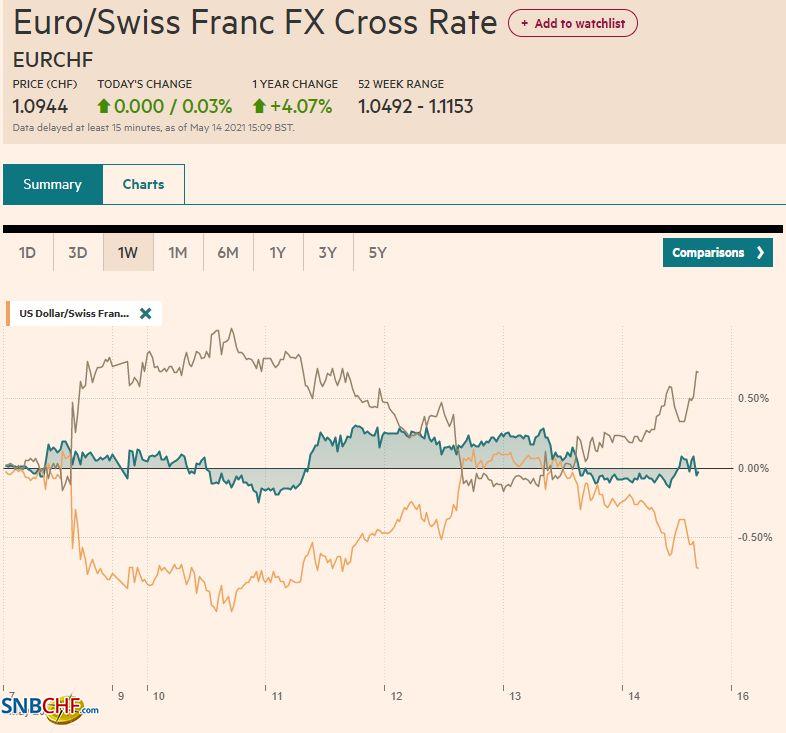

Swiss Franc The Euro has risen by 0.03% to 1.0944 EUR/CHF and USD/CHF, May 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The surge in consumer prices reported on Wednesday saw rates jump and the dollar push higher. Stronger than expected producer prices yesterday, and news of wage increases (average 10%) at Mcdonalds and for 75,000 people Amazon wants to hire, saw rates ease and the dollar’s upside momentum stall. Before the week draws to a close, the US reports April retail sales and industrial production figures. US stocks recovered smartly from the stomach-clenching sell-off on Wednesday, which helped lift sentiment in Asia and Europe. The largest markets in the Asia Pacific advanced mostly 1%-2.3%.

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Bank of Canada, Bank of England, Banxico, China, commodities, Currency Movement, EUR/CHF, Featured, newsletter, Olympics, U.K., USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.03% to 1.0944 |

