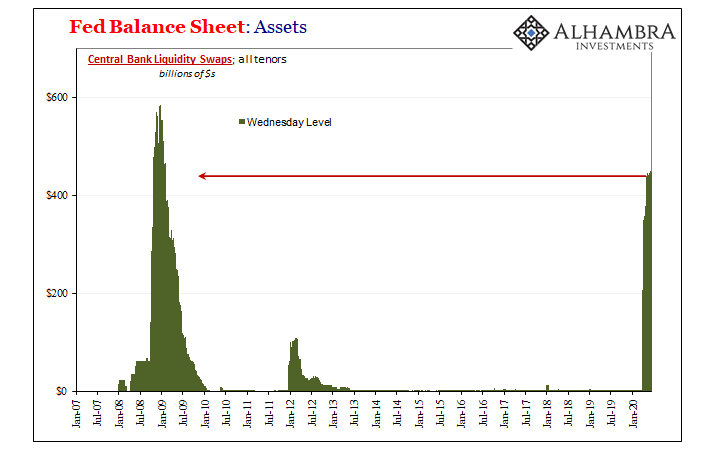

Just a quick update to add a little more data and color to my last Friday’s swap line criticism so hopefully you can better see how there is intentional activity behind them. Since a few people have asked, I’ll break them out with a little more detail. While the volume of swaps outstanding at the Fed has, in total, remained relatively constant (suspiciously, if you ask me), the underlying tenor of them has not. Meaning, there is purpose. It’s not like everyone panicked in March, signed up for longer swap trades, and are now letting them just roll off as everything has gone back to normal (as is alleged). Fed Balance Sheet: Assets, 2007-2020 - Click to enlarge Foreign central banks (remember, the overseas institution initiates the transaction likely on

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, central bank liquidity swaps, currencies, dollar flood, economy, eurodollar system, Featured, Federal Reserve/Monetary Policy, jay powell, Liquidity, Markets, newsletter, overseas dollar swaps

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

Just a quick update to add a little more data and color to my last Friday’s swap line criticism so hopefully you can better see how there is intentional activity behind them. Since a few people have asked, I’ll break them out with a little more detail. While the volume of swaps outstanding at the Fed has, in total, remained relatively constant (suspiciously, if you ask me), the underlying tenor of them has not. Meaning, there is purpose. It’s not like everyone panicked in March, signed up for longer swap trades, and are now letting them just roll off as everything has gone back to normal (as is alleged). |

Fed Balance Sheet: Assets, 2007-2020 |

| Foreign central banks (remember, the overseas institution initiates the transaction likely on behalf of perceived or real demand of banks operating within its jurisdiction – including, as I pointed out, foreign subsidiaries of US banks) have instead kept up the volume, but as longer-dated arrangements have been expiring these have been actively renewed and shifted to shorter duration transactions. |

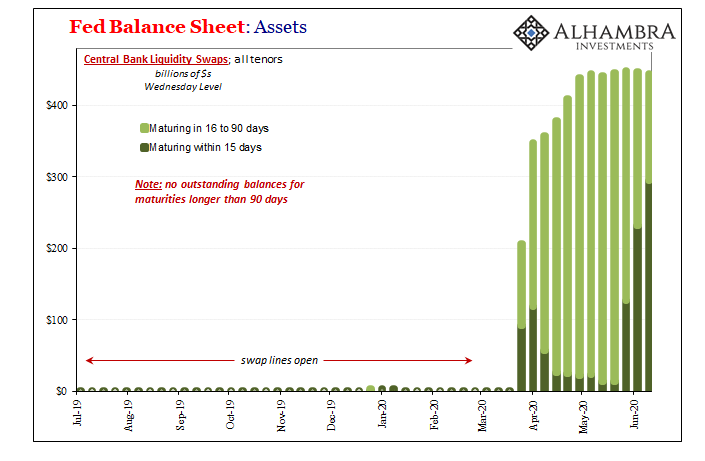

Fed Balance Sheet: Assets, 2019-2020 |

The question is, why haven’t they disappeared altogether? If March had been a one-off, June is a long way off to show so much volume still taking this circuitous route.

|

|

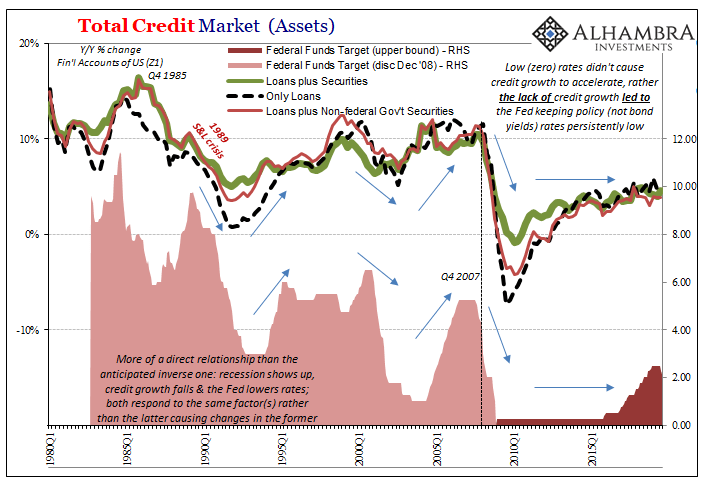

| Has the Fed morphed back into a quasi-real bills state, or is the “temporary” market disruption of March and April maybe not nearly so temporary? And, thinking along these lines, that “flood” maybe didn’t work at least so far as getting things back closer to normal.

If QE really had unleashed a flood, these things should’ve zeroed out by now. As the longer duration trades come up for maturity, those made under panic of March and early April, the initiating agent (central bank) would’ve just let them expire with local banks flush with Jay Powell’s “money printing.” Instead, they are clearly, purposefully, and actively being replaced week by week for practically the same net volume just lesser maturities. Again, why? If only someone would have the guts to ask Jay Powell directly. But that might spoil some or all of his 60 minutes. Which is it: |

|

Tags: central bank liquidity swaps,currencies,dollar flood,economy,eurodollar system,Featured,Federal Reserve/Monetary Policy,jay powell,Liquidity,Markets,newsletter,overseas dollar swaps