There are two parts behind the inflation mongering. The first, noted yesterday, is the Fed’s balance sheet, particularly its supposedly monetary remainder called bank reserves. The central bank is busy doing something, a whole bunch of something, therefore how can it possibly turn out to be anything other than inflationary? The answer: the Federal Reserve is not a central bank, not really. What it “prints” are, as Emil Kalinowski likes to call them, the equivalent of laundromat tokens (I wonder if they’re even that useful). Even Jay Powell knows this, but he’s absolutely thrilled that so many people believe otherwise. When grasped by the dark specter of deflation, what better way (according to an Economist) to get out of it than to make people think you’re

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bank reserves, bond yields, bonds, Chicago Fed, controlled inflation, currencies, economy, farm relief bill of 1933, Featured, Federal Reserve, Federal Reserve/Monetary Policy, fiscal deficit, Government debt, inflation, interest rate fallacy, Markets, money printing, newsletter, thomas inflation amendment, tight money, weimar germany

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

There are two parts behind the inflation mongering. The first, noted yesterday, is the Fed’s balance sheet, particularly its supposedly monetary remainder called bank reserves. The central bank is busy doing something, a whole bunch of something, therefore how can it possibly turn out to be anything other than inflationary? The answer: the Federal Reserve is not a central bank, not really. What it “prints” are, as Emil Kalinowski likes to call them, the equivalent of laundromat tokens (I wonder if they’re even that useful). Even Jay Powell knows this, but he’s absolutely thrilled that so many people believe otherwise. |

|

| When grasped by the dark specter of deflation, what better way (according to an Economist) to get out of it than to make people think you’re being monetarily reckless; therefore, he’s not about to correct the record as to what QE really is. As Paul Krugman once put it, credibly promise to be irresponsible.

It’s the “credible” part that goes lacking. Thus, the parade of counterexamples – “Japan 2001. America 2008. Japan 2013. Europe 2015” – each one unanswered by any inflationary breakout. Has the whole world just forgot about QQE? It’s still ongoing seven years later! The other part or half of what’s driving fears is fiscal, governmental in general. Come hell or high water, it is told, the feds as opposed to the Fed are going to drive inflation. Why? Because, as legend has it, that’s the way you “pay down” massive debt loads. You go nuts borrowing and then, quietly, ambiguously, you screw your lenders (bond holders) by devaluing the currency. Occasionally, as the kids say, they say the quiet part out loud. A working paper just released (but not edited) by the Chicago branch of the Federal Reserve does just that. A taste:

|

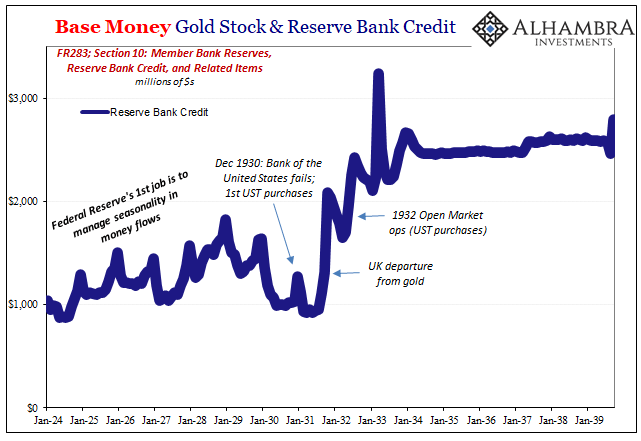

Base Money Gold Stock & Reserve Bank Credit |

| See!!, bond vigilantes will scream. We told you that’s what they’re up to!

Sorry, folks, this isn’t actually a surprise nor is it the matter for debate since everyone knows that’s what politicians want. It won’t make one bit of difference what authorities want to do, under cover or right out in the open, it’s what they actually can do. And it’s just not all that much when it comes to the monetary system. Controlled inflation, by the way, is not a new concept, either (obviously). Lost deep within the minutiae of the flurry of programs brought on by the Great Depression is something called the Thomas Amendment to FDR’s Agricultural Adjustment Act of 1933 (better known as the Farm Relief Bill). Not just the Thomas Amendment, it was actually called the Thomas Inflation Amendment because it included a number of legal provisions which would force the costs of all manner of produce to be set (read: increased) by the diktat of federal government agencies. American farms and farmers had, like industry, been equally ravaged by deflationary prices. But that wasn’t all, the amendment would have required the Federal Reserve to buy, at the President’s request, another $3 billion in federal government bonds (super QE) beyond those already purchased while also giving Roosevelt added authority to further lower the gold content of the dollar (statutory approval for official devaluation, meaning default, having been given just a few months earlier). |

Base Money Gold Stock & Reserve Bank Credit |

| There was more: authority to put silver on par with gold, or at any ratio in between that possible extreme and where it was priced at the time; legal approval for the Fed to issue greenbacks, $3 billion of them, to finance the bond purchases rather than use reserve bank credit (bank reserves).

