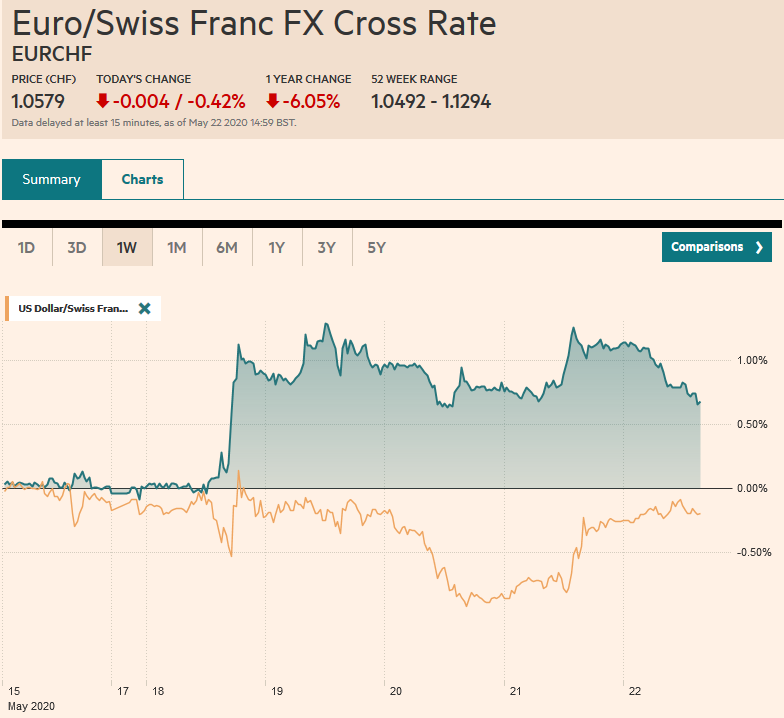

Swiss Franc The Euro has fallen by 0.42% to 1.0579 EUR/CHF and USD/CHF, May 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US has ratcheted up pressure on China on several fronts and has sapped risk appetites ahead of the weekend. Equity markets are lower across the world. Even in India, where the central bank unexpectedly cut the repo rate 40 bp, shares fell 0.7%. It was Hong Kong’s 5.5% that led the region lower. Europe’s Dow Jones Stoxx 600 is off around 1% in late morning turnover to pare this week’s gain to about 2.5%. US shares are trading heavily, and the S&P 500 is posed trim this week’s 3% gain coming into today’s session. The dollar is bid against nearly all the world’s currencies. The yen

Topics:

Marc Chandler considers the following as important: $CNY, 4.) Marc to Market, 4) FX Trends, Bank of Japan, Currency Movement, Featured, Federal Reserve, India, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.42% to 1.0579 |

EUR/CHF and USD/CHF, May 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

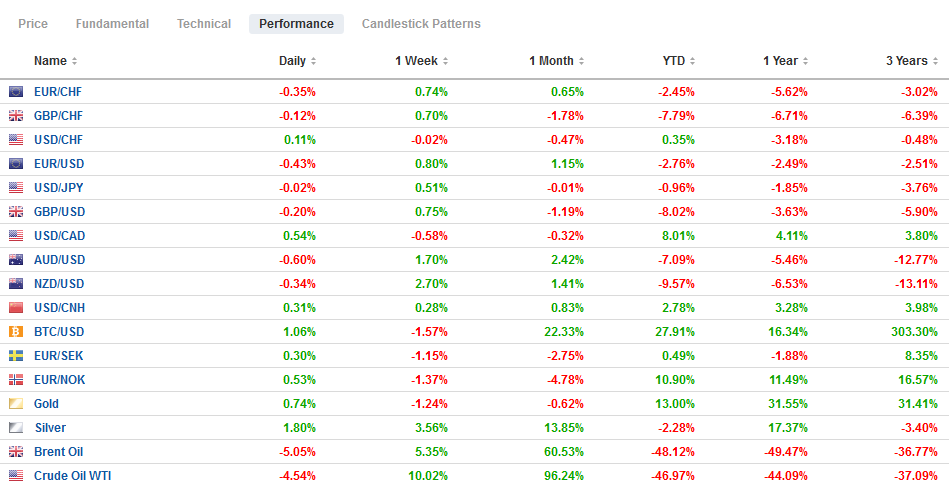

FX RatesOverview: The US has ratcheted up pressure on China on several fronts and has sapped risk appetites ahead of the weekend. Equity markets are lower across the world. Even in India, where the central bank unexpectedly cut the repo rate 40 bp, shares fell 0.7%. It was Hong Kong’s 5.5% that led the region lower. Europe’s Dow Jones Stoxx 600 is off around 1% in late morning turnover to pare this week’s gain to about 2.5%. US shares are trading heavily, and the S&P 500 is posed trim this week’s 3% gain coming into today’s session. The dollar is bid against nearly all the world’s currencies. The yen flat. For the week, though, the dollar is softer against all the majors but the yen and Swiss franc. Among emerging market currencies, the Russian rouble and South African rand are the weakest, losing more than 1% against the US dollar. The JP Morgan Emerging Market Currency Index is snapping a four-day advance with a loss of about 0.4%. Gold slipped to $1717 and rebounded to $1735-$1740 today. Oil prices are tumbling, and the July WTI contract is off around 6% to end a six-day advance. If sustained, it would be the biggest loss of the month. |

FX Performance, May 22 |

Asia Pacific

We suspect that many observers are making too big a deal of China dropping its formal 2020 GDP target. There are no policy implications as more stimulus is expected in the coming weeks. More importantly, Premier Li defended the measures to crack down on dissent as allowing Hong Kong and Macau “fulfill their constitutional responsibilities.” This comes as the US State Department is to issue a report as early as next week, which if Hong Kong’s autonomy is not affirmed, the Special Administrative Region could lose its trade privileges with the US. Hong Kong is not subject to the tariffs applied to the mainland. The US is taking measures that may lead to many Chinese stocks losing their listings in the US. According to Bloomberg, without the 140 listings, which account for $383 bln in market capitalization, the NASDAQ would go from being up 5% to being down almost 7%.

