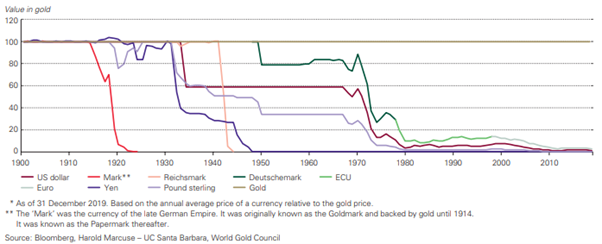

By Stephen Flood Governments are likely to continue printing money to pay their debts with devalued money. That’s the easiest and least controversial way to reduce the debt burdens and without raising taxes. Ray Dalio – Bridgewater Associates This is the only chart that matters in the world today. Consider the following: Gold can only be produced at a rate of 1.6% per annum. This is a relative constant. Gold has returned 8% per year in Euros and 9% in USD terms over the past 20 years. Gold has returned 12% per year in the Euros and 10% in USD terms over the past 50 or so years. Global population is growing at 1.1% per year. USD Currency in circulation as defined by the M1 monetary base has grown by 41% in the year to November 2020. Think about that last point.

Topics:

Stephen Flood considers the following as important: 6a.) GoldCore, 6a) Gold & Bitcoin, Daily Market Update, Featured, gold chart, gold price chart, newsletter, silver chart, silver price chart

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Governments are likely to continue printing money to pay their debts with devalued money. That’s the easiest and least controversial way to reduce the debt burdens and without raising taxes.

This is the only chart that matters in the world today.Consider the following:

Think about that last point. 41% in one year. All the dollars ever created have just increased by 41% in one year. In that same period gold, which was trading at $1,465 in October 2019, has gone up by 25% to $1,812. They are very similar changes, and it is quite sobering, because the buying power of the cash in your bank account has or will soon fall by this same margin. It will be ravaged by inflation as prices begin to rise at rates far exceeding your income and that will trigger some very dangerous economic consequences for our communities. |

World Gold Council, 1900-2010 |

In the last 20 years we have seen extraordinary financial upheavals and each time the authorities reach for the same old elixir – debt!

From the Nasdaq Stock Market Bubble of 2000, to the Global Financial Crisis of 2008 through 2012, the Sovereign Debt Crisis of 2007 and 2008 and now the Covid 19 Pandemic of 2020, the cure if not the cause has been the same, load up on debt, extinguish the market fervour and wrestle the market forces into submission.

At no point have the authorities sought to examine the factors that led to these crises and address them so they would be unlikely to reoccur again.

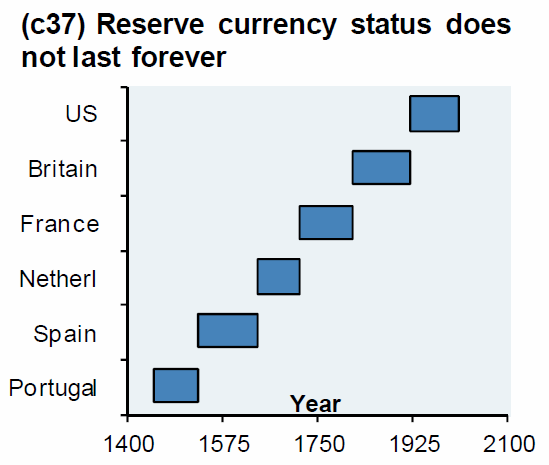

On the horizon we have enormous risks brewing; Brexit, European cohesion, the rise of China as an economic super-power, demographic time-bombs, a burgeoning environmental crisis and the largest of all, the potential catastrophic loss of market confidence resulting from a global debt crisis.

Since 2000, global investment demand for gold has increased on average by 14% per annum and gold prices have risen 4 fold in that time.

Historically all major currencies were pegged to Gold. This changed in 1971 when Nixon closed the gold window and the US Dollar became a full fiat currency backed only by the credibility of the US treasury. Since then fiat, or currencies backed only by the governments who manage them, have drastically fallen in value.

Fiat currencies always eventually fail, as the graph so eloquently depicts. It is a matter of time and like a game of musical chairs you do not want to be caught sitting in cash when the music stops. As if on cue the powers that be are looking for alternatives. You will notice the headlines being flown like kites in the wind; announcing new innovations such as cryptographic currencies, global resets, debt forgiveness etc. They all mean the same thing, the death of money and with it the savings of many people.

The issue at the heart of the matter is not some global conspiracy as some might have us think. It is something far more benign and dangerous. It is simply called “apathy”. You see, people are generally lazy in many many ways, especially about matters they perceive to be complex and the domain of others. More often than not, they only get active when an issue occurs on their doorstep. Politicians, their officials and appointed technocrats, who are paid to manage these complex issues are also lazy. They would rather people did not ask hard questions, kick up a fuss and make a nuisance of themselves.

In many ways the cohort that is most responsible is our so-called free press and by extension our academics, who should, in the ordinary course of their day, be evaluating and testing the integrity of the systems we rely upon.

Each of these groups have generally absolved themselves of responsibility, wrapped themselves up in diversionary excuses and quietly hope that someone else will manage away the risks they all know, and fear will manifest. The only people who can drive change are the public and they need to get active before it is too late.

|

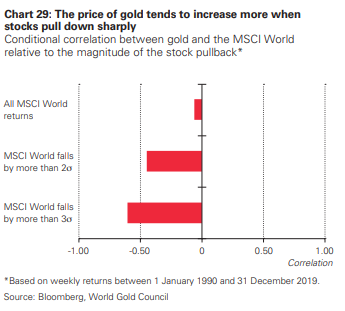

Gold: An Investors “Best Friend” They say a true friend tells you what you don’t want to hear sometimes. In the same vein gold is screaming to all those that are bothered to hear, that something is very very rotten. The reason gold is impervious to the excesses of man’s monetary shenanigans is one simple fact. It is very, very rare. In addition to this, it is heavily traded all around the world and it cannot be printed. Its values as a store of wealth transcends borders, language, culture and time. It is valuable for what it is not (a liability) and for what it is, rare and coveted. Take a look at this next chart… It is a measure of how loud gold will roar when the economy gets a little hairy. Over nearly 30 years, the economists at the World Gold Council studied how gold reacts when markets fall. They measure the fall in standard deviations, a fancy way of saying the degree of swings felt in a market. The top measure states that when things are normal gold is indifferent, not doing much, like a friend who has not called you in a while, knowing you are doing just fine. The middle measure is where gold gets interesting. Here the market is having a major fall and it is a big one in terms of its normal range. Gold is going the opposite way, its rising fast and the more the market falls the faster it rises. In this situation it is acting as a hedge, something that adjusts and protects against an adverse event. It is this behaviour that underpins gold’s credential as a great diversifier in a portfolio. This is akin to your friend looking at you late into the party, while you are on the table dancing, and pointing to their watch. The final measure is when gold as your friend is pulling you and your finances from the flames of an inferno. The market has sold off to a massive degree and gold is going in the direction of safety and rising. For every $1 lost gold is paying you back nearly 60 cents. You need to pay attention to these insights, when the proverbial excrement hits the fan we will not have a market for many assets out there, and people will be selling for cents on the dollar. |

Tags: Daily Market Update,Featured,gold chart,gold price chart,newsletter,silver chart,silver price chart