On May 13, 1933, in Britain’s The Economist these provisions were soundly condemned as going way too far:

|

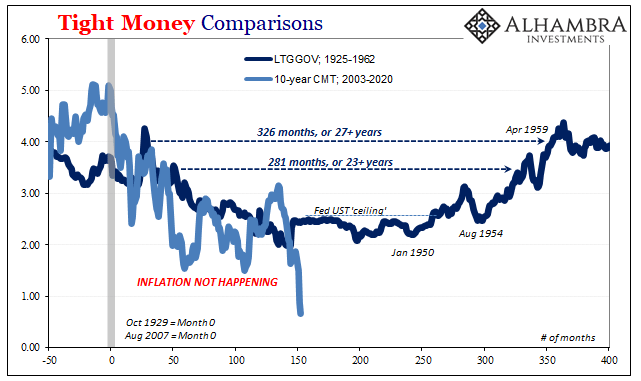

Tight Money Comparisons, 2003-2020 |

The only topic of conversation in New York during the past week has been ‘inflation.’ It is evident that the tide of inflationary sentiment is running at full flood.

Both The Economist article and one published in BusinessWeek four days later referred to “controlled inflation”, with the former quite negative on the theory, charging, “the country has exchanged a President with little effective power for a ‘currency dictator.’”

The latter, BusinessWeek, was far more sanguine:

This inflation is different. It contains controls that can be used to prevent a runaway…

Disagreement over the wisdom behind the amendment was fierce, but the foreseeable result, inflation, was widely viewed as a foregone conclusion.

As noted yesterday, on the contrary, there was none to be found anywhere – not until the mid-sixties under very different underlying (not deflationary) circumstances.

It wasn’t up to authorities to create it, no matter how much they wanted to or how willing they were to just tear up tradition and exceed political limits. The monetary power for inflation, or deflation, as the case would be, rested within the banking system which, contrary to “recovery” expectations, wasn’t recovering.

This undercurrent would persist for decades. Though the New Deal raised the budget deficit to extreme proportions, World War II would take them even further. And still no inflation.

Fearing it anyway, because central bankers through history have continuously proved how little they understand their jobs, the Federal Reserve by the time of America’s entry into WWII, wounded and weakened by its disastrous performance throughout the decade before, was made subservient to the Treasury Department. Its primary task had been whittled down to little more than bond market policeman; beginning in 1942, enforcing a ceiling on UST yields by promising to buy bonds at predetermined prices.

And yet, even that much was never required. Low interest rates persisted; the Fed, as I recalled a few years ago, never much more than a bystander and spectator as the banking system feared liquidity and deflation regardless of the government’s condition, intent, or disposition. You can’t credibly promise to be irresponsible when everyone, including Treasury, knows you’re toothless.

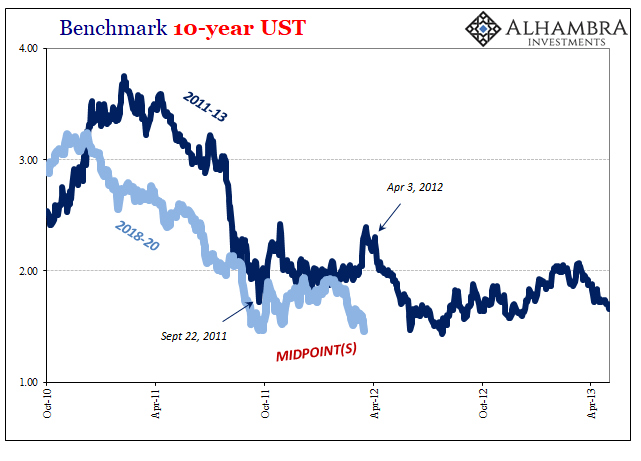

If you understand why interest rates had only gone lower in the thirties you can easily understand why they didn’t just surge one day in the forties or even fifties. Yes, the Fed kept a ceiling on long rates from ’42 to ’51, but in all that time the central bank rarely had to intervene in the market; none at all over the final years. There was no artificially constrained bond bear lurking underneath.

What ended this bond “bull” market was the same thing which would end up balancing the federal government’s books. Growth and opportunity, not inflation.

Thus, the question before us today isn’t really about inflation, either, it’s whether the debt being further piled on to defeat deflation (which has zero chance of succeeding at that) simply tightens the deflationary trap that much more.

Just like all these previous periods in history. “Japan 2001. America 2008. Japan 2013. Europe 2015.” Everyone 2020.

I’ll get to Japan in the nineties hopefully at some point this week. That’ll finish up the major episodes of this un-killable interest rate fallacy

Tags: bank reserves,bond yields,Bonds,Chicago Fed,controlled inflation,currencies,economy,farm relief bill of 1933,Featured,Federal Reserve/Monetary Policy,federal-reserve,fiscal deficit,government debt,inflation,interest rate fallacy,Markets,money printing,newsletter,thomas inflation amendment,tight money,weimar germany