India’s central bank cut the key repo rate by 40 bp in a surprise more. The repo rate now stands at 4.0%, the lowest since being introduced in 2000. The door was left open to additional rate cuts. The central bank also extended by another three months, to the end of August, the debt moratorium.

The Bank of Japan held an emergency meeting today. It launched a new JPY30 trillion (~$280 bln) facility to aid small businesses. It raises the BOJ’s response to about JPY75 trillion, which includes funds to purchase commercial paper and corporate bonds. The government’s fiscal response is estimated to be nearly JPY120 trillion. Separately, but related, Japan reported that core CPI, which excludes fresh food prices, fell back below zero (-0.2%) for the first time since the end of 2016. Excluding energy along with fresh food prices, Japan’s CPI slipped to 0.2% from 0.6%.

The dollar threatened the upper end of its recent range near JPY108 on Tuesday, but has been making successive lower highs and has given up this week’s gains. The greenback finished last week near JPY107.25 and is trading below JPY107.50 in European turnover. There are expiring options for $1.3 bln struck in the JPY107.45-JPY107.50 range today. The Australian dollar was also threatening a breakout higher above $0.6600 earlier this week and tested support today near $0.6510, the four-day low, where it found a bid in the European morning. Ahead of the weekend, the $0.6550 area may be a sufficient cap. The pressure on China has seen the yuan fall to new lows for the year today. The dollar rose to almost CNY7.1440. Last September, it reached almost CNY7.1850. The PBOC set dollar’s reference rate a little lower than the bank models suggested.

Europe

The market seems of two minds about the euro. On the one hand, many observers seem to be gushing over the German-French proposal that would allow the EU to borrow 500 bln euros and provide grants to countries needing funds for reconstruction. It seems more wishful thinking by those who think it is a step toward fiscal union. However, common bonds have existed for some time through the European Stabilization Mechanism and the European Investment Bank. The EU has also issued joint bonds in the past. The celebrations also ride roughshod over counter-proposals and objections by other creditor countries. Moreover, EMU is the monetary union, and it is difficult to square that with a fiscal union on the EU level.

On the other hand, the German Constitutional Court ruling that claims the right of the national court to overrule the European Court of Justice has yet to find a resolution. In fact, the German court urged the Bundestag and the government to push the ECB for a justification of its policies that many believe it has already made. Any concession to the German court risks encouraging other members to challenge EU laws and the European Court of Justice. Former German Finance Minister Schaeuble is the President of the Bundestag, and reports suggest he feel obligated to fulfill the German court ruling.

The UK reported a record collapse of 18.1% in April retail sales. It was a bit more than expected, but the difference seems to be largely a function of the drop in petrol prices. There are limited policy implications. The Bank of England is widely expected to increase its bond purchases at next month’s meeting even before today’s report. The UK two-year Gilt yield fell to a new record low of minus 7 bp today.

The euro ran into a wall of sellers when it poked above $1.10 yesterday for the first time since the start of the month. It has been sold below $1.09 in Europe today. There are options for roughly 2.75 bln euros struck between $1.0875and $1.0885 that will expire today. Another set of options for almost 2.6 bln euros that will roll-off today have been placed between $1.0855 and $1.0860. The price action appears to reinforce the broader trading range. Sterling fell every day last week and bounced on Monday and Tuesday this week but has turned down again. It is nursing its third consecutive decline today that brought it down to nearly $1.2160. The high for the week was set just shy of $1.23. The expiry of a nearly GBP755 mln option at $1.22 may cap the upside, at least in the US morning. Note that both the US and UK are on holiday on Monday.

America

The US calendar is light today, and the main feature to note is the Baker Hughes oil rig count. The count has fallen for the past nine weeks from 683 in mid-March to 258 as of last week. The rally in oil prices above $30 may see some rigs return to operation in the coming weeks. Canada and Mexico report March retail sales. The data is too old to matter much, and the broader risk appetite (low today) will be more important for the immediate price action.

Foreign central banks that were large sellers of US Treasury bonds in the market turmoil in the early days of the pandemic are rebuilding now. In the six weeks through mid-April, foreign central banks liquidated about $155 bln of Treasuries from their custody account at the Federal Reserve. In the week through Wednesday, they bought $19 bln of Treasuries to bring the replenishment operations in the past six weeks to nearly $75 bln. The Fed’s balance sheet increased by $103 bln last week after $212 bln the previous week.

The US dollar had approached the lower end of its two-month range against the Canadian dollar this week (~CAD1.3850). It held, and the greenback is resurfacing above CAD1.40 in the European morning. Resistance is seen in the CAD1.4100-CAD1.4115 area. The US dollar had sunk to its lowest level against the Mexican peso since late March yesterday, reaching almost MXN22.75, culminating a four-day slide. It is recovering today and reached MXN23.16 before consolidating. Around MXN23.00, the dollar is off about 4.2% this week. The peso is the strongest currency in the world here in May, gaining about 5.4% against the dollar.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,Bank of Japan,Currency Movement,Featured,federal-reserve,India,newsletter