Swiss Franc The Euro has fallen by 0.03% to 1.0959 EUR/CHF and USD/CHF, June 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The dollar is finishing the quarter on firm footing, gaining against most of the major currencies today. The euro is straddling the .1900 area, having begun the month above .22. Sterling has tested the .38 area. It had traded at a three-year high near .4250 at the start of the month. Similarly, the US dollar set a seven-year high near CAD1.20 on June 1 and is now trying to get a foothold above CAD1.24. Emerging market currencies are mixed today, but the JP Morgan Emerging Market Currency Index is off for the fourth session and is poised to finish the month lower for the

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Australia, Canada, COVID, Currency Movement, EUR/CHF, Featured, inflation, Japan, newsletter, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

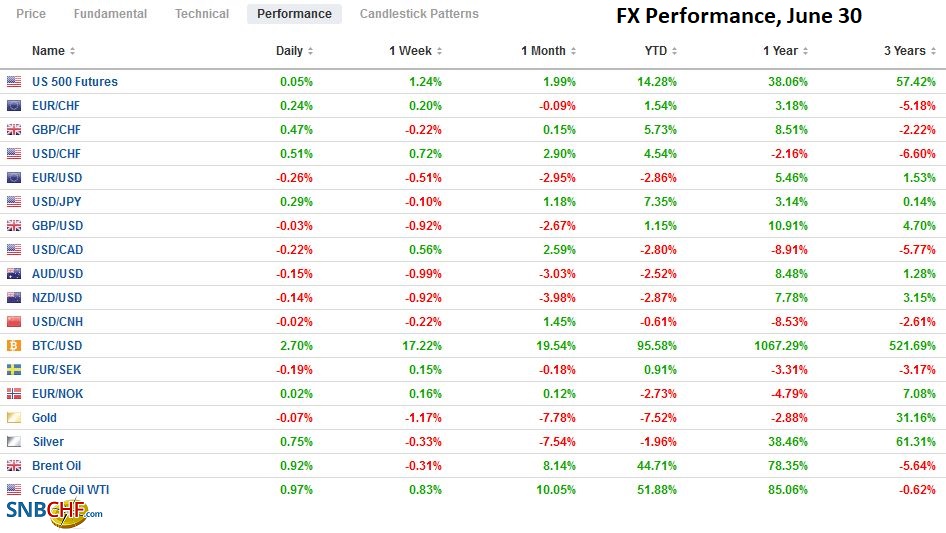

Swiss FrancThe Euro has fallen by 0.03% to 1.0959 |

EUR/CHF and USD/CHF, June 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The dollar is finishing the quarter on firm footing, gaining against most of the major currencies today. The euro is straddling the $1.1900 area, having begun the month above $1.22. Sterling has tested the $1.38 area. It had traded at a three-year high near $1.4250 at the start of the month. Similarly, the US dollar set a seven-year high near CAD1.20 on June 1 and is now trying to get a foothold above CAD1.24. Emerging market currencies are mixed today, but the JP Morgan Emerging Market Currency Index is off for the fourth session and is poised to finish the month lower for the first time since March. The US 10-year yield is soft, near 1.45%, off about 14 bp this month. European yields are around two basis points lower today and mostly down less than Treasury yields this month. After another record close for the S&P 500, most markets in the Asia Pacific advanced, but Japan and Hong Kong. On the month, the MSCI Asia Pacific Index is nearly flat. Europe’s Dow Jones Stoxx 600 is trading with a heavier bias but is still likely to finish its fifth consecutive month with gains. US futures indices are a little lower. Coming into today, the S&P 500 is up around 2% this month, and the NASDAQ is up about 5.7%. Gold is holding above yesterday’s $1750 low, but it continues to struggle to sustain upticks. It is off almost 8% in June after beginning the month above $1900. WTI set a 3-year high on Monday slightly below $74.50 and has been consolidating over the past couple of sessions. It is little changed, around $73. API estimated that the US drew down its oil stocks by another 8 mln barrels. The CRB Index is up 2.7% this month and is at six-year highs. |

