies are mixed, with central European currencies and the Taiwan dollar trading softer. The offshore Chinese yuan is firmer for the sixth consecutive session. The highlights of today's North American session features minutes from last month's...

Read More »Dollar Jumps, while Surge in Covid Cases Raise Questions about China’s Pivot

Overview: Surging Covid cases in China and Hong Kong are undermining hopes of a Covid-pivot and the US dollar is broadly higher. Equities are under pressure to start the week. Most of the large bourses in the Asia Pacific but Japan, fell earlier today. Europe’s Stoxx 600 is paring last week’s minor gain, which was the fifth consecutive weekly rise. US stock futures are lower, while the 10-year US Treasury yield is flat near 3.83%. European yields are mostly around...

Read More »May Payrolls (and more) Confirm Slowdown (and more)

May 2022’s payroll estimates weren’t quite the level of downshift President Phillips had warned about, though that’s increasingly likely just a matter of time. In fact, despite the headline Establishment Survey monthly change being slightly better than expected, it and even more so the other employment data all still show an unmistakable slowdown in the labor market. What’s left open for argument and concern is now a matter of how much of a downside there might end...

Read More »Neither Confusing Nor Surprising: Q1’s Worst Productivity Ever, April Decline In Employed

Maybe last Friday’s pretty awful payroll report shouldn’t have been surprising; though, to be fair, just calling it awful will be surprising to most people. Confusion surrounds the figures for good reason, though there truly is no reason for the misunderstanding itself. Apart from Economists and “central bankers” who’d rather everyone look elsewhere for the real problem. The Establishment Survey was right in the (statistical) zone, so for most of the public the...

Read More »For The Fed, None Of These Details Will Matter

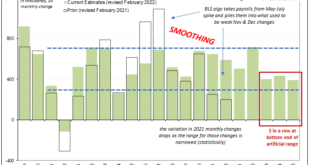

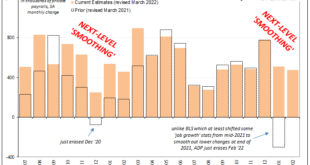

Most people have the impression that these various payroll and employment reports just go into the raw data and count up the number of payrolls and how many Americans are employed. Perhaps the BLS taps the IRS database as fellow feds, or ADP as a private company in the same data business of employment just tallies how many payrolls it processes as the largest provider of back-office labor services. That’s just not how it works, though. In fact, sampling and...

Read More »As The Fed Tapers: What If More Rapid (published) Wage Increases Are Actually Evidence of *Deflationary* Conditions?

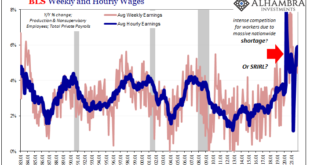

Since the Federal Reserve is not in the money business, their recent hawkish shift toward an increasingly anti-inflationary stance is a twisted and convoluted case of subjective interpretation. Inflation is money and if the Fed was a central bank the issue of consumer prices wouldn’t necessarily be simple, it would, however, be much simpler: is there or isn’t there too much money flowing through the economy. News to the vast majority of the public, no one at any...

Read More »Very Rough Shape, And That’s With The Payroll Data We Have Now

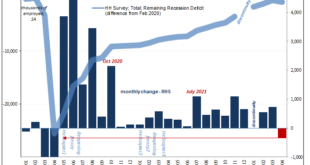

The Bureau of Labor Statistics (BLS) has begun the process of updating its annual benchmarks. Actually, the process began last year and what’s happening now is that the government is releasing its findings to the public. Up first is the Household Survey, the less-watched, more volatile measure which comes at employment from the other direction. As the name implies, the BLS asks households who in them is working whereas the more closely scrutinized Establishment...

Read More »Disposable (Employment) Figures

If last month’s payroll report was declared to be strong at +128k, then what would that make this month’s +266k? Epic? Heroic? The superlatives are flying around today, as you should expect. This Payroll Friday actually fits the times. It wasn’t great, they never really are nowadays (when you adjust for population and participation), but it was a good one nonetheless. November 2019, according to the BLS, was the first month since January to register better than...

Read More »Japan: Fall Like Germany, Or Give Hope To The Rest of the World?

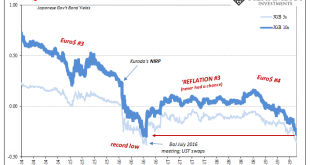

After trading overnight in Asia, Japan’s government bond market is within a hair’s breadth of setting new record lows. The 10-year JGB is within a basis point and a fraction of one while the 5-year JGB has only 2 bps to reach. It otherwise seems at odds with the mainstream narrative at least where Japan’s economy is concerned. Japan JGB, Jan 2014 - Jul 2019 - Click to enlarge Record lows in Germany, those seem to make sense. By every account, the German...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org