EUR/CHF and USD/CHF, May 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

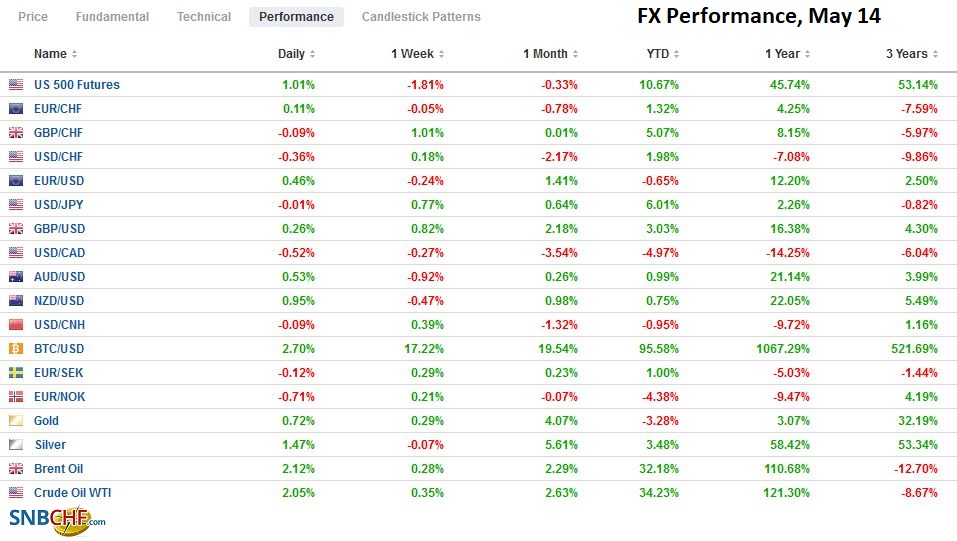

FX RatesOverview: The surge in consumer prices reported on Wednesday saw rates jump and the dollar push higher. Stronger than expected producer prices yesterday, and news of wage increases (average 10%) at Mcdonalds and for 75,000 people Amazon wants to hire, saw rates ease and the dollar’s upside momentum stall. Before the week draws to a close, the US reports April retail sales and industrial production figures. US stocks recovered smartly from the stomach-clenching sell-off on Wednesday, which helped lift sentiment in Asia and Europe. The largest markets in the Asia Pacific advanced mostly 1%-2.3%. New social restrictions in Singapore as the contagion reached a 10-month high saw the Strait Times Index drop 2.5%. Europe’s Dow Jones Stoxx 600 recovered yesterday, though finished off less than 0.2%, and helped by stronger gains in consumer staples and financials, is posting modest gains today. US future indices are trading broadly higher. The US 10-year yield briefly poked above 1.70% yesterday for the first time in a month but pulled back to around 1.64% now, shrugging off a lukewarm 30-year bond auction (despite higher rate, low bid coverage). The softer US yields were are doing little to European benchmark 10-year yields, which are extending yesterday’s push to the year’s highs. As go US interest rates, so goes the dollar. After rallying on Wednesday, its gains were pared against most of the major currencies and remains under modest pressure today, with the Norwegian krone leading the way (~+0.85%), while sterling, yen, and the Australian dollar lagging (~+0.1%). On the week, only sterling is higher (~+0.50%), while the Antipodeans and Scandis led the decline (~-0.8% to -1.3%). Emerging market currencies are also trading higher today, led by eastern and central European currencies. After falling in the first half of the week, the JP Morgan Emerging Market Currency Index is extending yesterday’s minor gains and for the week is off about 0.65%, after gaining nearly 1.8% last week. Gold is extending its recovery after dipping below $1810 yesterday and is near $1833 near midday in Europe. Crude oil prices are stabilizing in yesterday’s trough after June WTI slid 4.3% yesterday. Near $64.50 a barrel, it is off a little less than $0.50 this week. |

FX Performance, May 14 |

Asia Pacific

China’s Premier Li Keqiang called for measures to address the surge in commodity prices yesterday, and the market took it to heart. The materials sector underperformed in the Chinese equity rally today. Iron ore prices, for example, had risen by nearly 18% in the five sessions through Wednesday. Prices for the September futures contract fell by nearly 3.6% yesterday and another 6.4% today. Copper prices are off for the third consecutive session today. It is off 2% this week after a five-week, 19.5% rally. Steel rebar futures had rallied nearly 12% in the five sessions through the middle of the week, and the cumulative decline between yesterday and today is around 5.5%. The resumption of US pipelines that was hacked and indications that some 700 barges on the Mississippi held up by cracks in a highway bridge may able to continue their journey over the weekend also contributed to the 2.4% decline in the CRB index, its largest fall in nearly two months, and will likely snap a five-week advance of nearly 11%.

With the Olympics set to start in Tokyo in a little more than two months, Japanese business executives have stepped up their criticism of the Suga government for the slow vaccine rollout. Reports suggest around 2% of Japan has been vaccinated, putting it at the bottom of the OECD. Separately, despite the Topix falling nearly 2.6% this week, its largest decline in nearly two months, and the biggest three-day decline since last June, the BOJ did not intervene and buy ETFs. It appears to have bought ETFs only one day (April 21) since the start of April as its new rules came into effect (scrapping the JPY6 trillion target of ETF purchases).

The dollar stalled yesterday at its highest level against the yen in a month near JPY109.80, as US rates pulled back. Initial support near JPY109.25 is being tested in the European morning, and a break could signal a test on JPY108.90. The key ahead of the weekend is the bond market’s response to the US data. The intraday technical readings appear to be bottoming in late European morning turnover. The Australian dollar is approaching the $0.7750 area, which holds an expiring option for A$1 bln. The $0.7765 is the (38.2%) retracement of this week’s decline (~$0.7890-$0.7690). The next retracement (50%) is at $0.7790. If the intent of Chinese officials was to steady the yuan after its recent advance, it appears to have succeeded. The yuan gained a little more than 0.25% against the broadly softer greenback today, making it the strongest in the region, but it is virtually unchanged on the week. The PBOC set the dollar’s reference rate at CNY6.4525, in line with the bank models in Bloomberg’s survey.

Europe

The week is winding down quietly in Europe. There are two main talking points today, and they both involve the UK. First, Northern Ireland’s Democratic Unionist Party will pick a new leader today. Donaldson, who heads up the DUP members of the UK parliament, is seen to have an inside edge over the region’s Agriculture Minister Poots. Both are critical of the Northern Ireland Protocol, which controversially instituted custom checks on Northern Ireland’s border with Britain, seemingly violating the Good Friday Agreement. This and Scotland’s independent-minded majority will be a persistent pressure on UK Prime Minister Johnson.

Second, BOE Governor Bailey said that inflation was being watched closely and noted the elevated readings in the US. Bailey sounded increasingly optimistic about the UK economy. He said it was rapidly recovering and that the labor-intensive sectors that had been the hardest hit are poised for a fast recovery. The economy is on track for a full reopening on June 21. The Bank of England slowed its bond purchases this week and aims to complete them by the end of the year.

