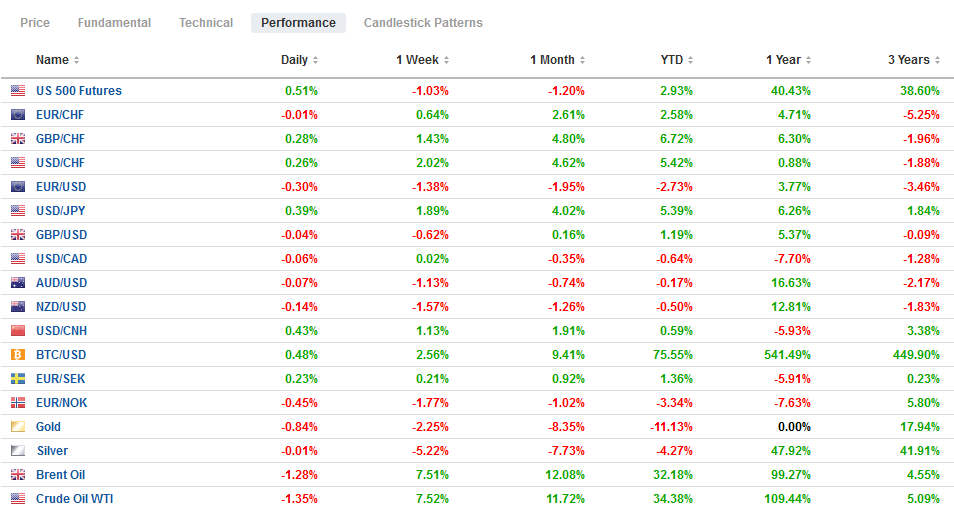

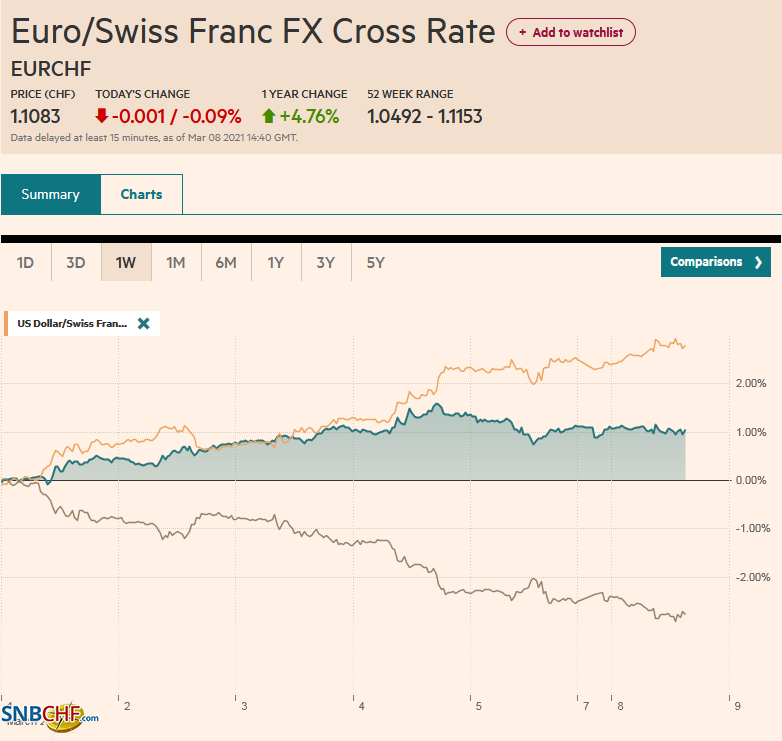

Swiss Franc The Euro has fallen by 0.09% to 1.1083 EUR/CHF and USD/CHF, March 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The attack on Saudi Arabia’s largest crude terminal reverberated through the capital markets, where sentiment was already fragile, despite the lack of disruption. Brent rose to nearly .40, and April WTI to almost extended their gains for the fourth consecutive session before being fully unwound. Most equity markets fell in the Asia Pacific region, lead by more than a 2% decline in China and nearly as much in Hong Kong. Australia and Singapore bucked the regional trend. Europe’s Dow Jones Stoxx 600 is rising for the first time in three days, led by financials and industrials.

