The BLS’s most recent labor market data is, well, troubling. Even the preferred if artificially-smooth Establishment Survey indicates that something has changed since around March. A slowdown at least, leaving more questions than answers (from President Phillips). That as much because of the other employment figures, the Household Survey. April and May, in particular, not just a slowdown but a drop in overall employee count. As I pointed out last Friday, a 2-month...

Read More »May Payrolls (and more) Confirm Slowdown (and more)

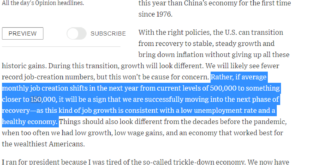

May 2022’s payroll estimates weren’t quite the level of downshift President Phillips had warned about, though that’s increasingly likely just a matter of time. In fact, despite the headline Establishment Survey monthly change being slightly better than expected, it and even more so the other employment data all still show an unmistakable slowdown in the labor market. What’s left open for argument and concern is now a matter of how much of a downside there might end...

Read More »ADP Front-Runs BLS and President Phillips

It’s gotten to the point that pretty much everyone is now aware of the risks. Public surveys, market behavior, on and on, hardly anyone outside politics thinks the economy is in a good place. Gasoline, sentiment, whatever, Euro$ #5 in total is much more than what’s shaping up inside the American boundary. Globally synchronized of which the US is proving to be a close part. The destination, or depth, really, is what’s left to argue. As noted yesterday, even President...

Read More »For The Fed, None Of These Details Will Matter

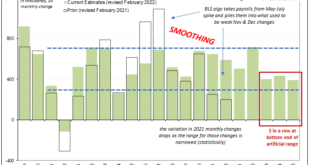

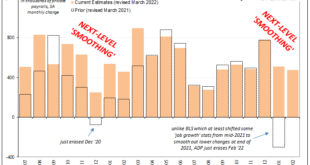

Most people have the impression that these various payroll and employment reports just go into the raw data and count up the number of payrolls and how many Americans are employed. Perhaps the BLS taps the IRS database as fellow feds, or ADP as a private company in the same data business of employment just tallies how many payrolls it processes as the largest provider of back-office labor services. That’s just not how it works, though. In fact, sampling and...

Read More »Taper Discretion Means Not Loving Payrolls Anymore

When Alan Greenspan went back to Stanford University in September 1997, his reputation was by then well-established. Even as he had shocked the world only nine months earlier with “irrational exuberance”, the theme of his earlier speech hadn’t actually been about stocks; it was all about money. The “maestro” would revisit that subject repeatedly especially in the late nineties, and it was again his topic in California early Autumn ’97. As Emil Kalinowski and I had...

Read More »How Many More Americans Might Have Quit Their Jobs Than The Huge Number Already Estimated, And What Might This Mean For FOMC Taper

There were a few surprises included in the BLS JOLTS data just released today for the month of November (note: the government has changed its release schedule so that JOLTS, already one month further in arrears than the payroll report, CES & CPS, will now come out earlier so that its numbers are publicly available for the same monthly payrolls before the next CES & CPS get released). Not really about the JOLTS figures themselves, though there are...

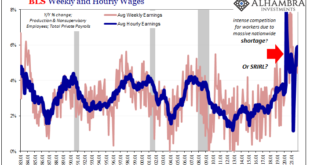

Read More »As The Fed Tapers: What If More Rapid (published) Wage Increases Are Actually Evidence of *Deflationary* Conditions?

Since the Federal Reserve is not in the money business, their recent hawkish shift toward an increasingly anti-inflationary stance is a twisted and convoluted case of subjective interpretation. Inflation is money and if the Fed was a central bank the issue of consumer prices wouldn’t necessarily be simple, it would, however, be much simpler: is there or isn’t there too much money flowing through the economy. News to the vast majority of the public, no one at any...

Read More »A Global JOLT(s) In July

The Bureau Labor Statistics reported today another huge month for Job Openings (JO). According to their methodology (which I still believe is flawed, but that’s not our focus this time), the level for October 2021 (JOLTS updates are for one month further back than payrolls) was a blistering 11.03 million. It wasn’t a record high, though, as that was set back in July. Yes, the number remains upward in the stratosphere, but it has been in the same general area of it...

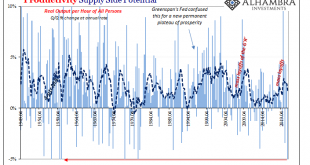

Read More »The Productive Use Of Awful Q3 Productivity Estimates Highlights Even More ‘Growth Scare’ Potential

What was it that old Iowa cornfield movie said? If you build it, he will come. Well, this isn’t quite that, rather something more along the lines of: if you reopen it, some will come back to work. Not nearly as snappy, far less likely to sell anyone movie tickets, yet this other tagline might contribute much to our understanding of “growth scare” and its affect on the US labor market. This topic deserves a much deeper dive than I am going to give it (for now). What...

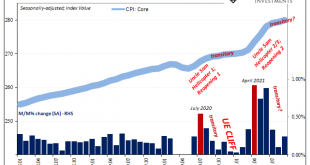

Read More »The Wile E. Powell Inflation: Are We Really Just Going To Ignore The Cliff?

Last year did not end on a sound note. The initial rebound after 2020’s recession was supposed to be a straight line, lifting upward for the other side of the infamous “V” shape. Such hopes had been dashed, though, and as the disappointing year wound toward its own end yet another big problem loomed. In December 2020, millions of Americans still out of work were going to lose government benefits. The Department of Labor would later tally up the scale of this...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org