One of the biggest reasons for people deciding to buy gold bars or to own silver coins is because of the folly of central banks and government. It seems bizarre to most people that we are all aware that money doesn’t grow on trees and yet those responsible for financial stability have forgotten this basic life-lesson. But, what has felt even more bizarre (and maddening) is for how long this foolishness has been allowed to continue. Well, it seems this won’t be the...

Read More »Ben Bernanke Wins Nobel Prize for Kicking Can Down the Road!

So Ben Bernanke has won a Nobel Prize for kicking a can down the road! Many will have heard the saying ‘those who do not learn from history, are doomed to repeat it’. It is often attributed to Churchill, but he was in fact quoting George Santanya. We prefer the Stephen Hawking quote, ‘“We spend a great deal of time studying history, which, let’s face it, is mostly the history of stupidity.” as this feels more apt in this day and age. Below we outline the Nobel-prize...

Read More »What Does Taper Look Like From The Inside? Not At All What You’d Think

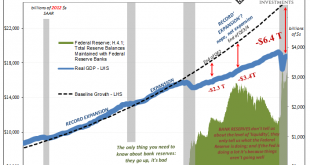

Why always round numbers? Monetary policy targets in the post-Volcker era are changed on even terms. Alan Greenspan had his quarter-point fed funds moves. Ben Bernanke faced with crisis would auction $25 billion via TAF. QE’s are done in even numbers, either total purchases or their monthly pace. This is a messy and dynamic environment, in which the economy operates out of seeming randomness at times. Yet, here we have something that is “quantitatively” determined...

Read More »You Don’t Have To Take My Word For It About Eliminating QE

You don’t have to take my word for it. QE doesn’t work and it never has. That’s not just my assessment, pull out any chart of interest rates for wherever gets the misfortune of having been wasted with one of these LSAP’s. If none handy, then just read what officials and central bankers write about their own programs (or those of their close and affectionate counterparts). After nearly a decade of Abenomics in Japan, the latest Japanese Prime Minister Fumio Kishida...

Read More »The Inflation Emotion(s)

Inflation is more than just any old touchy subject in an age overflowing with crude, visceral debates up and down the spectrum reaching into every corner of life. It is about life itself, and not just quality. When the prices of the goods (or services) you absolutely depend upon go up, your entire world becomes that much more difficult. For those at the “bottom”, that much more unbearable (hello Communism!) The real issue in that situation isn’t that narrow slice of...

Read More »Central Banks Will Still Do “Whatever It Takes”!

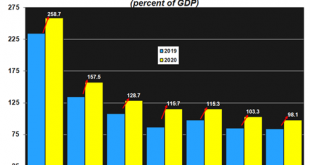

Governments are taking a page out of the play book that monetary policy began a decade ago – which will lead to even higher debt levels. During the throes of the financial crisis almost a decade ago Mario Draghi, then President of the European Central Bank (ECB) pushed the ECB’s mandate to the limits with his speech in July 2012: “within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough” This was during a...

Read More »Gold, the Tried-and-True Inflation Hedge for What’s Coming!

Global confirmed coronavirus cases surpassed 100 million this week. There is no denying that the coronavirus pandemic has caused tremendous hardship and loss. To mitigate new cases climbing further, stricter lockdown and travel restrictions are being announced and implemented, with the curfew in the Netherlands as an example. Lock-down fatigue, as evidenced by the riots against this implemented curfew, is growing. Through it all, hope is on the horizon as vaccine...

Read More »If the Fed’s Not In Consumer Prices, Then How About Producer Prices?

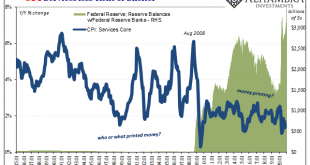

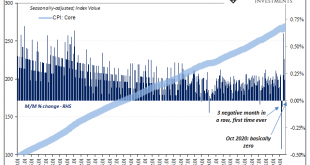

It’s not just that there isn’t much inflation evident in consumer prices. Rather, it’s a pretty big deal given the deluge of so much “money printing” this year, begun three-quarters of a year before, that consumer prices are increasing at some of the slowest rates in the data. Trillions in bank reserves, sure, but actual money can only be missing. U.S. CPI Services Core Fed, Jan 1985 - -2020 - Click to enlarge U.S. CPI Services Core percentile, Jan 2009 - 2020...

Read More »Where Is It, Chairman Powell?

Where is it, Chairman Powell? After spending months deliberately hyping a “flood” of digital money printing, and then unleashing average inflation targeting making Americans believe the central bank will be wickedly irresponsible when it comes to consumer prices, the evidence portrays a very different set of circumstance. Inflationary pressures were supposed to have been visible by now, seven months and counting, when instead it is disinflation which is most evident...

Read More »Meanwhile, Outside Today’s DC

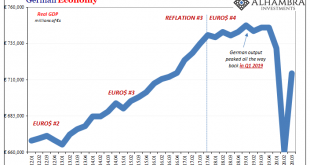

With all eyes on Washington DC, today, everyone should instead be focused on Europe. As we’ve written for nearly three years now, for nearly three years Europe has been at the unfortunate forefront of Euro$ #4. We could argue about whether coming out of GFC2 back in March pushed everything into a Reflation #4 – possible – or if this is still just one three-yearlong squeeze of a global dollar shortage. Either way, Europe gets at it first. In 2018, what had been...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org