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Australia, China, Currency Movement, Featured, newsletter, Trilateral, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.09% to 1.1083 |

EUR/CHF and USD/CHF, March 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The attack on Saudi Arabia’s largest crude terminal reverberated through the capital markets, where sentiment was already fragile, despite the lack of disruption. Brent rose to nearly $71.40, and April WTI to almost $68 extended their gains for the fourth consecutive session before being fully unwound. Most equity markets fell in the Asia Pacific region, lead by more than a 2% decline in China and nearly as much in Hong Kong. Australia and Singapore bucked the regional trend. Europe’s Dow Jones Stoxx 600 is rising for the first time in three days, led by financials and industrials. Utilities and consumer staples are drags. US futures are 0.7%-1.6% lower. The US 10-year yield is knocking on 1.60%, while core European yields are slightly firmer. Peripheral yields are a little softer. The market anticipates that ECB data will show stepped-up purchases last week. The US dollar is riding higher against nearly all the world’s currencies today. Among the majors, the Antipodean and Swiss franc are off 0.5%-0.75% to lead the move, and the euro slide extended for a fourth session, during which time it has slipped more than two cents to around $1.1865. The JP Morgan Emerging Market Currency Index is also off for the fourth session and is at its lowest since before last November’s US election. Gold began the session higher and tested $1714 before being sold back toward the pre-weekend lows below $1690. |

FX Performance, March 8 |

Asia Pacific

Japan’s January current account surplus was about half of what economists had expected (JPY647 bln vs. JPY1.253 trillion). The main culprit was the swing in the balance-of-payments trade balance from a JPY695 bln surplus in December to a JPY130 bln deficit in January. Japan also reports some country-specific bond flow data with its current account figures. The notable development was that Japanese investors reduced their buying of European bonds. They bought the least amount of Gilts since at least 2005 and were net sellers of German Bunds. There was a sharp decline in the purchases of Italian and French bonds. Separately, Japanese investors bought the least Australian bonds since last February. Also, of interest, China sold about JPY808.5 bln of Japanese bonds, the most in seven years.

A year ago, China’s economy saw the worst of the economic hit from the pandemic. The year-over-year comparison is distorted by the experience. January-February 2020, China’s exports fell 17.4%. Here in 2021, they are up 60%, and imports rose by 22%. The trade surplus for the first two months of this year is a whopping $103.25 bln, and the US accounts for nearly half (~$51.3 bln). Separately, citing pests, Beijing announced a ban on imports of pineapples from Taiwan. It usually buys the bulk of Taiwan’s crop. For nearly two decades, China has been a strong buyer of Taiwan’s agriculture exports. Given Beijing’s penchant for using trade as a way to express its disapproval, the situation will be closely monitored.

The divergence of Australia’s trade policy from its foreign policy remains stark. Beijing says it has been wronged in 14 ways by Canberra, to which it can add a 15th way. Citing human rights complaints, an Australian broadcaster has suspended China Global Television Network (CGTN). On a separate front, Prime Minister Morrison appeared to be more empathic than some in the media to Italy’s (and EU’s) decision to block the export of about 250k vaccines to Australia, recognizing that the contagion is hitting Italy harder than his country. The lesson that Morrison and others will likely take away from the episode is the need to have mRNA manufacturing capacity local, which strike us as part of the broader rise of economic nationalism.

The dollar is firm against the yen but is holding a tough below the pre-weekend high near JPY108.65. It has spent hardly any time below JPY108.30. The intraday momentum indicators suggest a consolidative North American session. Last week’s price action showed rising yields trumped equity weakness as the driver of the yen. The Australian dollar is trading inside the pre-weekend range (~$0.7620-$0.7730). Here too, the intraday technical indicators suggest a sideways session is likely in North America today. The PBOC set the dollar’s reference rate at CNY6.4795. The gap between the fixing and the median forecast in Bloomberg’s survey was among the largest in recent weeks. The dollar has finally risen above the highs set in the first trading session of the year (~CNY6.5150) and made it to almost CNY6.5315 before steadying. Despite tightening financial conditions, the PBOC refrained from injecting extra liquidity into the banking system, and money market rates jumped. News that China’s official reserves slipped a bit less than expected to $3.205 trillion from $3.211 trillion was taken in stride. There is no doubt that the currency is well managed, though not through an official intervention.

