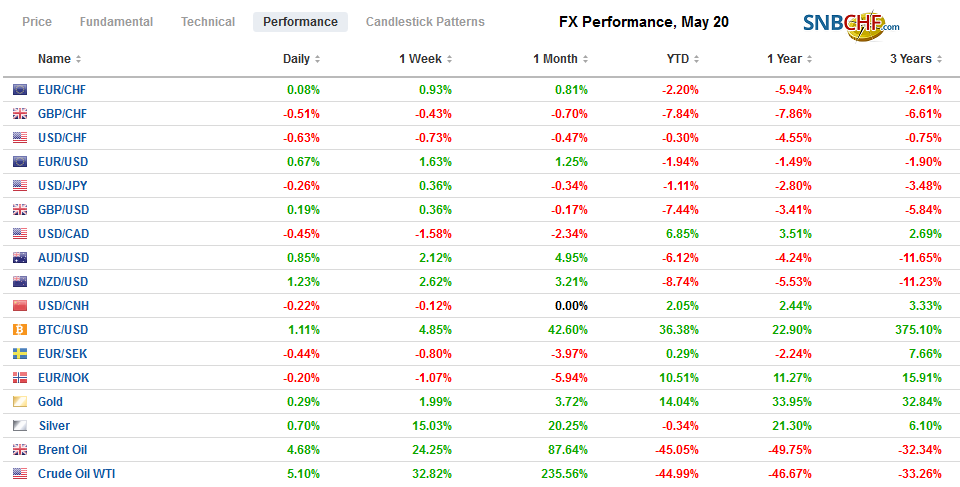

Swiss Franc The Euro has fallen by 0.13% to 1.0592 EUR/CHF and USD/CHF, May 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Another late sell-off of US equities, ostensibly on questions over Moderna’s progress on a vaccine, failed to deter equity gains in the Asia Pacific region. China was a notable exception, but the MSCI Asia Pacific Index rose for the fourth consecutive session. European shares are little changed, but reflects a split. On the one hand, health care and utility sectors are up more than 1%, while financials and real estate are off more than 1%. Meanwhile, US shares are higher with the S&P 500 poised to recoup most of the late losses seen yesterday. Bond markets are quiet, with yields

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Brazil, China, Currency Movement, EU, EUR/CHF, Eurozone Consumer Price Index, Eurozone Core Consumer Price Index, Eurozone Current Account, Featured, Federal Reserve, FX Daily, negative rates, newsletter, Turkey, U.K. Consumer Price Index, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.13% to 1.0592 |

EUR/CHF and USD/CHF, May 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Another late sell-off of US equities, ostensibly on questions over Moderna’s progress on a vaccine, failed to deter equity gains in the Asia Pacific region. China was a notable exception, but the MSCI Asia Pacific Index rose for the fourth consecutive session. European shares are little changed, but reflects a split. On the one hand, health care and utility sectors are up more than 1%, while financials and real estate are off more than 1%. Meanwhile, US shares are higher with the S&P 500 poised to recoup most of the late losses seen yesterday. Bond markets are quiet, with yields mostly edging higher. The US 10-year yield is little changed below 70 bp. The dollar is nursing losses against most of the major and emerging market currencies. The New Zealand dollar is leading the majors higher as negative rates speculation there eased. The JP Morgan Emerging Market Currency Index is higher for the third consecutive session, which, if maintained, would be the longest advance in more than a month. Gold is hovering around $1750, while July crude oil continues to consolidate after Monday’s surge. |

FX Performance, May 20 |

Asia Pacific

Japan reported that Q1 GDP contracted by 0.9% (quarter-over-quarter) on Monday, and that makes most Q1 data moot, but today’s core machine orders for March drew attention. The 0.4% decline followed a 2.3% gain in February and was considerably better than the 6.5% drop economists expected in the Bloomberg survey. However, this overstates the case. In a different time series, machine tool orders collapsed 48.3% in March. The April report is due next week. Separately, a supplemental budget is being planned for August-September that would aid small businesses.

