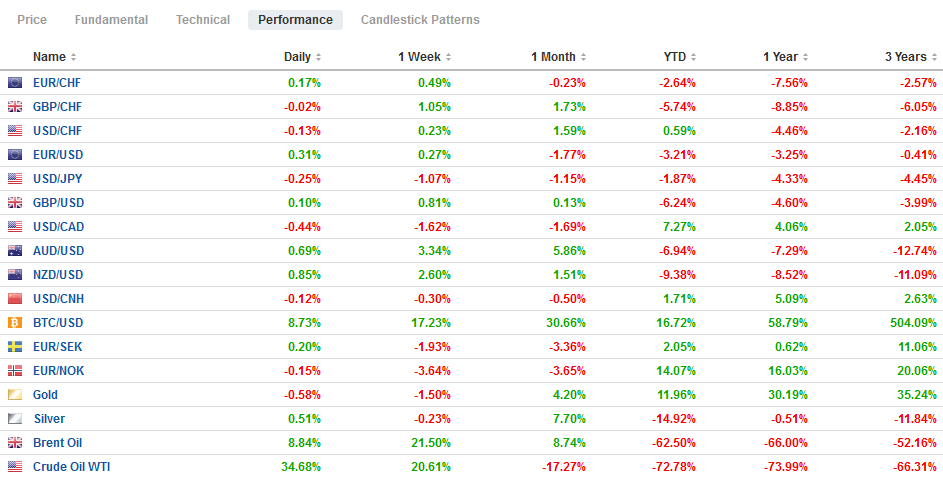

Swiss Franc The Euro has risen by 0.05% to 1.0553 EUR/CHF and USD/CHF, April 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The dollar is lower across the board as dealers attribute the selling to month-end pressures ahead of the FOMC today and ECB tomorrow and long-holiday weekend for many. Japan’s Golden Week holiday has already begun. Despite the loss in US equities yesterday, despite the higher opening, it has not spilled over, as Alphabet earnings helped lift sentiment. The MSCI Asia Pacific Index rose for a third session as is approaching the halfway mark of this year’s range. Europe’s Dow Jones Stoxx 600 little changed near the month’s high. US shares are firm, and the S&P 500 is poised to recover

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Australia, Currency Movement, ECB, Featured, Federal Reserve, Italy, newsletter, South Korea, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.05% to 1.0553 |

EUR/CHF and USD/CHF, April 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The dollar is lower across the board as dealers attribute the selling to month-end pressures ahead of the FOMC today and ECB tomorrow and long-holiday weekend for many. Japan’s Golden Week holiday has already begun. Despite the loss in US equities yesterday, despite the higher opening, it has not spilled over, as Alphabet earnings helped lift sentiment. The MSCI Asia Pacific Index rose for a third session as is approaching the halfway mark of this year’s range. Europe’s Dow Jones Stoxx 600 little changed near the month’s high. US shares are firm, and the S&P 500 is poised to recover most of yesterday’s loss. Caterpillar earnings before the US are awaited for global economic insight as it operates in nearly all countries. Peripheral European bond yields begin off higher, with Italy under the most pressure after Fitch downgraded it late yesterday. Core bond yields are a little lower, and the US 10-year is near 60 bp. The Antipodean currencies are leading the move against the US dollar by the major currencies, with sterling the laggard, having been turned back from the $1.25 area yesterday. JP Morgan’s Emerging Market Currency Index rose a little more than 1% yesterday, its best showing in April, and is extending those gains today. Gold is little changed, hovering around $1700, while oil is firmer. |

FX Performance, April 29 |

Asia Pacific

Australia’s Q1 CPI was reported a bit higher than expected at 2.2% year-over-year. This was above the Bloomberg survey median forecast of 1.9% after 1.8% in Q4 19.This represents a five-year high. The trimmed mean was also higher at 1.8% (vs. 1.6% in the previous quarter). Food (vegetable prices) and pharmaceuticals lifted the CPI. The rise in price pressures is understood to be temporary with deflationary forces from the compression of demand, and falling oil prices likely be evident in Q2.

South Korea saw March industrial output jump 4.6% or more than three times more than economists expected. In February, industrial production fell by 3.8%. The number of working days may have helped inflate the series. Tomorrow South Korea reports April trade figures as is seen as a barometer of regional and electronic trade. Foreign investors had been large sellers of South Korean equities this month, but it has slowed in recent days.

