It certainly seems that technological advances make our lives better. Instead of writing a letter, stamping it, and mailing it (which was vastly more personal), we now send emails. Rather than driving to a local retailer or manufacturer, we order it online. Of course, we mustn’t dismiss the rise of social media, which connects us to everyone and everything more than ever. Economists and experts have long argued that technological advances drive U.S. economic...

Read More »Risks Facing Bullish Investors As September Begins

Since the end of the “Yen Carry Trade” correction in August, bullish positioning has returned with a vengeance, yet two key risks face investors as September begins. While bullish positioning and optimism are ingredients for a rising market, there is more to this story. It is true that “a rising tide lifts all boats,” meaning that as the market rises, investors begin to chase higher stock prices, leading to a virtual buying spiral. Such leads to an improvement in...

Read More »Japanese Style Policies And The Future Of America

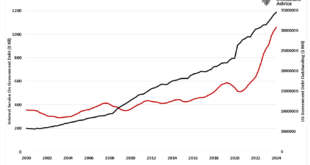

In a recent discussion with Adam Taggart via Thoughtful Money, we quickly touched on the similarities between the U.S. and Japanese monetary policies around the 11-minute mark. However, that discussion warrants a deeper dive. As we will review, Japan has much to tell us about the future of the U.S. economically. Let’s start with the deficit. Much angst exists over the rise in interest rates. The concern is whether the government can continue to fund itself, given...

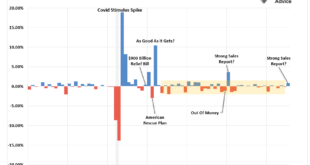

Read More »Red Flags In The Latest Retail Sales Report

The latest retail sales report seems to have given Wall Street something to cheer about. Headlines touting resilience in consumer spending increased hopes of a “soft landing” boosting the stock market. However, as is often the case, the devil is in the details. We uncover a more troubling picture when we peel back the layers of this seemingly positive data. Seasonal adjustments, downward revisions, and rising delinquency rates on credit cards and auto loans suggest...

Read More »What happens if the debt ceiling raises

It’s that time again when the US government has to prepare itself for an internal battle to raise the debt ceiling so it can meet various obligations. This is a merry dance that has been danced before, as we mention below. For sure, every time it happens fewer and fewer people are convinced of the trustworthiness of the US dollar. This combined with the recent announcement by Saudi Arabia of its willingness to consider trading in currencies other than the US Dollar...

Read More »Ep 50 – Brent Johnson: Has the Dollar Milkshake Spilled or Just Begun?

Is the dollar heading to new heights or new lows? Brent Johnson of Santiago Capital joins the Gold Exchange Podcast LIVE in New Orleans! Listen to Brent discuss the historic rise of the DXY, the effects on (d)emerging markets, and how he sees a currency and sovereign debt crisis playing out. Will Powell be able to solve Triffin’s Dilemma? Can foreign central banks escape the zugzwang position? Will the financial justice warriors finally be vindicated? Watch the full...

Read More »Ep 39 – Tavi Costa: Breaking Down the Pressures on the Market

Tavi Costa of Crescat Capital joins Keith and Dickson on the Gold Exchange Podcast to talk about the current state of the market, investing in good times and bad, and what future indicators to watch. Connect with Tavi on Twitter: @TaviCosta Connect with Keith Weiner and Monetary Metals on Twitter: @RealKeithWeiner@Monetary_Metals [embedded content] Additional Resources Fed Zugzwang Germany Announcement Jerome Powell Nose Tweet Bloomberg Misery Index Zombie Company...

Read More »Inflation

(Traveling and unable to provide a technical overview this week.) Rising price pressures, stronger and more persistent than generally expected, has been the main challenge for consumers, businesses, and policymakers. It will stay top of mind in the week ahead as both the world's two largest economies, the US and China, report July consumer and producer prices. During the Great Depression, the central governments discovered their balance sheets, and budget deficits...

Read More »David Graeber’s “Debt”

Goodreads rating 4.19. Graeber’s book contains many interesting historical observations but lacks a concise argument to convince a brainwashed neoclassical economist looking for coherent arguments on money and debt. After 60 pages, 340 more seemed too much. Chapter one: … the central question of this book: What, precisely, does it man to say that our sense of morality and justice is reduced to the language of a business deal? What does it mean when we reduce moral obligations to debts? …...

Read More »How China Lends

In a CEPR discussion paper, Anna Gelpern, Sebastian Horn, Scott Morris, Brad Parks, and Christoph Trebesch document “How China Lends: A Rare Look into 100 Debt Contracts with Foreign Governments:” China is the world’s largest official creditor, but we lack basic facts about the terms and conditions of its lending. … We collect and analyze 100 contracts between Chinese state-owned entities and government borrowers in 24 developing countries … First, the Chinese contracts contain...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org