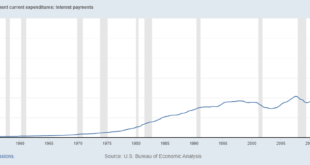

Interest rates surged last week on the back of a hotter-than-expected inflation report that wasn’t actually that bad (see below). Not that my – or your – opinion about these things matters all that much to the market. In the short run, all that matters is what the majority believes is the truth. What they believed last week was that inflation isn’t falling fast enough and the Fed will not be cutting rates anytime soon. That was enough to send the bond market into a...

Read More »“Die Schattenseiten von Schuldenbremsen (The Dark Side of Debt Limits),” ifoSD, 2021

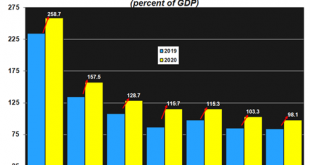

ifo Schnelldienst 4/2021, April 14, 2021. PDF. Was Schuldengrenzen aus politökonomischer Sicht besonders attraktiv erscheinen lässt – ihre vermeintliche Einfachheit und Klarheit – birgt also auch Risiken. Es führt dazu, dass Politiker und ihre Wähler die Solidität der Staatsfinanzen über Gebühr an expliziten Bruttoschulden messen. Was aber zählt, wenn es um unerwünschte Umverteilung zulasten künftiger Generationen geht, ist staatliches Nettovermögen in einer...

Read More »“Die Schattenseiten von Schuldenbremsen (The Dark Side of Debt Limits),” ifoSD, 2021

ifo Schnelldienst 4/2021, April 14, 2021. PDF. Was Schuldengrenzen aus politökonomischer Sicht besonders attraktiv erscheinen lässt – ihre vermeintliche Einfachheit und Klarheit – birgt also auch Risiken. Es führt dazu, dass Politiker und ihre Wähler die Solidität der Staatsfinanzen über Gebühr an expliziten Bruttoschulden messen. Was aber zählt, wenn es um unerwünschte Umverteilung zulasten künftiger Generationen geht, ist staatliches Nettovermögen in einer umfassenden...

Read More »Central Banks Will Still Do “Whatever It Takes”!

Governments are taking a page out of the play book that monetary policy began a decade ago – which will lead to even higher debt levels. During the throes of the financial crisis almost a decade ago Mario Draghi, then President of the European Central Bank (ECB) pushed the ECB’s mandate to the limits with his speech in July 2012: “within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough” This was during a...

Read More »“Staatsschulden sind keineswegs kostenlos (Free Government Debt?),” NZZ, 2021

NZZ, February 1, 2021. PDF. (Title changed by NZZ.) Do negative interest rates render government debt costless? No. What about r<g? I discuss Olivier Blanchard’s presidential address and the conclusions that columnists have drawn. For background: See this post.

Read More »Everyone Knows The Gov’t Wants A ‘Controlled’ Weimar

There are two parts behind the inflation mongering. The first, noted yesterday, is the Fed’s balance sheet, particularly its supposedly monetary remainder called bank reserves. The central bank is busy doing something, a whole bunch of something, therefore how can it possibly turn out to be anything other than inflationary? The answer: the Federal Reserve is not a central bank, not really. What it “prints” are, as Emil Kalinowski likes to call them, the equivalent...

Read More »“Financial Policy,” CEPR, 2018

CEPR Discussion Paper 12755, February 2018. PDF. (Personal copy.) This paper reviews theoretical results on financial policy. We use basic accounting identities to illustrate relations between gross assets and liabilities, net debt positions and the appropriation of (primary) budget surplus funds. We then discuss Ramsey policies, answering the question how a committed government may use financial instruments to pursue its objectives. Finally, we discuss additional roles for financial...

Read More »ECB Bond Purchases: Fiscal or Monetary Policy?

In an NBER working paper, Arvind Krishnamurthy, Stefan Nagel, and Annette Vissing-Jorgensen analyze which components of bond yields were affected by the European Central Bank’s government bond purchasing programs. Given the institutional restrictions on monetary policy in the Euro area, the ECB had to carefully argue why it intervened in the first place. (To many, the case was obvious; the ECB intervention amounted to quasi-fiscal policy. But an intervention with this objective would not...

Read More »Redistribution From Unexpected Deflation in the Euro Area

In the JEEA 14(4) (August 2016) Klaus Adam and Junyi Zhu argue that unexpected price-level movements generate sizable wealth redistribution in the Euro Area (EA) … The EA as a whole is a net loser of unexpected price-level decreases, with Italy, Greece, Portugal, and Spain losing most in per capita terms, and Belgium and Malta being net winners. Governments are net losers of deflation, while the household (HH) sector is a net winner … HHs in Belgium, Ireland, Malta, and Germany experience...

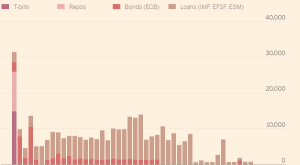

Read More »Greek Debt: Now and Then

In the FT, Mehreen Khan offers a “Greek debt dilemma cheat sheet.” Face value: EUR 321 billion, thereof EUR 248 billion owed to official creditors. Official creditors: Eurozone countries (Greek loan facility), eurozone rescue funds (EFSF and ESM), IMF, ECB. Maturity profile: IMF proposal for restructuring:

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org