The dollar is extending its fall against the Japanese yen for the sixth consecutive session. It has not closed above JPY108 since April 10 and is now near JPY106.35, which is the lowest level since March 17. The next important technical target is closer to JPY105.20. Immediate resistance is seen around JPY106.60 and then JPY107.00. The Australian dollar reached almost $0.6550, its best level since March 10. The next target is around $0.6600, and the 200-day moving average is closer to $0.6700. Here is April, the Aussie has led the majors with around a 6.3% rally. The New Zealand dollar is in second place with about a 2.2% gain. The yen is the third-best with roughly a 1% gain. The Chinese yuan is little changed as the dollar is “trapped” in a CNY7.06-CNY7.0950 range. It is virtually unchanged this month.

Europe

Although S&P did not downgrade Italy ahead of last weekend, Fitch moved late yesterday, cutting the sovereign rating to BBB-, but it changed the outlook to stable from negative. Remember how the ECB works. It takes the best rating of the four main agencies (includes DBRS). Also, the ECB has indicated since Italy had an investment-grade rating in early April, that it would continue to accept its bonds as collateral through September 2021, if it lost it. The ECB’s backstop may be the critical consideration allowing Italy to keep the investment-grade status.

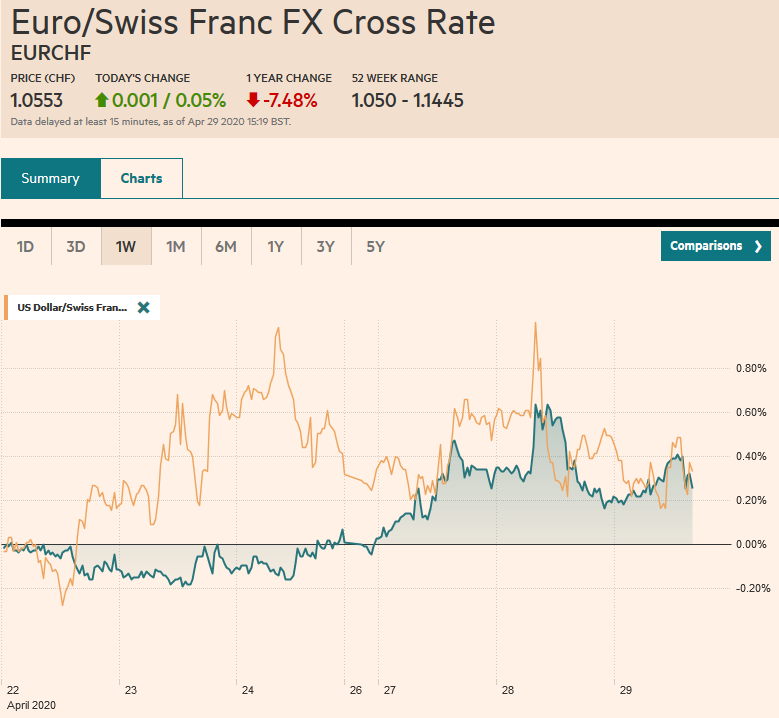

| Italy, Spain, and France will report Q1 GDP estimates ahead of the aggregate figure tomorrow. The median forecast in the Bloomberg survey sees a 3.7% quarter-over-quarter contraction. Separately, the preliminary April CPI will be reported. The headline pace is expected to slow to 0.1% from 0.7%, and the core rate may fall to 0.7% from 1.0%. The ECB meets tomorrow. There is some expectation that it will increase is Pandemic Emergency Purchase Program from 750 bln euros announced six weeks ago. While an increase is likely at some point, we see it as too soon now. In terms of the signaling effect, it could achieve the same by suggesting that its operations are scalable. Separately, alongside a surge in M3 money supply growth (7.5% vs. 5.5%), lending to non-bank financial companies surged in March to about 118 bln euros, which is near twice the previous record from December 2007. |

Germany Consumer Price Index (CPI) YoY, April 2020(see more posts on Germany Consumer Price Index, ) Source: investing.com - Click to enlarge |

The euro reached almost $1.0890 yesterday before being sold in the North American session back to $1.0820. Today it was bid to about $1.0875 in the European morning before running out of steam. Two sets of expiring options catch our eye today. The first is for 1.1 bln euros at $1.0865. The other is a set of options between $1.08 and $1.0815 for 1.5 bln euros. Tomorrow there are options for 1.9 bln euros struck at $1.08 that will expire.Sterling is also trading within yesterday’s range (~$1.2405-$1.2520). There is an option for roughly GBP270 mln at $1.2415 that will be cut today. We are monitoring a topping pattern (head and shoulders) in sterling. A close above $1.25 would threaten it, and a break of roughly $1.23 would confirm it.

