Market sentiment reverse sharply to the positive side due to several factors; as a result, the dollar has suffered The Fed beefed up its support for the corporate bond market; all eyes are on Fed Chair Powell as he delivers his semi-annual report to the Senate today The Trump administration is reportedly preparing a large infrastructure bill; May retail sales will be the data highlight Comments from UK and EU officials have sparked optimism about Brexit talks; UK reported mixed labor market data Regional tensions in Asia have been overlooked by the markets; BOJ kept rates on hold but boosted its pandemic loan program; RBA released its minutes Please see our new table at the end of this piece for a snapshot of the biggest movers of the day across asset classes.

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- Market sentiment reverse sharply to the positive side due to several factors; as a result, the dollar has suffered

- The Fed beefed up its support for the corporate bond market; all eyes are on Fed Chair Powell as he delivers his semi-annual report to the Senate today

- The Trump administration is reportedly preparing a large infrastructure bill; May retail sales will be the data highlight

- Comments from UK and EU officials have sparked optimism about Brexit talks; UK reported mixed labor market data

- Regional tensions in Asia have been overlooked by the markets; BOJ kept rates on hold but boosted its pandemic loan program; RBA released its minutes

Please see our new table at the end of this piece for a snapshot of the biggest movers of the day across asset classes.

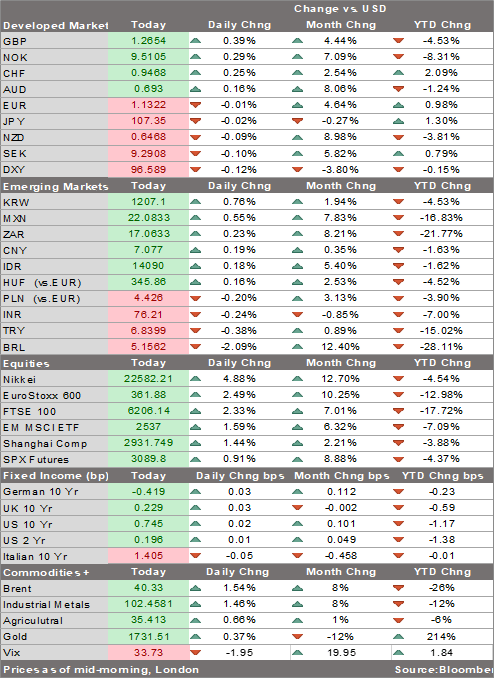

Market sentiment reverse sharply to the positive side due to several factors. These include (1) the Fed beefing up support for the corporate bond market, (2) talk of a $1 trln infrastructure spending proposal from the Trump administration, (3) subsiding second wave virus concerns, (4) optimism about Brexit talks, and (5) more BOJ action. Other major central banks are likely to underscore their dovish credentials this week, including the BOE, SNB, and Norges Bank. And it’s not just DM. Several major EM central banks are expected to deliver rate cuts this week, including Brazil, Indonesia, Taiwan, and Russia. All these actions should keep the risk rally going.

The dollar has suffered from this risk-on sentiment. DXY has fallen two straight days as market sentiment improved and is back below 97. Brexit optimism (see below) has seen the euro trade back above $1.13 area, while sterling has recovered to test the 200-day moving average near $1.27 currently. USD/JPY has not really benefited from the risk-on backdrop and is back to trading in its only 106-108 trading range.