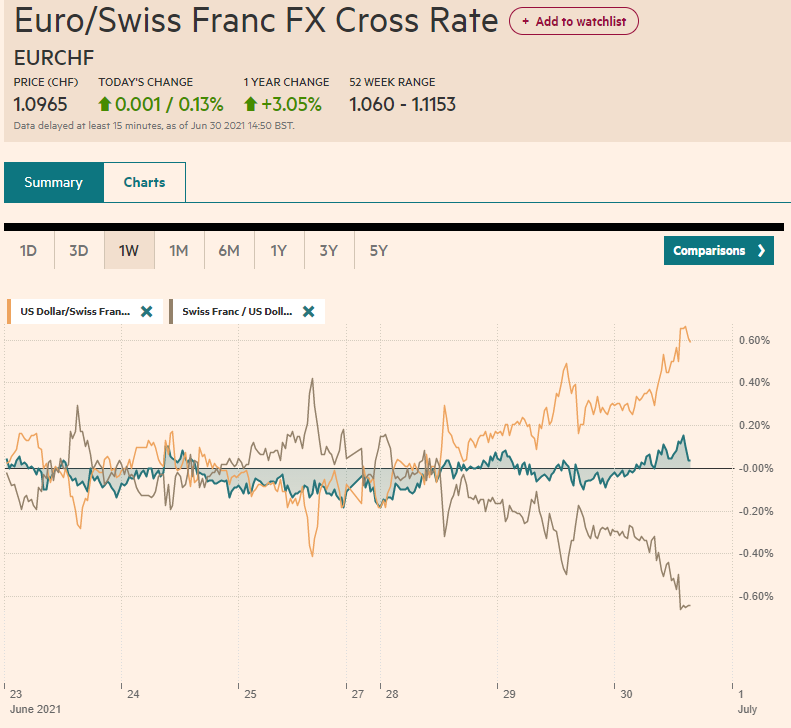

FX Performance, June 30 |

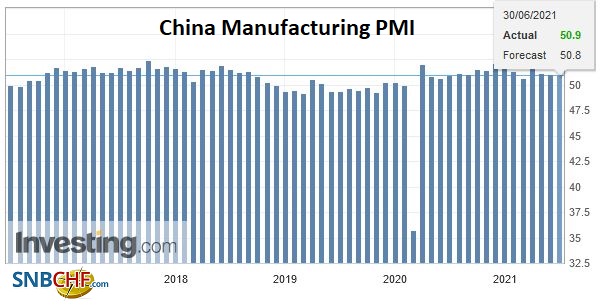

ChinaChina’s June PMI warns that the world’s second-largest economy has lost some momentum but continues to expand. The manufacturing PMI dipped to 50.9 from 51.0. |

China Manufacturing PMI, June 2021(see more posts on China Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

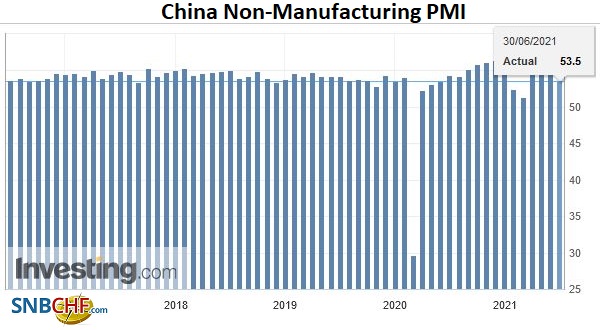

| The non-manufacturing PMI performed worse, falling to 53.5 from 55.2. This pushed the composite to 52.9 from 54.2. The composite finished last year at 55.1 and was at 55.3 at the end of Q1 21.

The social restrictions and weak domestic demand offset foreign demand and hit industrial production last month hard. The median forecast in Bloomberg’s survey called for a 2.1% decline. Instead, industrial output collapsed by almost 6% in the month. Separately, Japan reported that housing starts also slowed in May. While there is a strong sense of optimism that conditions will improve, and this should be reflected in tomorrow’s Tankan survey, covid cases in Tokyo are rising, and there is concern about a so-called fifth wave. |

China Non-Manufacturing PMI, June 2021(see more posts on China Non-Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

Asia Pacific

Australia shares a similar story. The lockdown extended to Alice Springs. Now nearly 80% of the population is in areas under lockdowns, the most since the pandemic began. With the new Delta mutation, household transmission is near 100% compared with around 25% previously. Reports suggest that a little less than 5% of the adult population is fully vaccinated. A little less than a third have had one shot. It is at the bottom of the OECD tables. Due to the vaccine availability, a mass inoculation may effort may not take place until next year.

The dollar set the high for the year on June 24 near slightly above JPY111.10. It could not sustain the move above JPY111 that day and has fallen since. Today is the fifth consecutive session that the greenback is under pressure. There are a couple of chunky options that expire today. There is one for $1.9 bln at JPY110.50 (today’s low so far is just above JPY110.40) and another at JPY110.20 for $1.1 bln. Still, the month-end is thus far quiet, with the dollar in less than a 20-tick range.

The Australian dollar continues to trade heavily and has slipped through the $0.7500 level that held yesterday. It looks poised to test the year’s low set on June 21 near $0.7475. A convincing break could spur a move to $0.7400. The extensive lockdown appears to be impacting expectations for next week’s central bank meeting.

The Chinese yuan edged higher against the dollar today after slipping the past two sessions. Still, narrow ranges are prevailing, which appears to be acceptable to officials. The PBOC set the dollar’s reference rate at CNY6.4601, tight to market expectations for CNY6.4599, according to the Bloomberg survey.

