With Cyril Monnet and Remo Taudien. University of Bern Discussion Paper 25.01, January 2025. PDF. The proposed revision of the Swiss Banking Act introduces a public liquidity backstop (PLB) for distressed systemically important banks (SIBs), in part to facilitate resolution. We examine the impact of the PLB on fiscal balances, societal welfare, and the incentives of bank shareholders and management. A PLB, like too-big-to-fail (TBTF) status, acts as a subsidy for non-convertible...

Read More »“Money and Banking with Reserves and CBDC,” JF, 2024

Journal of Finance. HTML (local copy). Abstract: We analyze the role of retail central bank digital currency (CBDC) and reserves when banks exert deposit market power and liquidity transformation entails externalities. Optimal monetary architecture minimizes the social costs of liquidity provision and optimal monetary policy follows modified Friedman rules. Interest rates on reserves and CBDC should differ. Calibrations robustly suggest that CBDC provides liquidity more efficiently than...

Read More »“Retail CBDC and the Social Costs of Liquidity Provision,” VoxEU, 2023

VoxEU, September 27, 2023. HTML. From the conclusions: … it is critical to account for indirect in addition to direct social costs and benefits when ranking monetary architectures. … the costs and benefits we consider point to an important role of central bank digital currency in an optimal monetary architecture unless pass-through funding is necessary to stabilise capital investment and very costly. … the interest rate on CBDC should differ from zero and from the rate on reserves. From...

Read More »“Money and Banking with Reserves and CBDC,” CEPR, 2023

CEPR Discussion Paper 18444, September 2023. HTML (local copy). Abstract: We analyze the role of retail central bank digital currency (CBDC) and reserves when banks exert deposit market power and liquidity transformation entails externalities. Optimal monetary architecture minimizes the social costs of liquidity provision and optimal monetary policy follows modified Friedman (1969) rules. Interest rates on reserves and CBDC should differ. Calibrations robustly suggest that CBDC provides...

Read More »Report of the Banking Stability Expert Group

The “Banking Stability” Expert Group that was formed following the failure of Credit Suisse has published its report (in German). I quote and add my own comments in brackets […]. Summary: Die staatlich unterstützte Übernahme der Credit Suisse durch die UBS im März 2023 hat eine gefährliche Situation schnell stabilisiert. Die Schweiz hat damit einen wichtigen Beitrag zur internationalen Finanzstabilität geleistet. Die Credit Suisse war am 19. März 2023 die erste global systemrelevante Bank...

Read More »“Payments and Prices,” CEPR/SNB, 2023

CEPR Discussion Paper 18291 and SNB Working Paper 3/2023, July 2023. HTML, PDF (local copy CEPR, local copy SNB). We analyze the effect of structural change in the payment sector and of monetary policy on prices. Means of payment are obtained through portfolio choices and commodity sales and “liquified” through velocity choices. Interest rates, intermediation margins, and costs of payment instrument use affect portfolios, velocities, liquidity, relative prices, and the aggregate price...

Read More »“Dunkle Perspektiven: Wenn auch die UBS gerettet werden müsste (Chilling UBS Rescue Scenario),” SRF, 2023

Echo der Zeit, SRF, 12 May 2023. HTML with link to audio file. Implications of capital injections and liquidity assistance for the federal government, the SNB, and Switzerland.

Read More »Bank Solvency vs. Liquidity

Recall this post from six years ago. Òscar Jordà, Björn Richter, Moritz Schularick, and Alan M. Taylor suggest that higher bank capital ratios help stabilize the financial system ex post but not ex ante, and that illiquidity breeds fragility.

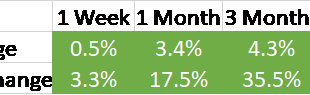

Read More »Weekly Market Pulse: Just A Little Volatility

Markets were rather volatile last week. That’s a wild understatement and what passes for sarcasm in the investment business. Stocks started the week waiting with bated (baited?) breath for the inflation reports of the week. It isn’t surprising that the market is focused firmly on the rear view mirror for clues about the future since Jerome Powell has made it plain that is his plan, goofy as it is. Stocks were down slightly Monday and Tuesday fearing the worst and...

Read More »The Russians (Propaganda) Are Coming!

The headline reads “Moscow World Standard to Destroy LBMA’s Monopoly in Precious Metals Pricing”. Wow! Could it be? Is this it?! The gold revaluation we’ve all been waiting for! Someone, who has the power, will give us a venue in which we can sell our gold at its true price… how does $50,000 sound, eh? Not so fast. Betting Against the Incumbent? For one thing, there are sanctions. If you’re a citizen of a Western country, there is a legal barrier between you and a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org