Overview: The dollar is soaring today, and the euro is trading at new 22-year lows having traded below .03. Even a 50 bp hike by the Reserve Bank of Australia has failed to prevent a sharp drop in the Australian dollar. The session seemed to have begun off well enough. Japan, South Korean, Taiwan, Australian, and Indian shares advanced in the Asia Pacific region. Europe’s Stoxx 600 began off firmly, but quickly unwound yesterday’s 0.55% gain. US futures are 0.6-0.8% lower. The US 10-year yield is firm near 2.90%, while European benchmark yields are 2-7 bp lower, with the peripheral premiums edging higher. The Scandis and euro are off 1.25%-1.50%. The yen is the best performer, off around 0.1% against the greenback, followed by the Swiss franc’s 0.45% decline.

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, China, Currency Movement, Featured, Japan, newsletter, Norway, PMI, RBA, Russia, tariffs, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

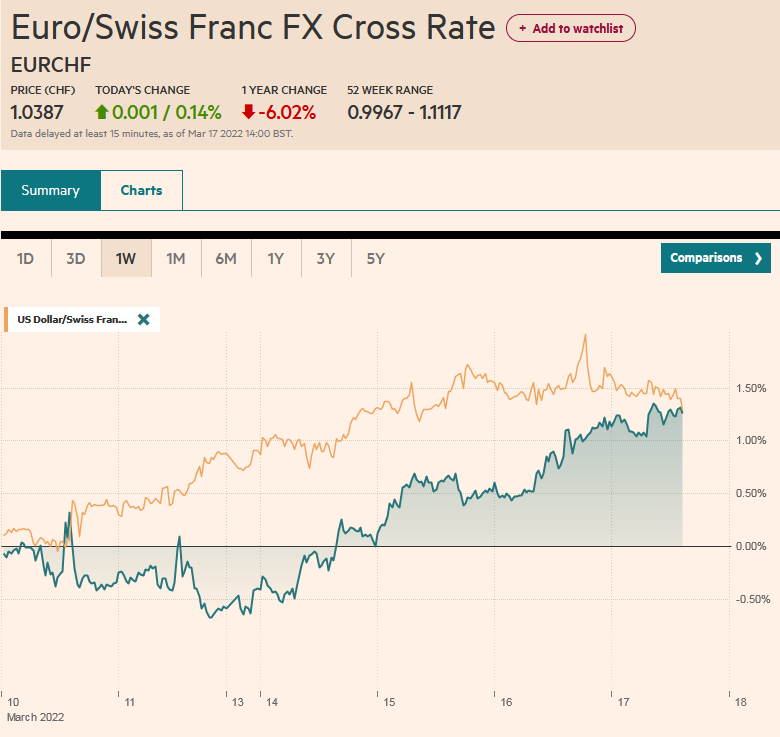

Overview: The dollar is soaring today, and the euro is trading at new 22-year lows having traded below $1.03. Even a 50 bp hike by the Reserve Bank of Australia has failed to prevent a sharp drop in the Australian dollar. The session seemed to have begun off well enough. Japan, South Korean, Taiwan, Australian, and Indian shares advanced in the Asia Pacific region. Europe’s Stoxx 600 began off firmly, but quickly unwound yesterday’s 0.55% gain. US futures are 0.6-0.8% lower. The US 10-year yield is firm near 2.90%, while European benchmark yields are 2-7 bp lower, with the peripheral premiums edging higher. The Scandis and euro are off 1.25%-1.50%. The yen is the best performer, off around 0.1% against the greenback, followed by the Swiss franc’s 0.45% decline. Emerging market currencies are under pressure, with central Europe hit the hardest. The JP Morgan Emerging Market Currency Index is off about 1.5%, which, if sustained, would be the largest drop since early March. Gold is soft but holding above $1800. August WTI is little changed around $108. US natgas has edged higher after falling almost 8% last week. Europe’s natgas is moving in the opposite direction. It is rising for the seventh consecutive session. Iron ore snapped a four-day spill to gain 2.8%, while September copper is off 2.65% after falling 3.75% last week, its fourth consecutive weekly drop.