Europe

The eurozone’s preliminary June CPI was in line with expectations. The year-over-year rate slipped to 1.9% from 2.0%. The core rate also ticked down to 0.9% from 1.0%. Nevertheless, this most likely does not represent a peak in price pressures. The base effect alone over the next two months warns of a spike higher. In July and August last year, eurozone consumer prices fell by 0.4% each month and only rose by 0.1% in September. The eurozone headline CPI may be closed to 2.8%-3.0% at the end of Q3. Of note, French consumer prices edged higher in June to 1.9% from 1.8%. It also reported a much stronger jump than expected in May consumer spending. The 10.4% rise offset the 8.7% decline in April and beat expectations for a 7.5% increase. The report gives a hint of the pent-up consumer demand as restrictions ease.

The UK took a last look at Q1 GDP and shaved it to show a 1.6% contraction instead of 1.5%. Consumption and government spending were revised lower. Net exports, the current account deficit, and business investment were not as bad as initially estimated. The economy is expanding in Q2, but there are two challenges going forward. First, the Delta mutation is adversely impacting the UK, and the broad re-opening has been delayed until at least the middle of next month. Second, the furlough program that subsidizes wages starts to taper tomorrow.

The euro is holding slightly above yesterday’s low (a little below $1.1880). A two-month low was recorded in the sessions that followed the hawkish outcome of the FOMC meeting near $1.1850. The quarter-end is quiet, and the euro has been confined to less than a quarter of a cent within yesterday’s range. There is an option for almost 310 mln euros at $1.1900 that expires today that could come back into play in the North American session. Initial resistance is seen near $1.1910.

Sterling is holding support around $1.3800, but the upticks have not been impressive. Today, it has held mostly below $1.3860. Yesterday, it held $1.3885. It needs to resurface above $1.3900 to take the pressure off.

United StatesThe focus in the US is turning to the labor market. Today, ADP’s estimate for the private sector will be released. It is expected to report that jobs rose by 600k after 978k in May. Tomorrow is the weekly jobless claims, where the four-week moving average through June 19 rose for the first time since April. The monthly jobs report is due Friday, and economists’ forecasts are still gravitating around 700k. If so, it would be the largest increase since March (785k), which itself was the highest since last August. May pending homes sales are also on tap for today. They are expected to have fallen by 1% and have only risen this year in March. Separately, with the Fed’s reverse repo paying more than a six-month T-bill, funds have poured in and yesterday set a new record of $841 bln. A month ago, talk of a trillion dollars seemed to be exaggerated but now seems less so. |

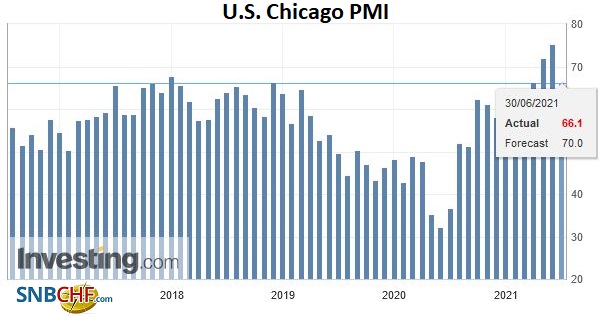

U.S. Chicago PMI, June 2021(see more posts on U.S. Chicago PMI, ) Source: Investing.com - Click to enlarge |

Canada reports April GDP figures. We thought they were too historical to matter, but more observers are citing it as a factor behind the Canadian dollar’s heavy tone. The median forecast calls for a 0.8% contraction after a 1.1% gain in March. It would be the first monthly contraction since last April. The Canadian economy expanded at a 5.6% annualized clip in Q1. Despite today’s likely contraction, it is expected to grow by 2% this quarter before accelerating in Q3 (median Bloomberg forecast is for 9.1% annualized growth).

The US dollar has pushed above the previous session’s high against the Canadian dollar each session this week. Yesterday, it rose above CAD1.24 for the first time in a week, and today has seen almost CAD1.2425. In the days that followed the FOMC meeting, the greenback reached almost CAD1.2490. Initial support is now seen near CAD1.2380. The three drivers that often seem to drive the exchange rate (risk-appetites, commodities/oil, and the two-year rate differentials) remain supportive for the Canadian dollar, but positioning may have gotten a bit ahead of itself, and as the CAD1.20 level held, a short-US dollar squeeze materialized.

Meanwhile, the greenback continues to consolidate in a triangle or wedge pattern against the Mexican peso since Banxico unexpectedly lifted rates last week. The dollar remains within the range set at the end of last week (~MXN19.7060-MXN19.9060). Although it is often seen as a continuation pattern, which would mean a downside breakout for the dollar, there does not appear to be much near-term conviction. Separately, the greenback’s downside momentum against the Brazilian real has faded. A move above BRL5.0 would boost confidence. A low is in place (set Monday near BRL4.8935).

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Australia,Canada,COVID,Currency Movement,EUR/CHF,Featured,inflation,Japan,newsletter,USD/CHF