Europe

The US and the EC agreed to a four-month suspension of tariffs over the Airbus-Boeing dispute. A week earlier, the US and UK struck a similar agreement. This is ultimately a positive development, and there is every reason to expect a formal resolution. Both sides have stopped the offensive behavior. However, a new front is going open shortly. A Chinese company (of which Huawei is the third-largest owner) is laying a 7500-mile underwater cable (called “Peace”) that will connect Europe and China. Huawei will also be providing transmission gear and equipment for landing stations. US companies own and operate nearly all of the intercontinental internet and telephone cables. A report estimated that Peace in one second could send the data to stream 90k hours of Netflix. The Nord Stream 2 pipeline brings Russian gas to Germany, bypassing Ukraine. The Chinese cable that first goes overland to Pakistan will terminate in France.

Ahead of the aggregate eurozone’s January industrial production report later this week, German and Spanish national figures were released today. Bloomberg’s survey found a median forecast for a 0.4% decline in Germany, and instead, industrial output tumbled by 2.5%. The sting was only partly offset by the strong upward revision in the December series to show a 1.9% gain instead of the initial flat report. Spain missed as well, and the December series was revised lower. Industrial production fell 0.7% in January, while Bloomberg’s median was for a 0.5% decline. The December gain of 1.1% was revised to 0.8%.

The euro peaked in the middle of last week, a little above $1.2110. It reached $1.1865 today. The 200-day moving average is around $1.1825, while the $1.1890 area marked the (61.8%) retracement of the euro post-US election/vaccine rally. The immediate selling pressure appears to have been satiated in the Europe morning, but it may take a move above $1.1900-$1.1915 to stabilize the technical tone. Sterling has held in better and remains above the pre-weekend low (~$1.3780). While the re-opening of English schools is hopeful, sterling needs to move above $1.39 to boost confidence.

America

News that the private sector jobs surged by 465k last month is welcome, but it is not a game-changer. Fed officials are in the quiet period ahead of next week’s FOMC meeting, preventing confirmation. Given Fed Chairman Powell’s comments last week, and to be fair, there does not seem to be a dissenting camp at the moment, it seems quite clear that it will take more than one month’s report to change the central view. The idea of a possible “Operation Twist” is coming from pundits, not Fed officials.

Despite buying $80 bln of Treasuries a month, Fed officials still think that yields contain information. It is saying that investors are preparing for a strong recovery from the pandemic. The US Treasury is selling $120 bln of coupons this week, and the corporate issuance calendar is busy too. The exemption of Treasuries and excess reserves (which are created by the Fed when buys Treasuries and Agency MBS) that expires at the end of the month is a potential disrupter. The uncertainty alone is not helpful, but the failure to extend could lead to a jump in rates.

The North American economic diary is light to start the week. The final reading US wholesale trade and inventories are not the stuff that moves the market. Nevertheless, the rise in inventories does underscore another source of economic strength. Inventories had been run down, and replenishing them contributes to GDP. The highlight of the week is the February CPI on Wednesday. Higher food and energy prices will likely lift the headline, but the real base effect kicks in with the March reading. Canada features the central bank meeting (Wednesday) and employment data (Friday). The central bank is not expected to change policy, but its confidence in the medium-term outlook is likely stronger. Canada’s labor market is expected to recover from January 213k job losses, which was concentrated in part-time positions (full-time employment rose by 12.6k). Mexico reports its February CPI tomorrow. The year-over-year rate is expected to tick up to 3.75% from almost 3.55%. At the end of the week, Mexico reports January industrial production. A small gain is projected.

Initial follow-through selling saw the US dollar slip briefly below CAD1.2625 in early Asia before rebounding to CAD1.2700 by early Europe. The greenback’s recovery faltered, and the intraday momentum indicators suggest a heavier tone is likely. Initial support is seen in the CAD1.2640-CAD1.2660 area. The US dollar bottomed in the first half of last week in front of MXN20.50. Ahead of the weekend, it punched above the 200-day moving average (~MXN21.1650) and has kept going today to reach almost MXN21.6360. Here too, it looks like some short-term buying climax was seen in late Asian or early European turnover. The first area of support may be near MXN21.40 and then MXN21.20.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Australia,China,Currency Movement,Featured,newsletter,Trilateral