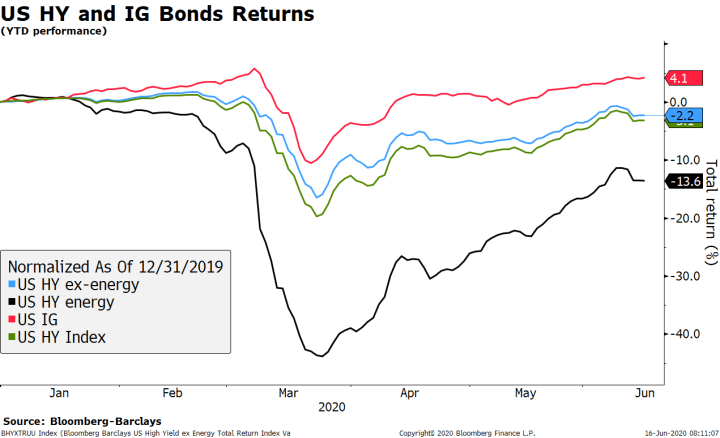

AMERICASThe Fed announced it will begin buying individual corporate bonds under its Secondary Market Corporate Credit Facility. This is an existing facility, but so far, the Fed has only bought ETFs. The Fed said purchases would follow an internally created index of US corporate bonds created expressly for the facility. No details were given about this index, but the Fed stated that “This index is made up of all the bonds in the secondary market that have been issued by US companies that satisfy the facility’s minimum rating, maximum maturity and other criteria. This indexing approach will complement the facility’s current purchases of exchange-traded funds.” This is not terribly surprising or unexpected, but any incremental steps are a risk positive. If nothing else, it serves as a reminder that the Fed continues to expand its balance sheet aggressively. Importantly, this removes the certification requirement for eligibility. Corporate bond indices and ETF rallied on the news. All eyes are on Fed Chair Powell as he delivers his semi-annual report to the Senate today. We expect Powell to stick to his cautious tone in both appearances, despite criticism from Trump officials that he was too dour. Clarida speaks later in the day. Powell then delivers the second part of his semi-annual report to the House tomorrow. The Trump administration is reportedly preparing a large infrastructure bill. Reports put the proposal around the $1 trln mark, with investment directed towards traditional shovel-ready projects as well as technology infrastructure such as 5G and rural broadband. Infrastructure spending should, in spirit, have bi-partisan support – the Democrats have made their own $500 bln proposal. But with a few months ahead of the elections, political calculations will surely be a more important factor in the calculation. Note that there is a still a $1 trln stimulus package still being discussed that’s aimed to support state and local governments. May retail sales will be the US data highlight for the week. Headline sales are expected to rebound 8.4% m/m vs. -16.4% in April, while ex-autos are expected to rise 5.5% m/m vs. -17.2% in April. The so-called control group used for GDP calculations is expected to rise 5.2% mm vs. -15.3% in April. IP will also be reported and is expected to rise 3.0% m/m vs. -11.2% in April. Most June data should show further improvement as more states reopen, but much will depend on how the virus numbers develop. May business inventories (-1.0% m/m expected) will also be reported today. The regional Fed manufacturing surveys for June have started to roll out this week. Yesterday, the Empire survey came in at -0.2 vs. -29.6 expected and -48.5 in May. This is the first snapshot for June and obviously welcomes news. That said, recent China data underscore the man problem with reopening. That is, the factories may be up and running but consumers are not returning to normal spending patterns as long as the risk of infection remains. Still, the trend is positive here. The Philly Fed survey comes out Thursday and is expected at -25.0 vs. -43.1 in May. |

US HY and IG Bonds Returns, 2020 |

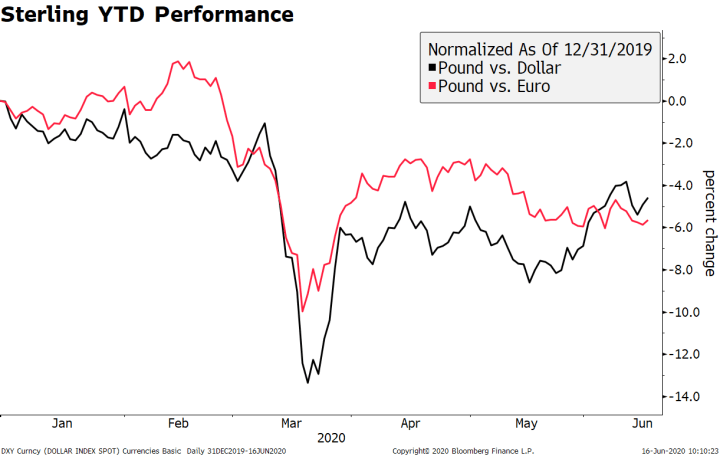

EUROPE/MIDDLE EAST/AFRICAComments from UK and EU officials have sparked optimism about Brexit talks. The phone call between UK Prime Minister Boris Johnson and EU leaders showed that both sides were willing to soften their positions. It also looks as if the UK is serious about not requesting an extension, contrary to our previous view. However, we caution that there have been many such optimistic flare-ups before. Both sides now move on to formal discussions on June 29 in an accelerated period of talks. Sterling is outperforming on the day against both the dollar and euro, albeit modestly. The currency is still down 6% and 5% against the euro and dollar this year, however. The UK reported mixed labor market data. Average earnings slowed to 1.0% in April vs. 1.3% expected and 2.4% in March. On the other hand, the unemployment rate was expected to rise almost a full point to 4.7% but instead was unchanged at 3.9& after employment rose 6k vs. -110k expected. Elsewhere, eurozone June ZEW expectations rose to 58.6 from 46.0 in May. In Germany, ZEW expectations rose to 63.4 from 51.0 in May. |

Sterling YTD Performance, 2020 |

ASIARegional tensions in Asia have been overlooked by the markets. North Korea blew up an inter-Korean liaison office on its side of the border. Whilst having no direct impact on the South, Seoul put its military on heightened alert. Elsewhere, India said three of its soldiers were killed in a clash with Chinese troops at their border high in the Himalayas. These were the first casualties from skirmishes in this meeting in four decades. Both of these developments bear watching for but now, they are not enough to derail this current rally in risk assets. The BOJ kept rates on hold but boosted its pandemic loan program. As expected, the bank didn’t change its policy rate from -0.1% or the 10-year target of 0.0%. However, it did increase the Special Program to Support Financing in Response to Covid-19 by ¥35 trln to ¥110 trln total. This will come through an increase in the funding measures for interest-free and unsecured loans from banks. The yen was little changed, and yields were up a couple of basis points across the curve. Nikkei closed up nearly 5% on the news and is outperforming many developed markets on the year (-4.5%). Reserve Bank of Australia released its minutes. The bank appears content with how its policies are working but warned that the economy is likely to need policy support for some time despite signs of improvement. It noted that “timelier payroll data suggested that the pace of job losses had slowed towards the end of April.” May jobs data will be reported Thursday. Jobs are expected to fall -78.8k vs. -594.3k in April, while the unemployment rate is seen rising to 6.9% from 6.2% in April. Preliminary May retail sales will be reported Friday. With Yield Curve Control in place and working, the bank is clearly in wait and see mode for now. |

Tags: Articles,Daily News,Featured,newsletter