Asia Pacific

The Reserve Bank of Australia delivered its second consecutive 50 bp rate hike. The cash target rate now stands at 1.35% and additional hikes are expected. The next RBA meeting is August 2, and the market has 39 bp of tightening discounted. The futures market sees a quarter-point hike as a done deal and has a little more than a 50% chance of a half point hike instead. The market has the year-end rate at a little more than 3.10%. It had peaked near 3.95% in mid-June.

Last week, we learned that China's "official" composite PMI surged to 54.1 in June from 48.4 in May and 42.7 in April. The Caixin composite PMI reported earlier today rose to 55.2 from 42.2 after bottoming in April at a lowly 37.2. However, in recent days the virus has begun infecting a different part of China. Now it is in the Yangtze Delta. Two counties in the eastern province of Anhni were in lockdown last week. Various supply chains run through this area, and there is a concentration of solar panels, medicines, and semiconductor chip production. Separately, the Shimao Group failed to make good on a $1 bln obligation maturing Sunday. The fallout seemed limited, and the CSI 300 rose on Monday, more than recouping the pre-weekend loss.

Japan's June services and composite PMI were revised a little lower, but still showing the recovery is intact. Separately, labor earnings improved though were still disappointing. The services PMI was revised to 54.0 from 54.2 after 52.6 in May. The composite rose to 53.0, not 53.2, after 52.3 in May. This is the highest since last November. The Bank of Japan argues that inflation pressures are unsustainable if wages stay subdued. Labor cash earnings by 1.0% in the year through May. Economists had projected a 1.5% gain (median, Bloomberg survey) and the April series was revised to 1.3% from 1.7%. It is the second slowdown after peaking at 2.0% in March. When adjusted for inflation, real cash earnings fell 1.8% year-over-year (-1.7% in April), to match the biggest decline since July 2020.

The dollar reached a three-day high near JPY136.35 with the help of an initial jump in the US 10-year yield, which reached almost 2.98%, a nearly 10 bp increase. However, as yields came off the dollar fell briefly below JPY135.60 in early European activity. The intraday momentum indicators are stretched and the some backing and filling looks likely. That said a close below JPY135.40 could weaken the technical tone. The Australian dollar initially rallied and took out yesterday's high (~$0.6890) before reversing lower. It was sold through yesterday's low (~$0.6795). A close below there would constitute a bearish outside down day. The two-year low was set before the weekend near $0.6765. Note that $0.6760 is the 50% retracement of the rally from the March 2020 low (~$0.5510). The next retracement (61.8%) is found around $0.6465. The greenback did trade on both sides of yesterday's range against the Chinese yuan and is trading above yesterday's high (~CNY6.7020). Still, the range is narrow, and the broad consolidation continues. The reference rate for the dollar was set at CNY6.6986, a bit higher than expected (~CNY6.6967, median Bloomberg survey).

Europe

Helped by somewhat better than expected peripheral reports, the eurozone June service and composite PMI were revised slightly higher from the flash readings. This simply pared the sharp decline. The services PMI was revised to 53.0 from 52.8. It was 56.1 in May. The composite PMI stands at 52.0, up from 51.9, but still down from 54.8 in May. It is at its lowest level since February last year. The German figures were unchanged from the flash reading while the French estimates were revised lower. The slowdown was evident in Italy and Spain just not as much as economists projected. The takeaway is that the regional economy slowed sharply last month. Separately, France's May industrial output figures were flat, while manufacturing rose by 0.8%, beating the median forecast of a 0.3% rise. It offered little consolation.

The UK final June services and composite PMI were revised higher. The services PMI stands at 54.3 rather than 53.4 of the flash and May readings. The composite PMI rose to 53.7 from 53.1 flash and May reading. Separately, and disappointingly, UK June auto registrations (proxy for sales) fell 24.3% year-over-year, to the lowest in 30 years. The Bank of England meets on August 4 and the market continues to favor a 50 bp hike.

