Swiss Franc The Euro has risen by 0.05% to 1.0809 EUR/CHF and USD/CHF, February 3(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities have charged higher, and the greenback is mostly firmer. News that Draghi may become Italy’s next Prime Minister has boosted Italian bonds. The PBOC unexpectedly drained liquidity, and this may have deterred buying of Chinese stocks, a notable exception in the regional rally....

Read More »FX Daily, January 14: Markets are Subdued Despite Impeachment and Record Chinese Trade Surplus

Swiss Franc The Euro has fallen by 0.06% to 1.0784 EUR/CHF and USD/CHF, January 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets are becalmed today. There does not appear to be much reaction to the news that the House of Representatives impeached President Trump an unprecedented second time with greater bipartisan support than previously (10 GOP voted with the Democratic majority). Nor has...

Read More »FX Daily, October 22: Greenback Stabilizes

Swiss Franc The Euro has fallen by 0.11% to 1.0723 EUR/CHF and USD/CHF, October 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Two sets of talks have riveted attention, and both appeared to have made progress yesterday. After some words, the EC, recognizing the importance of UK sovereignty, UK Prime Minister Johnson signaled a resumption of trade talks. In the US, Pelosi and Mnuchin appear to be on the...

Read More »FX Daily, October 07: The Day After

Swiss Franc The Euro has risen by 0.18% to 1.0785 EUR/CHF and USD/CHF, October 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: President Trump’s tweet announced that negotiations with the House Democrat leadership had collapsed, and there will be no further talks until after the election. Many economists had been removing it from their Q4 GDP projections, but the market was caught wrongfooted. Risk came off....

Read More »FX Daily, May 13: Will Powell have any more Luck Pushing against Negative Rate Expectations in the US?

Swiss Franc The Euro has risen by 0.08% to 1.0521 EUR/CHF and USD/CHF, May 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Another late sell-off in US shares, this one perhaps related to the sobering assessment by the leading medical adviser for the Trump Administration about the risks of opening too early, failed to deter investors in the Asia Pacific region. Although Japanese shares slipped, most other...

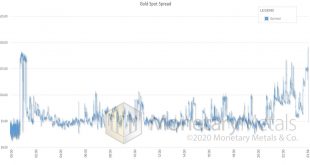

Read More »The Out Has Not Yet Begun to Fall, Market Report 31 March

So, the stock market has dropped. Every government in the world has responded to the coronavirus with drastic, if not unprecedented, violations of the rights of the people. Not to mention, extremely aggressive monetary policy. And, they are about to unleash massive fiscal stimulus as well (for example, the United States government is about to dole out over $2 trillion worth of loot). The question on everyone’s mind is what will be the consequences? The standard...

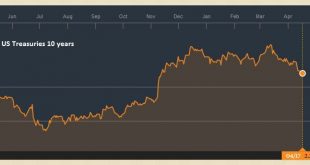

Read More »FX Weekly Preview: Recovering from Too Much of a Good Thing?

Too much of a good thing is bad. That, in a nutshell, is an important insight that Hyman Minsky offered about the financial sector, but has broader application. The low volatility that has been a characteristic of the capital markets for the past few years spurred financial innovation to profit from it. A broad range of financial instruments constructed to profit from continued low volatility, such as exchange-traded...

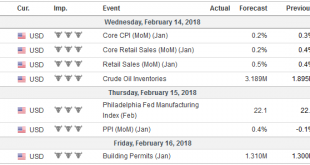

Read More »Monetary Policy is Important, but US Fiscal Stance Moving Center Stage

Summary: Monetary policy is off the table for at least the next two months. Several fiscal issues are coming to a head. Despite the GOP majority in Congress and White House, brinkmanship cannot be ruled out. The Federal Reserve hiked rates in March. Whatever gradual hikes mean, it seems to preclude moves in back-to-back meetings. There are two chances of a May hike: Slim and none and Slim left town. June...

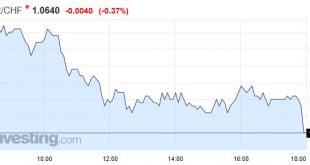

Read More »FX Daily, February 28: Markets Little Changed as Breakout is Awaited

Swiss Franc EUR/CHF - Euro Swiss Franc, February 28(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge GBP/CHF GBH CHF continues to see a volatile period with the general global uncertainty which has seen investors favour the safe haven currency. GBP CHF currently sits at 1.25 for this pair and there is resistance at these levels which is preventing the pound from driving higher. Brexit is now...

Read More »Great Graphic: Growth in Federal Spending

Introduction by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs Summary: Federal spending growth under Obama is lower than under the previous four presidents. Subsequent to the chart, US federal spending has increased. It will likely increase more under the next President. The US policy mix is changing. The trajectory of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org