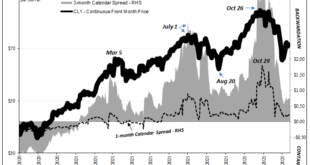

That was fast. Just yesterday I said watch out for when the oil curve flips from backwardation to contango. When it does, that’s not a good sign. Generally speaking, it means something has changed with regard to future expectations, at least one of demand, supply, or also money/liquidity. Contango is a projected imbalance which leaves the global system facing realistic prospects of being overwhelmed with too much oil. Back during 2014’s crude crash, Economists and...

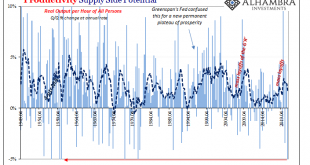

Read More »The Productive Use Of Awful Q3 Productivity Estimates Highlights Even More ‘Growth Scare’ Potential

What was it that old Iowa cornfield movie said? If you build it, he will come. Well, this isn’t quite that, rather something more along the lines of: if you reopen it, some will come back to work. Not nearly as snappy, far less likely to sell anyone movie tickets, yet this other tagline might contribute much to our understanding of “growth scare” and its affect on the US labor market. This topic deserves a much deeper dive than I am going to give it (for now). What...

Read More »There Was Never A Need To Translate ‘Weimar’ Into Japanese

After years of futility, he was sure of the answer. The Bank of Japan had spent the better part of the roaring nineties fighting against itself as much as the bubble which had burst at the outset of the decade. Letting fiscal authorities rule the day, Japan’s central bank had largely sat back introducing what it said was stimulus in the form of lower and lower rates. No, stupid, declared Milton Friedman. Lower rates don’t mean stimulus they mean monetary policy has...

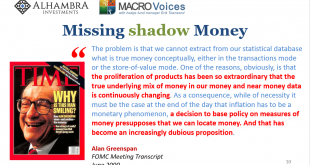

Read More »Everyone Knows The Gov’t Wants A ‘Controlled’ Weimar

There are two parts behind the inflation mongering. The first, noted yesterday, is the Fed’s balance sheet, particularly its supposedly monetary remainder called bank reserves. The central bank is busy doing something, a whole bunch of something, therefore how can it possibly turn out to be anything other than inflationary? The answer: the Federal Reserve is not a central bank, not really. What it “prints” are, as Emil Kalinowski likes to call them, the equivalent...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org