Russia unsurprisingly is using the leverage it has in the non-shooting war with NATO. It has dramatically reduced its gas shipments to Europe. A fire knocked out a facility in Texas that accounts for a sixth of US natural gas exports and 10% of Europe's LNG imports. Norway, the second largest provider of LNG to Europe, is becoming the source of a third shock. Managers of three fields went on strike today and managers from another three will join them tomorrow. Estimates suggest more than an eighth of Norway's gas exports could be at risk. The Dutch natgas benchmark rose 13.5% last week and rose another 11.5% yesterday. It has risen an additional 5.2% today. It has more than doubled in the past month and is at its highest since March 8.

The euro buckled under strong selling pressure and briefly traded below $1.03 after testing the $1.0450 level in late Asia Pacific turnover, where an option for around 765 mln euros expires today. The euro found a bid, but the technical damage was done. The $1.0320-$1.0340 area now offers the nearby resistance. Note that the lower Bollinger Band (two standard deviations below the 20-day moving average) is found by $1.0330. Sterling has fared a bit better, and it remains above last week's low (~$1.1975). Last month's low was closer to $1.1935. The intraday momentum indicators are stretched, and consolidation is likely in North America.

America

The US reports May factor orders and revised durable goods orders. Given the broader economic context, the data is unlikely to move markets. The Atlanta's Fed's GDPNow tracker at -2.1% and the jobs data at the end of the week are the major talking points. No Fed officials are slated to speak today, but NY Fed's Williams will speak tomorrow ahead of the June FOMC minutes. Canada reports May building permits. They are expected to have fallen for the third consecutive month. Ahead of Friday's employment report, Canada will report May trade figures and IVEY purchasing managers index on Thursday.

The Biden administration is reportedly close to making a decision to roll back some of the tariffs that the previous administration imposed on China as part of the four-year mandatory review. Trade representative Tai seemed to be more in favor of retaining them than Treasury Secretary Yellen. There is some debate about removing the extra tariffs on some consumer products like clothing, school supplies, and grant more waivers. The impact on measured CPI is likely to be minimal and there is no guarantee that the lower tariffs will be passed on to the consumer.

News that an Indian cement maker bought coal from Russia for Chinese yuan will get the chins wagging about the demise of the US dollar. According to reports the transaction was for CNY127.6 mln (~$25.8 mln) for 157 tons of coal. Some reports suggest that there will likely be a few other companies that make similar arrangements. The average daily turnover in the foreign exchange market is more than $6.5 trillion a day and the greenback are on one side of more than 85% of the trades. The Indian deal is not even a rounding error. It must be appreciated that capital flows outstrip trade flows by a huge magnitude. The turnover of the foreign exchange market is sufficient to cover annual world trade in less than a week. There are many things that can be said about an Indian company buying Russian coal for renminbi but eclipsing of the dollar is not one of them. The fact that neither the rouble nor the rupee was used also says something. There was an attempt earlier this year to restart a Cold War rupee payment mechanism, but it apparently went nowhere. Separately, Bloomberg estimates that yuan-rouble volume rose to a six-month high in June of CNY321 mln or $48 mln. Chinese figures put China-Russia bilateral trade at almost $66 bln. The vast majority of China and Russia's trade is not conducted in yuan, or apparently in roubles.

After falling to four-day lows yesterday (~CAD1.2840), it has come back bid near CAD1.2930. The pre-weekend high was near CAD1.2965. However, more formidable resistance is not seen until closer to CAD1.30. The intraday momentum indicators are stretched in European turnover. Initial support now may be seen around CAD1.29. The greenback is also bid against the Mexican peso. It is near last week's highs (~MXN20.4660). Last month's high was closer to MXN20.70, while the upper Bollinger Band is a bit lower (~MXN20.6470). The momentum indicators are stretched.

Tags: #USD,China,Currency Movement,Featured,Japan,newsletter,Norway,PMI,RBA,Russia,tariffs