As anticipated, China lefts its loan prime rate unchanged. The one-year rate is at 3.85%, and the five-year is at 4.65%. China is expected to reduce rates and step up spending in the period ahead. Meanwhile, fresh from rebuffing efforts to give Taiwan observer status at the WHO summit (which might help explain the US threat to pull out), China is pushing back against US Secretary of State overtures to Taiwan. Pompeo also pressed China about the Panchen Lama, who was kidnapped in 1995 at the age of 6.

Talk of negative rates in New Zealand had weighed on the Kiwi. Today, RBNZ Governor Orr seemed to de-emphasize it, suggesting that it remains “some ways off.” He suggested as we had read his earlier remarks that there were other policy moves that would come first. Orr wants a low and flat curve. The New Zealand dollar is firm, consolidating the 2.3% gain of the past two sessions.

The dollar poked above JPY108 briefly yesterday for the first time since April 23 and stalled in front of the 200-day moving average (~JPY108.30). It pushed back to JPY107.60 in the European morning, where bids were found. There is an expiring option for almost $600 mln at JPY107.70 and another for around $935 mln at JPY108.00. The intraday technicals suggest scope for the dollar to recover. After making a fresh two-month high yesterday (~$0.6585), the Australian dollar is consolidating in a narrow range below $0.6560. Recall that last week, it settled a little below $0.6415. Although the PBOC set the dollar’s reference rate a little lower than the models suggested, the greenback remains firm against the yuan. It has risen four of the past five sessions coming into today, and it continues to trade at the upper end of the two-month range (around CNY7.10).

EuropeThe German-French proposal is being heralded as a major breakthrough in some quarters. Some are even suggesting it is a big step toward fiscal union. This seems to be exaggerated. Surely, Merkel’s rival in the CDU, Merz, would not have supported the proposal if it were. Moreover, there are already joint obligations, like the bonds issued by the European Stabilization Mechanism and the European Investment Bank. The hyperbolic claims also seem to conflate the EU and the EMU. The EU has on rare occasions in the past issued bonds. There is also the suggestion that the German-French proposal was made possible by the departure of the UK. This seems more like a logical fallacy that because the UK left before the proposal that it caused the proposal unless the linkages can be demonstrated. |

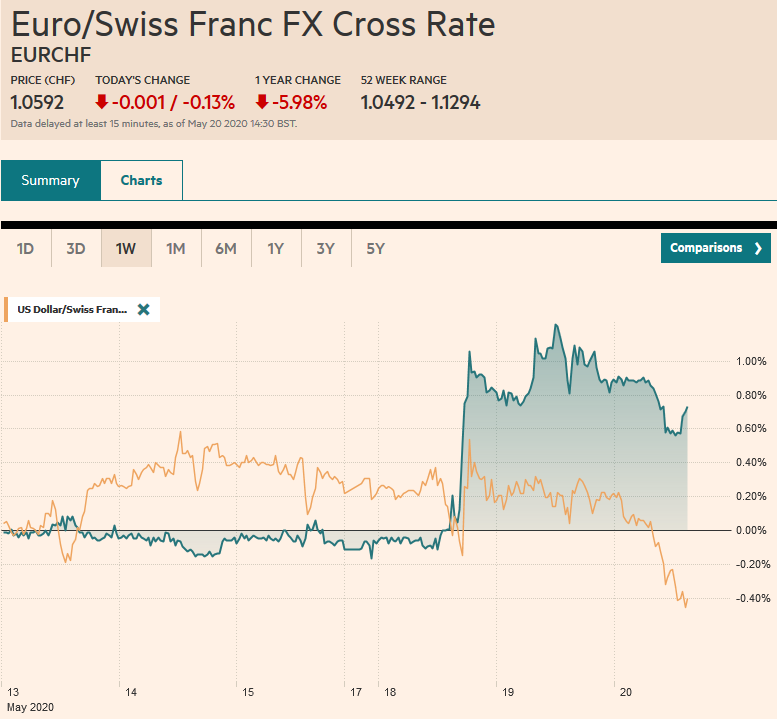

Eurozone Consumer Price Index (CPI) YoY, April 2020(see more posts on Eurozone Consumer Price Index, ) Source: investing.com - Click to enlarge |

| Today is the first allotment of the new Pandemic Emergency Long Term Refinancing Operation (PELTRO). The interest rate is 25 bp below the repo rate, which is zero. |

