With its 0 billion bond-buying expansion in response to the COVID crisis, the Federal Reserve has thrust itself into the limelight. Like a sixteen-year-old with a credit card, the Fed is salivating over what money-printing powers it shall seize next. How is the prudent investor to respond? First, what the Fed’s already done: pushed interest rates to zero and expanded into “unlimited” buying of assets, now reaching to corporate bonds and local government bonds. These bring the same concerns we had in 2008: trillions in new money to dilute the spending power of current savers, along with the risk of “moral hazard” where government covers the losses for corporate, and government, irresponsibility. What’s more concerning is what the Fed might do next. Proposals are

Topics:

Peter St. Onge considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

With its $700 billion bond-buying expansion in response to the COVID crisis, the Federal Reserve has thrust itself into the limelight. Like a sixteen-year-old with a credit card, the Fed is salivating over what money-printing powers it shall seize next. How is the prudent investor to respond?

With its $700 billion bond-buying expansion in response to the COVID crisis, the Federal Reserve has thrust itself into the limelight. Like a sixteen-year-old with a credit card, the Fed is salivating over what money-printing powers it shall seize next. How is the prudent investor to respond?

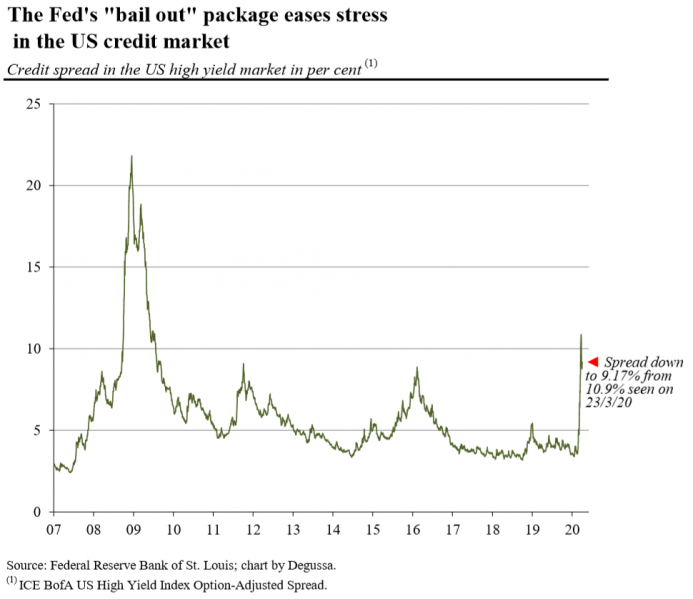

First, what the Fed’s already done: pushed interest rates to zero and expanded into “unlimited” buying of assets, now reaching to corporate bonds and local government bonds. These bring the same concerns we had in 2008: trillions in new money to dilute the spending power of current savers, along with the risk of “moral hazard” where government covers the losses for corporate, and government, irresponsibility.

What’s more concerning is what the Fed might do next. Proposals are floating up for four very corrosive measures: negative interest rates; directly subsidizing bonds; writing Fed checks for corporate equity or for a universal basic income up to $72,000 per year; and letting poor countries effectively print their own US dollars.

All four may be bonkers, but they carry significant political risk, because they enjoy support not just from the redistributionist left, but also “business conservatives” happy to raid our future to make their pain stop.

Why bonkers? Even champions concede that negative rates would need compulsory rules such as declaring worthless all serial numbers ending in zero, or forcing Americans to use “crypto” dollars that automatically devalue. Subsidizing bonds by targeting interest rates would permanently suck capital from the private sector into unlimited local government spending. Buying corporate equity risks turning every business in America into a government-run entity, a road Japan is already well along. Meanwhile, printing up $72,000 per family per year, or letting Guatemala print US dollars at will, is the kind of thing one expects from crash-the-dollar Bitcoiners, not from Congress and central bankers.

The common thread of all these proposals is to triple down on the money printing and gamble covering of 2008—spreading unlimited dollars to, especially, big business and governments, the price of it all to be paid by those unwise enough to either not work for the government or to not have a good lobbyist.

Alas, the joy of all that generosity is immediate but the pain is paid over decades, as savers are diluted by the new trillions. This fear was muted in 2008, because the ensuing recession lasted so long that new money was largely saved. If, as some expect, COVID leads to a V-shaped recovery, that inflation may come with a vengeance this time.

Beyond inflation, this level of spending risks permanent distortions in capital markets—a permanent siphon of trillions from the private sectors and individuals to the government and politically favored sectors. All that new money artificially props up prices, and the longer they remain propped up, the longer capital flows towards the prop. Even after the crisis, no politician, much less Trump, will want to be the guy who takes away the punch bowl.

And this is already becoming a supersized punch bowl. We can only imagine the pressure to keep propping, say, local government borrowers, again becoming a permanent siphon on the productive economy.

Historically pandemics have a limited impact on long-term growth. After all, as Austrian theory emphasizes, an economy is made of entrepreneurs forever seeking new desires to satisfy. This process does not stop just because a disease temporarily shutters businesses. There is a hit to wealth, yes, but the fundamental workings of an economy are not affected by pandemics any more than by an earthquake or a bad winter.

That said, what can affect the fundamental workings of an economy is radical policies that impose new burdens on producers, whether in the form of new regulations or new taxes to pay for a raft of handouts. We can see the difference in America’s last two pandemics, in 1957 and 1968. When policy was prudent, in 1957, recovery was very fast. When policy was interventionist, as in 1968, the pain lasted for a generation, through the 1970s and into the 1980s.

As for inflation, Austrian models of money demand suggest little risk during the recession itself, as excess money is saved, but a raised risk if we do get that V-shaped recovery and cash savings are spent. And, of course, stagflation becomes a real possibility if the government follows the 1970s playbook of economy-wrecking reforms while pumping out all that fresh cash.

It’s still possible for us to get out of this relatively economically intact, but only if we reign in the empire-builders in Washington now.

Tags: Featured,newsletter