The euro fell to almost $1.2050 yesterday and has rebounded to about $1.2130 today, which is roughly the (61.8%) retracement of the loss from the $1.2180 week’s high seen on May 11. However, the buying appears to have dried up in the European morning, and initial support is in the $1.2080-$1.2100 band. After gaining 1.2% last week, helped by that shockingly disappointing US jobs report, the euro is off about 0.4% this week (near $1.2115). Sterling held $1.40 support yesterday and has stalled today near yesterday’s high, just shy of $1.4080. It gained almost 1.2% last week, and near $1.4065 is up about 0.6% this week. It is poised to finish above $1.40 this week for the first time since mid-February.

America

It will be difficult for the April retail sales to match the March gain of 9.7%. We know that auto sales were among the strongest in history last month (18.51 mln unit seasonally adjusted annual pace). However, anecdotal reports suggest fleets were particularly active and maybe driving up used car prices too (where a 10% jump in April accounted for a third of the increase in headline CPI). The economists surveyed by Bloomberg seem particularly bearish on the core retail sales, which exclude food services, autos, gas stations, and building materials. The median forecast is for a 0.4% decline, and the average estimate is -0.17%. However, of the 23 economists, 11 look for an up number. April industrial output is widely expected to have expanded further after the 1.4% increase in March. Two of the 62 economists surveyed look for a decline. The median and average forecasts are near 1%.

Three data points today will feed the investors’ anxiety about inflation. First, April import/export prices are expected to rise by 0.6% and 0.8%, respectively. Due to the base effect, these gains, notable in their own right, will appear as a year-over-year surge of 10.2% and 14.0% for import and export prices, respectively. This hints at positive terms of trade developments working in the US favor even if masked by a record trade deficit. Second, the utilization rate of US industrial capacity says something about the slack in the economy. The capacity utilization rate peaked since last year’s trough in January at 75.3%. The poor weather in February saw the utilization rate fall to a little below 73.4%. It bounced back in March and is expected to have moved to 75% in April. In 2019, with inflation still too low for the Fed’s comfort, it was chopping around 76%-78%. Third, the University of Michigan consumer survey also asks about long-term (5-10 years) consumer inflation expectations. It stood at the end of 2019 at 2.2% (which admittedly was a bit of an outlier and averaged 2.4% in the last few months of the year). At the end of last year, it was at 2.5%. This year it has been 2.7%-2.8%, which is the highest since 2014.

Over the past month and year-to-date, the Canadian dollar is the strongest of the major currencies (3.1% and 4.8%, respectively), driven arguably by the tapering Bank of Canada’s bond purchases and the dramatic rise in commodity prices. However, yesterday, it posted its first back-to-back decline in a month. Yesterday’s pullback was blamed by some on the pullback in commodity prices, but note that the Bank of Canada Governor Macklem’s comments also may have spurred some profit-taking. He said he wanted to ensure that the appreciation of the Canadian dollar did not disrupt its exports. Last week, Canada did report a C$1.14 bln trade deficit in March after a C$1.4 bln surplus in February. However, the source of the deterioration was not so much a function of exports, which edged up 0.3%, but the surge in imports (5.5%). Indeed, in Q1 21, exports rose by 8.3% to C$153 bln, their highest value since Q2 19. However, Macklem did play down an early rate hike, saying he wanted to see the number of employed surpass the pre-pandemic level by 200k to indicate a full recovery.

The central bank of Mexico left the target rate at 4.00%, as widely anticipated. The Banxico statement indicated that even though inflation has accelerated faster than expected, it has not given up on the idea that it will still converge to the 3% target by the middle of next year. Like the Federal Reserve and the European Central Bank, Banxico views the higher inflation prints (headline CPI nearly 6.1% in April, with the core a little above 4.1% and the non-core prices rising almost 12.35%. After sketching out both upside and downside risks, the central bank concluded, “The balance of risks that might affect the anticipated path for inflation within the forecast horizon is biased to the upside.” The market seems to think those upside risks will, in fact, materialize, and the swaps market about 50 bp in rate hikes in H2 21. Banixco’s next meeting is on June 24.

The US dollar is trading inside yesterday’s roughly CAD1.21-CAD1.22 range. There is an option for $365 mln at CAD1.2125, just below the low seen in Europe. A break of CAD1.21, which is also the (61.8%) retracement of the Wednesday-Thursday bounce, would likely signal a retest on the six-year low set this week near CAD1.2045. The greenback reversed lower against the Mexican peso yesterday after setting the week’s high around MXN20.2135. It is extending the pullback today and looks poised to challenge the week’s low (~MXN19.8275). The peso sold off the first three sessions this week but has bounced back and is now higher on the week (~0.25%). The peso has fallen only one week of the past seven.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Bank of Canada,Bank of England,Banxico,China,commodities,Currency Movement,EUR/CHF,Featured,newsletter,Olympics,U.K.,USD/CHF