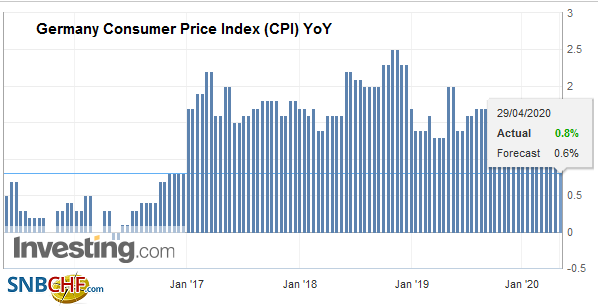

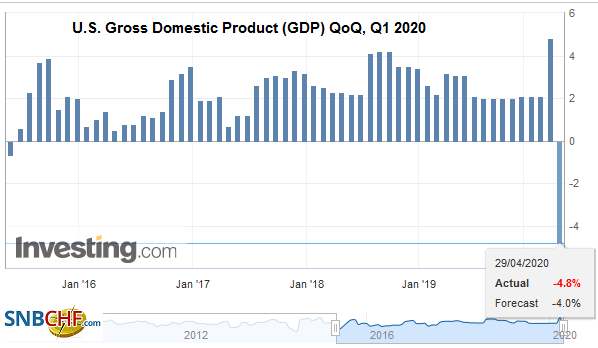

AmericaThe first estimate of Q1 US GDP will have little bearing on policy or the present discounted value of investments. It is little more than an intellectual curiosity. No matter how poor it is, the one thing that everyone seems to agree on is that Q2 will be far worse. The median in a recent Reuters poll anticipates a 4.8% contraction. The Bloomberg survey found a median forecast of a 4.0% decline in output, and The Wall Street Journal’s poll’s median expectation is a 3.5% fall. A great amount of ink has been spilled, so to speak, in arguing about whether this is a recession or depression. It is like how many angels dance on the head of a pin. There is no fixed definition of the end of a business cycle. Two consecutive quarters is a rule of thumb and one that the US does not officially use. The record-long US expansion has come to a dramatic end as opposed to fading away as we had thought had begun before the crisis. Estimates of Q2 GDP appear to be running for the most part in the -20% to -30% range. |

U.S. Gross Domestic Product (GDP) QoQ, Q1 2020(see more posts on U.S. Gross Domestic Product, ) Source: investing.com - Click to enlarge |

The FOMC meets today amid criticism that the Fed has done too much; that it is buying everything and creating powerful moral hazards in its wake, while others push it to do more. A recent call from the former President of the Minneapolis Federal Reserve for negative interest rates fanned speculation that this could happen as soon as today. Don’t hold your breath. Negative interest rates are an ongoing experiment, and the preliminary results are not very favorable. In fact, the crisis has not seen a central bank with negative interest rates go further down that path. Numerous Fed officials indicated the likelihood is slim-to-none. The more relevant question is could US rates go negative without such a move by the Fed. While the sample size is small, only countries where the central bank took policy rates below zero have bond yields gone negative. It is true that US T-bills briefly trading with an implied negative yield, but this was an exception and an expression of the dysfunctional market at the time. Most assuredly, the Fed is definitely not buying everything. Many central banks, including the Swiss National Bank and the Bank of Japan, have bought equities (for the former international stocks and the latter domestic ETFs).The Fed has not, and Treasury Secretary Mnuchin said just yesterday that he did not expect this to change.

There are three areas that the Fed could move. First, there is some thought that the officials may want to include some non-for-profits in its Main Street lending program. Non-for-profit businesses can apply to assistance under the federal government”s programs, including the Payroll Protection Program. Second, the Treasury is likely going to ramp up its T-bill issuance to raise funds for its massive stimulus efforts. To avoid disruptions, the Federal Reserve may resume its purchases. Third, short-term US benchmarks, including the effective fed funds rate, but also the secured overnight financing rate and general collateral rates are below 10 bp the Fed pays on reserves and is just above zero. The FOMC may tweak the rate of reverse repos (10 bp) and/or interest rate on reserves higher, rather than lower as those talking about negative rates would suggest. Moreover, Congress authorized the Fed to pay interest on reserves. It is not clear that this authorizes it to charge a negative rate on reserves.

The US dollar is near a two-week low against the Canadian dollar around CAD1.3920. It fell the first two sessions this week, and coming into today had fallen in four of the past five sessions. The price action underscores our insight that the Canadian dollar is more sensitive to the broader risk environment than it is to oil prices (most of the time). The break of the CAD1.40 area targets the month’s low (~CAD1.3855). The greenback rose every session last week against the Mexican peso but fell Monday and Tuesday, and is lower today. It peaked at the end of last week near MXN25.29 and tested the MXN24.10 today. A break of targets the MXN23.80.

Tags: #USD,Australia,Currency Movement,ECB,Featured,federal-reserve,Italy,newsletter,South Korea