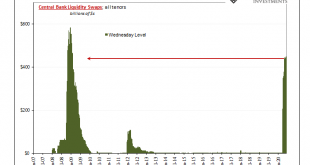

Why are there still outstanding dollar swap balances? It is the middle of September, for cryin’ out loud, and the Federal Reserve reports $52.3 billion remains on its books as of yesterday. Six months after Jay Powell conducted what he called a “flood”, with every financial media outlet reporting as fact this stream of digital dollars into every corner of the world, how can there be anything greater than zero in overseas liquidity swaps? Six months is an eternity....

Read More »Fed Balance Sheet: Swap Me Update

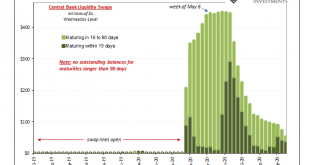

Just a quick update to add a little more data and color to my last Friday’s swap line criticism so hopefully you can better see how there is intentional activity behind them. Since a few people have asked, I’ll break them out with a little more detail. While the volume of swaps outstanding at the Fed has, in total, remained relatively constant (suspiciously, if you ask me), the underlying tenor of them has not. Meaning, there is purpose. It’s not like everyone...

Read More »So Much Dollar Bull

According to the Federal Reserve’s calculations, the US dollar in Q1 pulled off its best quarter in more than twenty years – though it really didn’t need the full quarter to do it. The last time the Fed’s trade-weighed dollar index managed to appreciate farther than the 7.1% it had in the first three months of 2020, the year was 1997 during its final quarter when almost the whole of Asia was just about to get clobbered. In second place (now third) for the dollar’s...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org