Eurozone Core Consumer Price Index (CPI) YoY, April 2020(see more posts on Eurozone Core Consumer Price Index, ) Source: investing.com - Click to enlarge |

| While there will be interest in the new facility today, the greater interest will be in next month’s TLTRO, where the interest rate could be minus 100 bp if certain lending targets are met. Still, the combination of the ECB operations and confidence of the EU fiscal response is encouraging carry trades, which favor peripheral European bonds. |

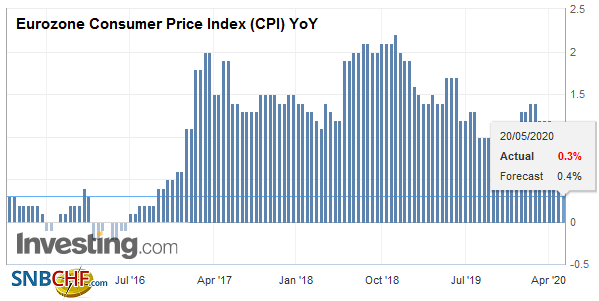

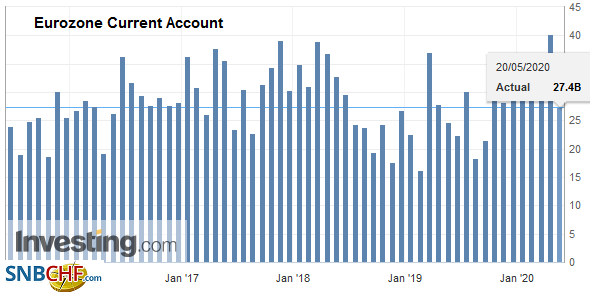

Eurozone Current Account, March 2020(see more posts on Eurozone Current Account, ) Source: investing.com - Click to enlarge |

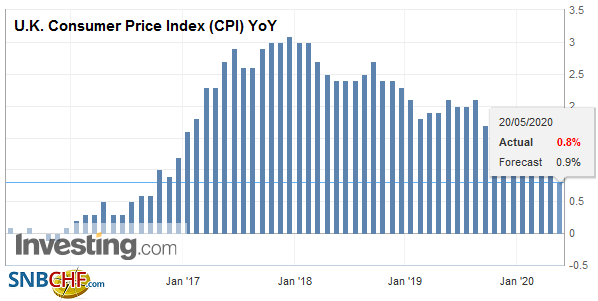

| UK’s April CPI was in line with forecasts with a 0.9% rise in CPIH measure (included owner-occupied housing costs) and a 1.4% rise in the core rate. In March they had risen 1.5% and 1.6% respectively. Deflationary pressures continue to be felt at the producer level. The debate about negative rates continues, and the UK 2-year yield remains below zero. Meanwhile, UK-EU talks on a new trade agreement show little progress and a great deal of frustration. |

U.K. Consumer Price Index (CPI) YoY, April 2020(see more posts on U.K. Consumer Price Index =, ) Source: investing.com - Click to enlarge |

