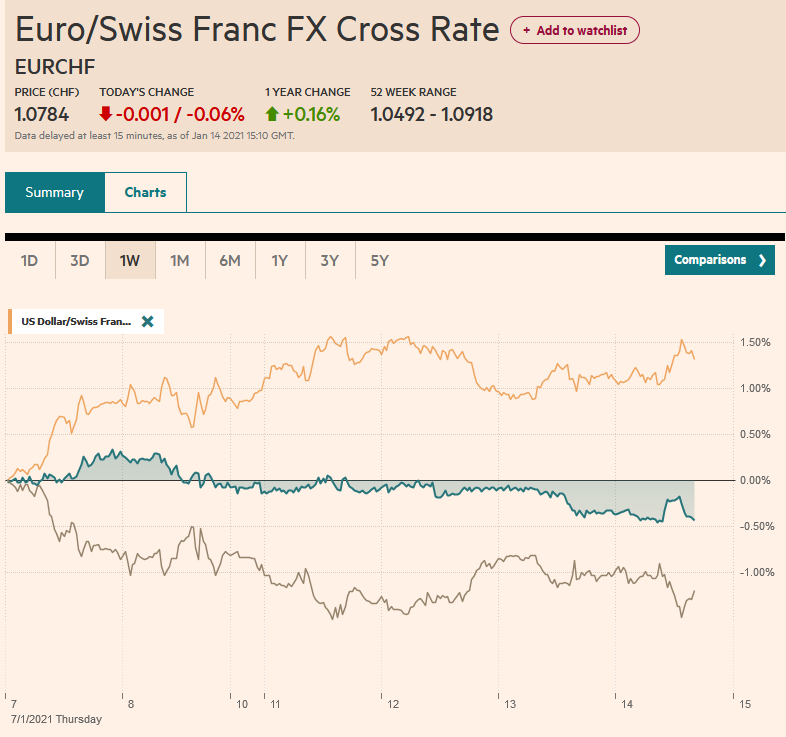

Swiss Franc The Euro has fallen by 0.06% to 1.0784 EUR/CHF and USD/CHF, January 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets are becalmed today. There does not appear to be much reaction to the news that the House of Representatives impeached President Trump an unprecedented second time with greater bipartisan support than previously (10 GOP voted with the Democratic majority). Nor has there been a significant reaction to Italy’s political turmoil, where a small but key minority party withdrew from the governing coalition. Most Asia Pacific equity markets advanced, with China and Taiwan being notable exceptions. Europe’s Dow Jones Stoxx 600 is pushing higher for the third consecutive

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, China, Currency Movement, Featured, Fiscal, Italy, Japan, newsletter, trade, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.06% to 1.0784 |

EUR/CHF and USD/CHF, January 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The capital markets are becalmed today. There does not appear to be much reaction to the news that the House of Representatives impeached President Trump an unprecedented second time with greater bipartisan support than previously (10 GOP voted with the Democratic majority). Nor has there been a significant reaction to Italy’s political turmoil, where a small but key minority party withdrew from the governing coalition. Most Asia Pacific equity markets advanced, with China and Taiwan being notable exceptions. Europe’s Dow Jones Stoxx 600 is pushing higher for the third consecutive session. US shares are also firmer. The US benchmark yield is holding around 1.10% after strong receptions to the 10- and 30-year bonds auctions this week. Core European bond yields are mostly a little lower, while the yields in the periphery are edging up. Italian bonds have weakened as the European session progressed and after bringing new long-term bonds to market today. The dollar appears to be going nowhere quickly. The Swedish krona and dollar-bloc currencies are up around 0.25%-0.50%, but the euro, yen, sterling, and Swiss franc are little changed. Emerging market currencies are mostly higher, led by South Africa, Russia, and Mexico. The South Korean won and Taiwan dollar are laggards. Gold is heavy and hovering around the 200-day moving average (~$1843). After rallying to almost $54 a barrel yesterday, February WTI is consolidating. The upside momentum stalled yesterday, snapping a six-day advance. |

FX Performance, January 14 |

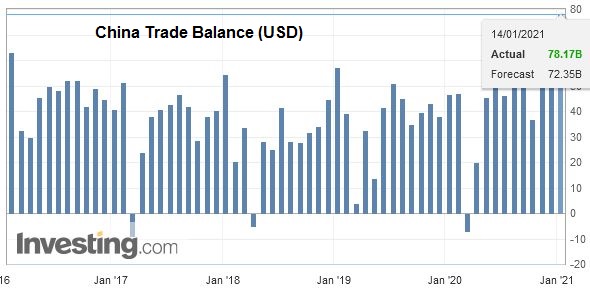

Asia PacificThe US will not block Americans from investing in China’s Alibaba, Tencent, or Baidu. However, the outgoing Trump Administration is adding several more companies to its ban. Separately, it has banned cotton products and tomatoes that come from Xinjiang on human rights grounds. The US imported about $9 bln of cotton last year and $10 mln of tomatoes. China reported another record trade surplus in December, despite a slowing in exports and an increase in imports. Exports rose 18.1% year-over-year in December after a 21.1% increase in November. Imports rose by 6.5%, which is more than expected (5.7% median forecast in the Bloomberg survey) and stronger than the 4.5% gain in November. The trade surplus widened to $78.2 bln from $75.4 bln. China’s 2020 trade surplus was nearly $630 bln after a $421 bln surplus in 2019. Of note, facemasks accounted for around 2% of China’s exports last year, and exports of medical equipment/machines rose by nearly a third. Although commodity imports, like oil, copper, iron ore, slipped in December, annual records were reached. |

China Trade Balance (USD), December 2020(see more posts on China Trade Balance, ) Source: investing.com - Click to enlarge |

Japan’s core machinery orders surprised on the upside in November, but the new extensive state of emergency amid the virus surge tempers any enthusiasm. Still, the market had expected a 6.5% drop in orders after a 17.1% surge in October. Instead, core machine orders rose by 1.5%. As a proxy, it suggests that capex may be somewhat resilient. Still, the economy looks poised to contract here in Q1, and the BOJ meets next week and may downgrade its economic assessment.