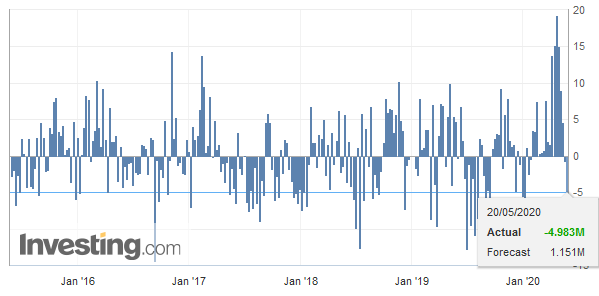

Local press reports suggest that Turkey is close to a swap deal with Japan and the UK. The talks with each are reportedly for a $10 bln line. Japan’s Prime Minister Abe is scheduled to visit Turkey on Thursday when a formal announcement is possible. Turkey sought swap lines with the Federal Reserve were apparently was rebuffed, and without Treasurys, it cannot take advantage of the Fed’s repo facility. Turkey has a $1.7 bln swap line with China and a $5 bln facility with Qatar. With little reserves to speak of and a growing trade deficit and the disruption of tourist flows (~12% of GDP) and roughly $80 bln in foreign currency debt coming due in three months, Turkey’s back is against the wall. At the same time, liquidity is drying up. Euroclear and Clearstream have stopped their clearing services for lira transactions, and at least one bank, with prime broker facilities, will only allow transactions that maintain or reduce lira exposure. The dollar peaked on May 7, just shy of TRY7.27. Through yesterday, it fell for the ninth successive session, during which time it declined by about 7.2%. Erdogan is deadset against turning to the IMF, not only because of the stigma but also because of the reforms it would insist upon as a condition for the aid. Nor does Erdogan want to take the other orthodoxy and raise rates. On the contrary, the CBRT is expected to deliver another 50 bp rate cut tomorrow that would bring the key one-week repo rate to 8.25%. It was peaked near 24% for nine months until last June when the aggressive rate cuts began. April’s CPI was a little below 11%. It peaked in October 2018 at almost 25.25%.

The euro is moving sideways inside yesterday’s range when it traded to about $1.0975. A move above $1.1000-$1.1015 would reinvigorate the bulls. On the other hand, a break below $1.09 would reinforce the broad trading range. There is an option for 630 mln euros at $1.0930 that expires today. Sterling has also been confined to yesterday’s ranges (~$1.2185-$1.2295). An expiring option for GBP215 mln at $1.2230 still looks to be in play. A move above $1.23 would immediately target $1.2360, the (50%) retracement of this month’s decline.

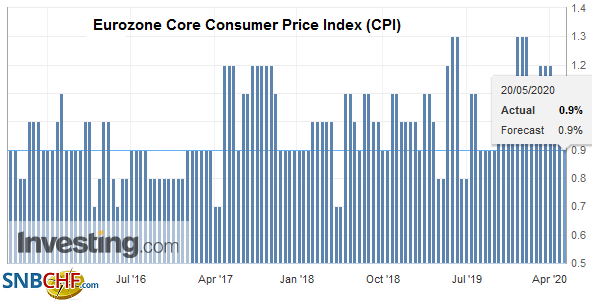

AmericaThe FOMC minutes from April well be released today. We suspect that they are too dated to shed much fresh insight. Still, the discussion around negative interest rates, if there was one, will be of interest. Canada reports April CPI figures, and another month of weakness may push the year-over-year rate below zero. This may exaggerate the deflationary pressures as the underlying measures will prove considerably firmer. |

U.S. Crude Oil Inventories, May 20, 2020(see more posts on U.S. Crude Oil Inventories, ) Source: investing.com - Click to enlarge |

The entire Fed funds futures strip settled with positive implied yields. The move began on Monday and was completed yesterday. There are two broad interpretations of the negative rates. The first camp sees it as some investors think that the Fed will adopt negative rates, though officials have denied it, or believe that they can deliver the Fed a fait accompli. The other camp is that the negative rates were a result of hedging activity associated with the swapping of floating for fix rates and other financial exposures. When the insurance/hedging activity ran its course, risk-takers, using fair value models, could take advantage of the price discrepancy.

Sao Paulo, the center of the virus in Brazil, which now has the third most cases (behind the US and Russia), has brought forward June 11 and November 20 holidays to today and tomorrow, as part of a six-day holiday. The federal government has been plagued by political scandal and incompetence, and there is no health minister after the previous two resigned over disputes with President Bolsonaro. The measures ostensibly are to help facilitate social distancing. Initial efforts to close roads and restrict traffic failed. There was initial concern that the local markets would close as well, but this is not the case. However, the central bank did affirm that the Corpus Christi holiday on June 11 will still be a bank/market holiday.

The US dollar found support yesterday just ahead of last month’s lows in the CAD1.3850 area. The late sell-off of US shares helped lift the greenback toward CAD1.3950 before the end of the session. It is testing the CAD1.39 area in the European morning. The dollar is at new lows for May against the Mexican peso (~MXN23.40). Last month’s low was closer to MXN23.25. The recovery of US equities and what it means about risk appetites seem to be the key consideration.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Brazil,China,Currency Movement,EU,EUR/CHF,Eurozone Consumer Price Index,Eurozone Core Consumer Price Index,Eurozone Current Account,Featured,federal-reserve,FX Daily,negative rates,newsletter,Turkey,U.K. Consumer Price Index,USD/CHF