The dollar is mostly in a 20-pip range on either side of JPY104. There is an option for almost $500 mln at JPY104.25, which expires today. The week’s high was set on Monday around JPY104.40, and the week’s low was set yesterday near JPY103.50, by the 20-day moving average. The Australian dollar is firm within yesterday’s range. It made a new marginal high for the week yesterday (~$0.7780) but settled near its lows (~$0.7720). The intraday technicals favor a pullback rather than a sustained move to new highs. The dollar initially extended its recovery against the Chinese yuan, reaching about CNY6.4755 today following what appeared to be a subtle protest in the setting of the reference rate yesterday. The fixing was set today at CNY6.4746, which was still a bit stronger of a dollar than the bank models implied (CNY6.4724, according to Bloomberg). The dollar’s low yesterday was near CNY6.45 while last week’s low was closer to CNY6.43.

Europe

As threatened, Italy’s Renzi pulled his two ministers and one junior minister from the coalition government in Italy. Renzi has been complaining for a few weeks about Conte, who he had helped pluck from academic obscurity, about the handling of the pandemic and what he called a hoarding of power. Renzi wants Conte to draw on the ESM for 36 bln euros separately to support the health system. No other country has done that in part due to the likely conditionality attached. Still, the wily former prime minister has kept the door open to rejoining the government if a new pact could be agreed upon. Conte can also seek a replacement for Renzi’s small party. He needs about 25 seats in the 630-member lower chamber and as many as 18 seats in the 315-member upper chamber. If that failed, Conte might have to seek Renzi’s support to avoid an election.

Germany is the first to report 2020 GDP. It says that the economy contracted by about 5% last year. The October-December quarter will not be broken out until a report at the end of the month, but it appears that the world’s fourth-largest economy stagnated in Q4. The budget deficit was about 4.8% last year. On both scores, Germany is likely to have done considerably better than its peers in Europe. France, Italy, and the UK likely may have shrunk by 9%-10% and larger budget deficits.

The euro has recorded a low each day this week in the $1.2130-$1.2140 area. This, after peaking on January 6 near $1.2350. Nearby resistance is seen in front of $1.2180. The daily momentum indicators are still pointing lower, and the downside correction does not appear over but in need of a new catalyst. Sterling is firm, holding above $1.36 today after the attempt at the two-and-a-half-year-plus high recorded on January 4 (~$1.3705) faltered. An option for a couple hundred million pounds is struck at $1.37 is expiring today. Initial support is seen near $1.3620.

America

The interest of investors is not so much on the US impeachment proceedings. That is about domestic politics with no appreciable economic implications. The weekly jobless claims may draw a little attention. It comes after last week’s national report, and it is next week’s survey that covers the survey period of the January non-farm payrolls. Given the market’s sensitivity to inflation, one might expect attention on today’s import/export price report. But here, too, the data is unlikely to add much to investors’ information set. Imported inflation is not a problem despite the weaker dollar after the last March-April period. Excluding oil imports, prices may have risen by 0.1% in December after a flat report in November.

Separately, yesterday’s Beige Book contained few surprises, and some price pressures were reported, more for inputs but construction, building materials, steel, and shipping sectors appear to have some pricing power. Meanwhile, the Fed’s Vice Chairman Clarida gave the most specific guidance. He said that the Fed would not hike rates until inflation was above 2% for a year.

Today’s main interest is in Biden’s speech a few hours after the market closes, where the President-elect will outline his Covid relief and fiscal intentions. There are rumors that he will seek as much as $2 trillion, but this attention-grabbing number, if true, will likely include more efforts to help households and businesses as well as state and local governments through this difficult time. Perhaps the most important aspect is not the size, but Biden’s legislative strategy. Through the reconciliation process, it could be jammed through Congress with the Democratic-majority. However, this risks antagonizing the GOP, limiting what the new administration can do in the next two years. Instead, Biden could seek a compromise with the Republicans. Reports suggest there is potential to secure the support of several, maybe as many as 10 Republican Senators.

The greenback is pushing lower against the Canadian dollar for the third consecutive session. The decline snaps a four-session gain. The US dollar set a new low for the week today near CAD1.2665. Last week’s low, which was the weakest the greenback has been since April 2018, was CAD1.2630. A close above CAD1.27 may be needed to steady the technical tone. The Canadian dollar has gained about 0.4% this year, putting it in third place among the G10 currencies, behind the Norwegian krone (~1.3%) and the Australian dollar (~0.95%). The Mexican peso is firm, but the US dollar is holding above yesterday’s low (~MXN19.74). The greenback peaked Monday near MXN20.2630. Last week’s low was close to MXN19.60. The most likely scenario today may be continued broad consolidation between MXN19.75 and MXN19.90.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,China,Currency Movement,Featured,Fiscal,Italy,Japan,newsletter,Trade